As rising home valuations force first-time home buyers out of the market, expect to see non-owner-occupied loans to increase.

-

Comerica, which focuses on the energy sector, reported strong payment trends last quarter, while M&T, which concentrates more on real estate, showed deterioration. The divergence reflects varying exposures to sectors hit hard by the COVID-19 recession.

July 21 -

The meager increase suggests the largest boost in inventory possible would likely still leave the backlog of homes on the market at historic lows.

July 21 -

RFS Asset Securitization could issue additional notes, up to $500 million, at any time during the revolving period, which could be as soon as June 2024.

July 21 -

Despite lower numbers, refi applications continued trending strongly, while purchases fell close to lows from more than a year ago.

July 21 -

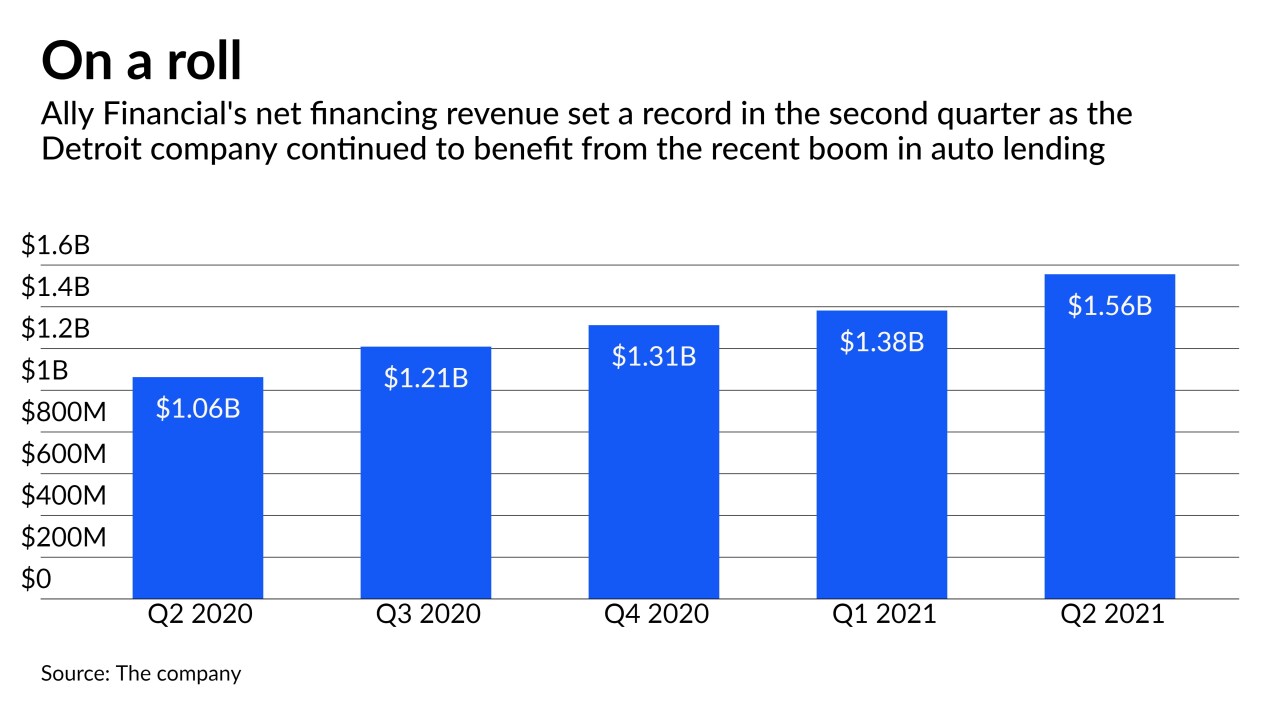

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

July 20

-

Meanwhile, the average new-home mortgage price climbed to a new all-time high, according to the Mortgage Bankers Association.

July 20 -

Industry observers say they expect current market conditions to support healthy deal flow through the end of 2021.

July 20 -

As rising home valuations force first-time home buyers out of the market, expect to see non-owner-occupied loans to increase.

July 20 -

In a deal underwritten by RBC, the initial note balance could either be $1.2 billion or $1.7 billion, depending on market conditions at the time of pricing.

July 19 -

Consumers are booking rooms at levels not seen since early 2020 and loan delinquencies have fallen sharply as a result. Still, business travel remains sluggish and new COVID variants are spreading, threatening the hotel industry’s recovery.

July 19 -

The GSE forecasts $4 trillion in production this year because refinance activity is stronger than expected.

July 16 -

Most of the pool, 63.7%, consists of new agricultural equipment, followed by new construction equipment and new turf equipment.

July 16