-

A consensual deal cuts legal costs and hastens a Chapter 11 exit, but plans block possible restructuring proposals that can curb cash payouts to lower-ranking creditors.

February 3 -

Environmental, social and governance issues topped the list of risk managers’ concerns in a Deloitte poll .

February 2 -

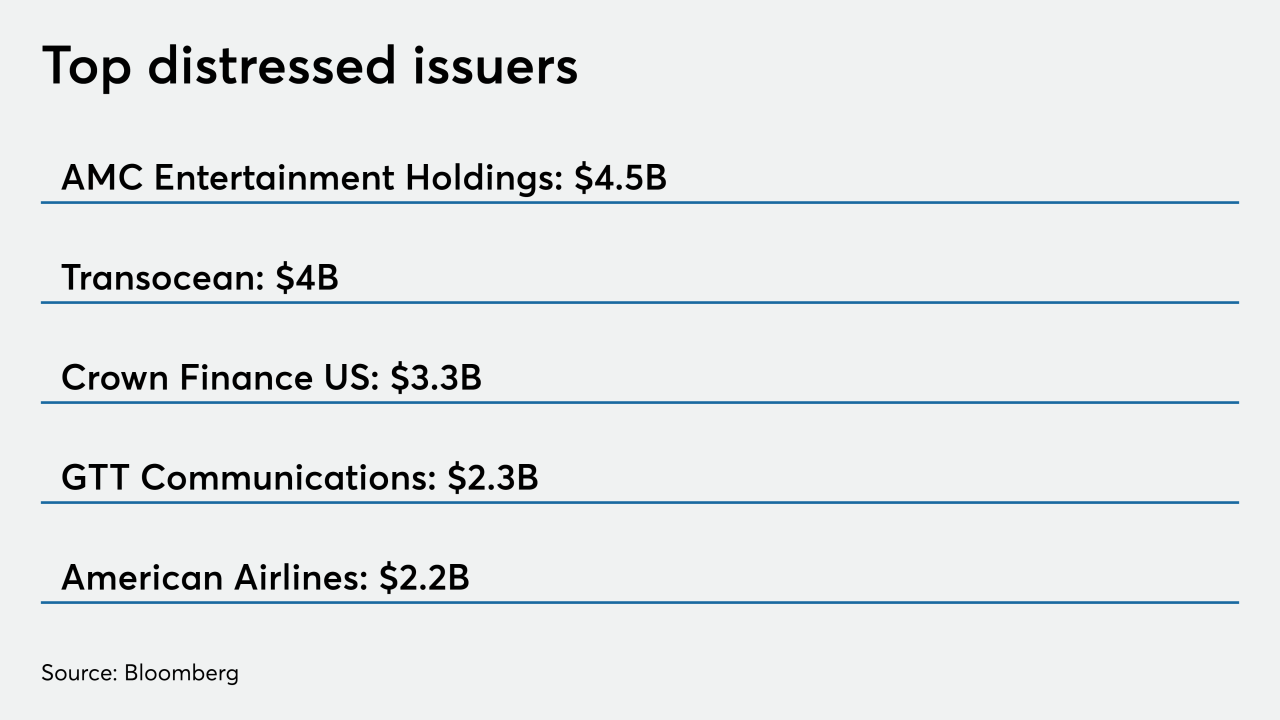

AMC and American Airlines took advantage of surprise stock-price surges to cash out shares and raise liquidity for possible debt reduction — a massive stroke of good fortune for the companies as well as their creditors.

February 1 -

The struggling movie-theater chain is among once-risky debt investments reaping big gains after day traders helped fuel the sudden stock surge.

January 29 -

Cheap funding costs have extended a lifeline to many troubled companies, slowing the pace of U.S. bankruptcy filings, but shops, offices and hotels have been particularly vulnerable to the pandemic this month.

January 27 -

About $16 billion across 43 deals in both new-issue and refinancing has prompted analysts into making early revisions to raise their initial volume forecasts.

January 26 -

More may be on the horizon as lenders lose patience with defaulting property owners.

January 19 -

Distressed debt funds on average gained 11.4%, according to Hedge Fund Research Inc., compared to the riskiest corporate bonds rising 2.3%.

January 11 -

Energy, retail and consumer services companies led a total of 244 filings, according to data compiled by Bloomberg.

January 5 -

Bausch, formerly Valeant Pharmaceuticals, has paid down more than $24 billion of the $32 billion in leverage it owed five years ago from a debt-driven acquisition spree — which ended after a drug-pricing scandal.

January 4 -

The buyout industry has about $3 trillion of unrealized value on its books, according to Preqin. And it’s tapping that to land loans for bolt-on deals, to refinance debt or bail out struggling companies in their portfolios.

December 31 -

Bankruptcies reached levels not seen in a decade, distressed debt soared to almost $1 trillion and it may take years to repair the damage to airlines, restaurants and hotels. While 2020 may be over, the drama probably isn’t.

December 23 -

Investment firms and hedge funds are increasingly engineering bankruptcy loans and side deals to take control of Chapter 11 reorganizations from the outset, locking in rich rewards for themselves while potentially locking out rivals and lower-ranking creditors with little transparency. The trend is sure to speed up cases, but it also forces judges to make quick decisions that may shortchange some valid claims.

December 17 -

Promising vaccines may not reach the general public fast enough to save a number of struggling companies next year, and workout professionals and distressed investors are expecting smaller private companies will search for cash in 2021. They’re also anticipating that businesses of all sizes may struggle to adjust to changing consumer habits in a post-pandemic world.

December 16 -

After issuance dampened during the presidential election week, corporate bonds and loans are expected to roll out amid a large trove of post-election earnings reports.

November 9 -

Loan issuers in the hotel/leisure, oil and gas, retail and business equipment/services industries – which make up nearly a quarter of the S&P/LSTA Leveraged Loan Index – are expected to lead the default tally over the next 12 months, according to a report from S&P.

November 3 -

Bankruptcy filings hit a three-month high as investors brace for economic shifts from the U.S. election that could force more large corporations to seek protection from creditors.

November 3 -

Annualized returns have now exceeded double digits for the 10th straight year, despite early 2020 volatility related to the coronavirus pandemic.

November 2 -

Property debt funds, including at Blackstone Group Inc., raised $14.1 billion from April through September, compared with $15.7 billion a year earlier, according to research firm Preqin Ltd. Yet the expected flood of deals has so far been just a trickle.

October 28 -

Bankruptcy filings are surging due to the economic fallout of Covid-19, and many lenders are coming to the realization that their claims are almost completely worthless. Instead of recouping, say, 40 cents for every dollar owed, as has been the norm for years, unsecured creditors now face the unenviable prospect of walking away with just pennies - if that.

October 26