-

Nelnet Student Loan Trust 2020-2, arranged by Bank of Montreal, is made up of nearly 50% of formerly delinquent loans that have been cured to current status.

March 4 -

SoFi Professional Loan Program 2020-B Trust is a $1.06 billion asset-backed offering of bonds secured by a pool of loans made to advanced-degree graduates of medical, dental or legal universities, or MBA recipients.

February 19 -

Upstart is disputing an analysis accusing it of discriminating against prospective borrowers based on the college they attended, saying it contains “inaccuracies and misunderstandings.”

February 9 -

Sallie's first student-loan securitization of the year comes a week after SLM Corp. announced plans to sell more loans from its portfolio to fund a share buyback program.

January 30 -

Macro factors point to a solid year in the securitization market but wild cards abound, many of them political.

January 13 -

SoFi Professional Loan Program 2020-A Trust is a $482.3 million bond offering, backed by a pool of approximately $500 million in loans taken out by post-graduate professionals from high-income fields.

January 8 -

Along with an Aaa from Moody's, Nelnet's latest FFELP securitization received an infrequent AAA rating from S&P after providing additional cushion against collateral losses for the senior-most notes.

December 11 -

CommonBond is coming to the securitization market again with another trust that uses the highly selective prefunding period feature to issue notes backed by private, refinanced student loans.

October 23 -

The idea of forgiving student debt has gained traction in the Democratic presidential debates. Undiscussed so far: the significant impact any program could have on the roughly $175 billion of securities backed by student loans.

September 9 -

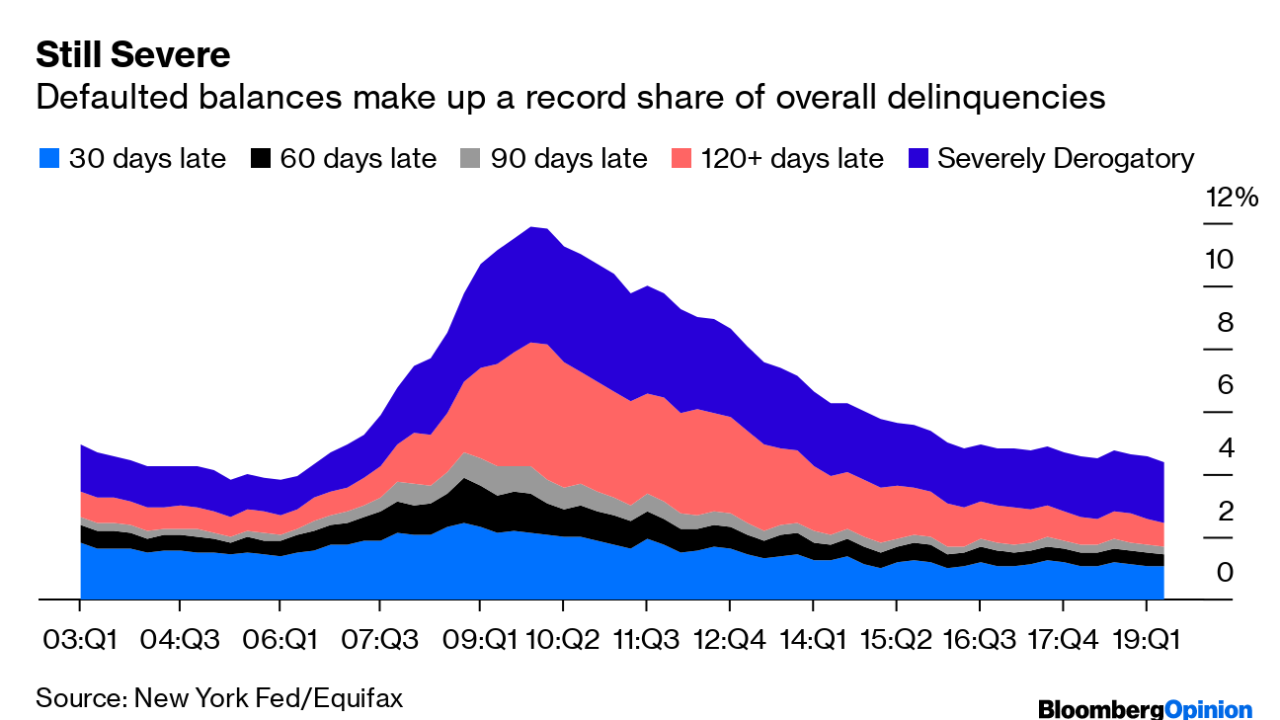

Of the roughly $250 billion severely derogatory outstanding balance, defaulted student loans make up 35%, a New York Fed report found. That’s a new phenomenon.

