-

A proposal to expand consumer protections in the state was added to a budget bill after being dropped in June. Financial institutions say the measure conflicts with federal law and are working behind the scenes to stop it.

August 14 -

The complaint filed by New York, California and Illinois argues that the regulation, issued in response to the 2015 Madden decision, undermines state laws intended to protect consumers.

July 29 -

If it’s approved, the charter is expected to lower the fintech’s cost of funds and allow for more product offerings. It comes nearly three years after SoFi pulled the plug on an earlier effort to open an industrial bank.

July 9 -

Nonbank servicers have been seeking more sources of cash since the coronavirus disrupted markets and elevated forbearance rates. These are some strategies they may be able to use.

June 26 -

The new regulation is intended as a workaround for banks affected by the 2015 decision that created legal uncertainty for loans sold across state lines.

May 29 -

Mortgage lenders have imposed steep pricing adjustments for cash-out refinancing as more borrowers seek forbearance.

May 4 -

The Treasury secretary said recent government moves will help the firms get through the risk of millions of borrowers missing their loan payments.

April 24 -

Lenders that split their sales of loans and servicing between two different investors may be facing yet another challenge due to the coronavirus outbreak.

April 13 -

Mark Calabria needs to be working to secure a Fed facility for servicer advances and to support, not denigrate, smaller servicers, the Mortgage Bankers Association said.

April 8 -

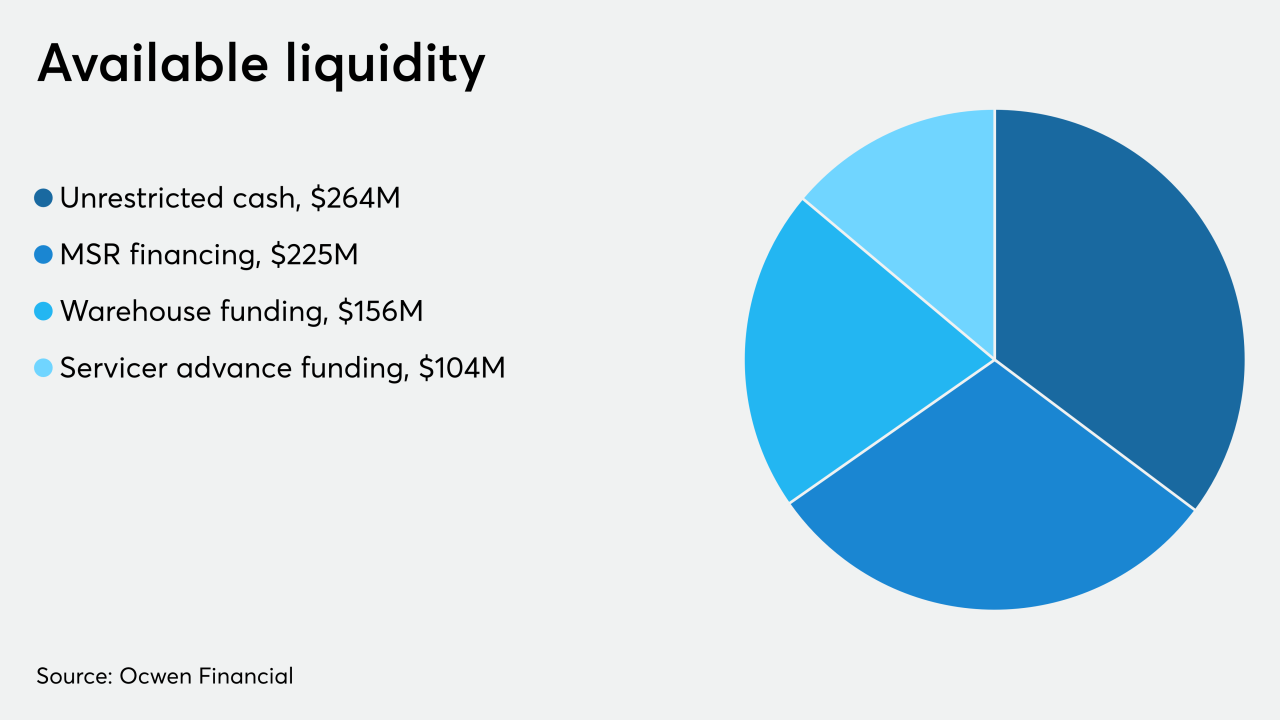

Ocwen Financial has approximately $749 million of liquidity from various sources to deal with servicing issues arising from the coronavirus, a company press release said.

April 3 -

After budget cuts and a strategic transition, the interagency body conceived by Dodd-Frank to identify systemic threats has largely been silent as the pandemic roils the economy.

March 31 -

Mortgage servicers need direction from federal agencies on how to implement the forbearance plans called for in the CARES Act, according to the Community Home Lenders Association.

March 31 -

Refinancing activity is surging, existing borrowers are inquiring about loan modifications, loan closings are being delayed by more complex credit checks — and banks are short on people to handle it all.

March 19 -

Banks may be protected from a direct hit, but they have invested in vehicles that include such loans, potentially exposing them to defaults.

March 11 -

Mortgage companies that borrow heavily to keep their operations running may face financial pressure from coronavirus-related market volatility as it affects the valuations of collateral securing their financing.

March 9 -

The cancellation by New Residential of a money-losing subservicing agreement should benefit Ocwen's financial results going forward, the company said.

February 26 -

The Federal Housing Finance Agency plans to increase liquidity standards for nonbank conforming loan servicers, and at the same time raise the net worth requirements for those that also perform the function for Ginnie Mae.

February 5 -

Despite changes by the Federal Housing Administration, bankers remain reluctant to join the program for fear of legal liability. But that could change if it revamps servicing processes, experts say.

January 13 -

California Gov. Gavin Newsom plans to ask the legislature to revamp the current Department of Business Oversight and rename it the Department of Financial Protection and Innovation, modeled after the federal CFPB.

January 9 -

With fintech firms appearing stuck in neutral in their efforts to seek bank charters from federal regulatory agencies, observers say state licensing options could be in vogue again in 2020.

December 30