Center Parcs Group, a company that operates short-break vacation sites across England, plans to sell £830 million (US$1.06 billion) in bonds backed by its operational cash flow.

-

Banco Santander plans to go ahead with a proposal to increase control of its U.S. subprime auto loan unit, after the business passed the Federal Reserve's stress test last month, according to people familiar with the matter.

July 12 -

A joint venture between Paramount Group and a wealthy New York family is tapping the commercial mortgage bond market to refinance a 52-story trophy office building in midtown Manhattan.

July 12 -

Progress Residential's lastest pooling of 2,080 rental homes - all secured by a single-borrower mortgage - includes 719 homes rolled over from paid-off SFR securitizations.

July 12 -

BANK 2017-BNK6 is a transaction backed by 72 fixed-rate commercial property loans covering 189 properties, including midtown Manhattan's iconic General Motors Building.

July 11 -

Chinese banks and insurance companies represent a new and potentially large source of capital that could crowd out U.S. banks as investors in collateralized loan obligations.

July 11

-

President Trump will nominate Randal Quarles as the Federal Reserve's vice chairman of supervision, the top bank regulatory post at the central bank, according to an announcement by the White House late Monday.

July 10 -

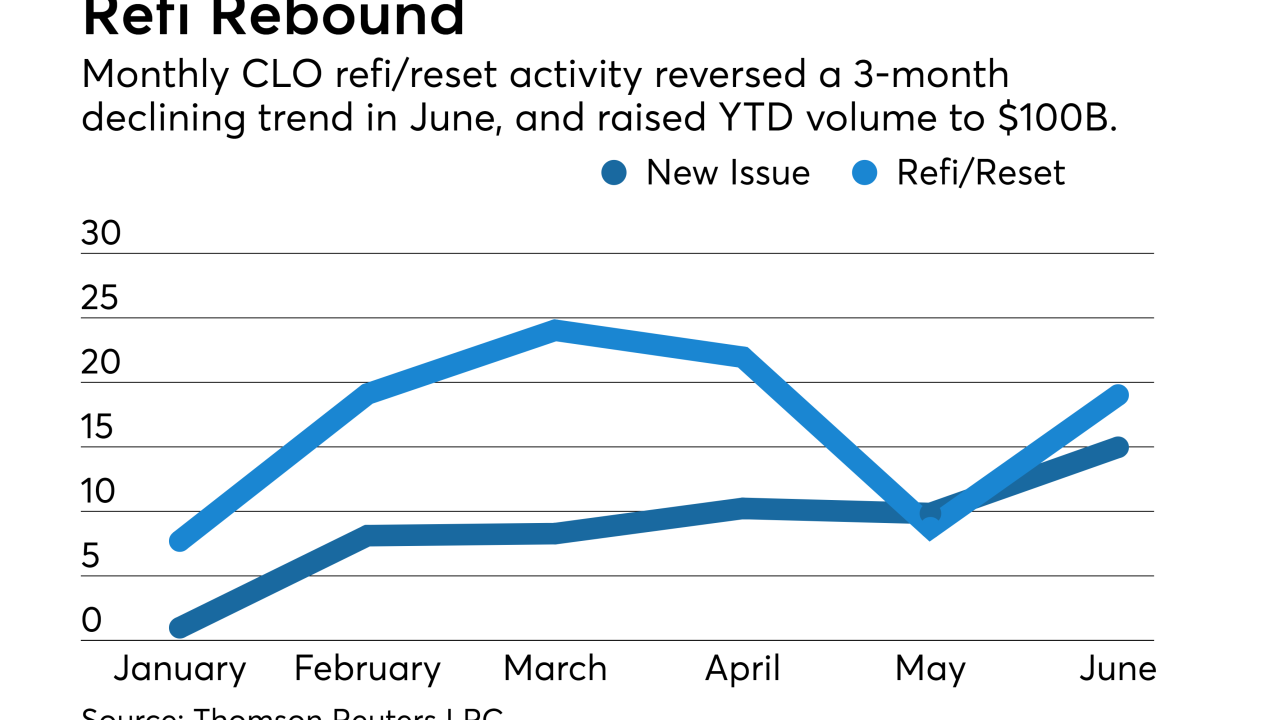

That was an increase of more than $5 billion, or 30%, from May's total, according to Thomson Reuters LPC, though it fell short of refinancing/reset activity, which rebounded to more than $19 billion.

July 10 -

Triumph Capital Advisors doubled its business with a risk-retention driven acquisition of Doral Bank's CLO assets in 2015; the same regs spurred its spin-off as a separately capitalized vehicle to Pine Brook under CEO Gibran Mahmud.

July 10 -

The two firms jointly obtained three separate loans totaling $706.7 million from Citigroup and Morgan Stanley on 52 retail properites with a combined 7 million square feet.

July 9 -

Moody’s expects cumulative net losses of 0.55% of the collateral, while Fitch takes a more conservative view; it expects net losses to reach 1% due to a deterioration in the construction equipment sector.

July 9 -

The Consumer Financial Protection Bureau's final rule to formalize guidance on a number of TILA-RESPA Integrated Disclosures compliance points omits an originally proposed fix for the so-called black hole that's created when a mortgage closing is delayed.

July 7 -

The senior notes benefit from initial credit enhancement of 29.5%, nearly three percentage points higher than the same tranche of the sponsor's previous transaction.

July 7