August 14 -

Navient’s next securitization of private student-loan refinancing will involve only loans primarily issued to advanced-degree professionals by online lender Earnest, which Navient acquired in 2017.

July 17 -

The collateral will include $147.3 million in well-seasoned loans that were part of HESAA’s 2009 issuance, as well as up to $155 million in new loans that the trust will originate through an Oct. 31, 2020 prefunding and recycling period for the next academic calendar year.

May 28 -

Navient Corp. is returning to all fixed-rate collateral for its next securitization of refinanced private student loans issued via its Earnest affiliate to high-earning college graduate professionals.

May 1 -

Nelnet's second ABS of federally insured private student loans consists entirely of formerly delinquent FFELP loans that are back in current status.

April 22 -

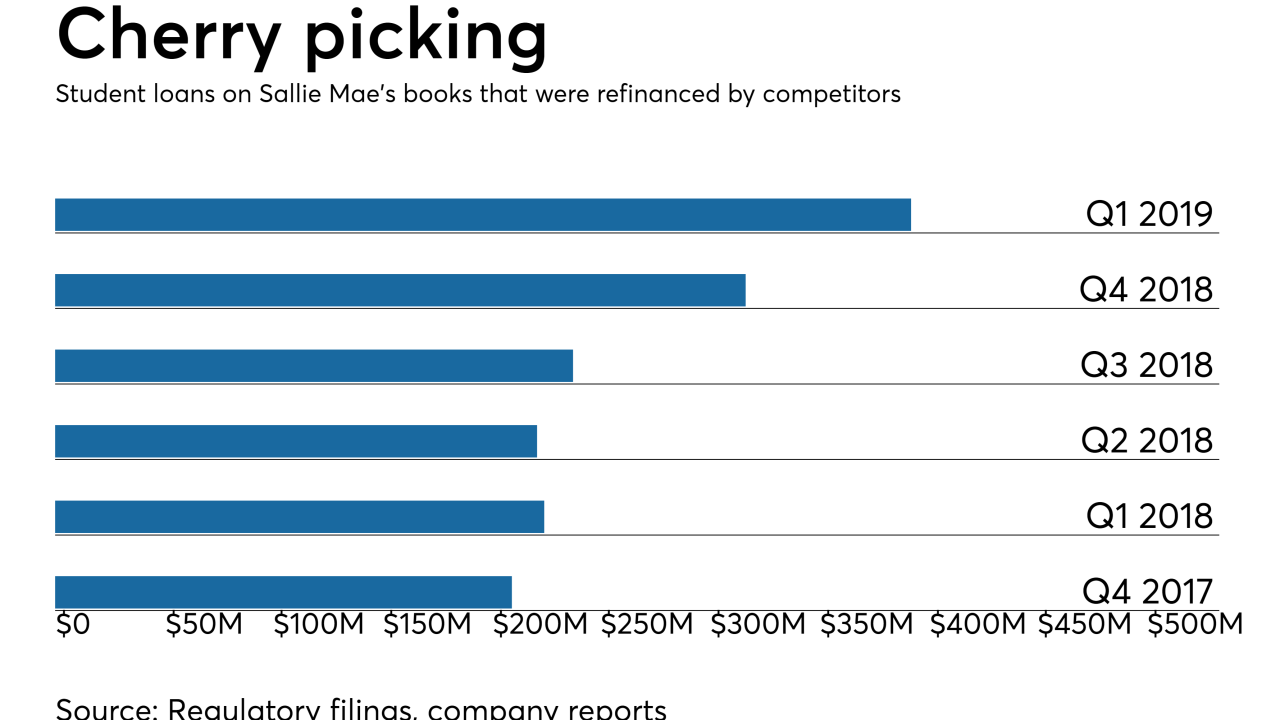

SLM Corp. wants to "target the people our competitors are targeting and bring on their federal balances" CFO Steven McGarry said during an earnings call.

April 18 -

Since most U.S. securities transactions are subject to New York law, it could be expedient to pass legislation defining Libor as SOFR plus a spread, says David Bowman, special adviser to the Fed.

February 26 -

Navient Corp. shares surged after Canyon Capital Advisors said it could boost a $3.1 billion takeover offer that was rejected by the student-loan servicer.

February 19 -

For the first time in almost two years, borrowers are taking out floating-rate loans to refinance their student debt. So Navient is testing investor appetite for floating-rate bonds backed by refinance loans.

February 6 -

Now that the noncompete has expired, Navient plans to market private student loans to borrowers in school; the servicing giant is also free from restrictions on marketing refinance loans through Earnest.

January 23 -

The company has filed a request with a federal judge in Pennsylvania for a summary judgment in two counts against it, accusing the bureau of failing to provide evidence.

January 18