-

This year saw elation over the rollback of risk retention for CLOs give way to concerns about leveraged lending, the 1st post-crisis downgrade of a subprime auto deal, the 1st AAA for commercial PACE, and much, much more.

December 31 -

The single-family rental market could benefit from more consistent loan terms and expanded secondary mortgage market opportunities, Freddie Mac found in a preliminary test of expanded involvement in the sector.

December 28 -

They differ slightly from those released earlier by the Fed-convened ARRC, including language making it easier to ditch a SOFR-derived benchmark in favor of a new benchmark that has yet to be developed.

December 26 -

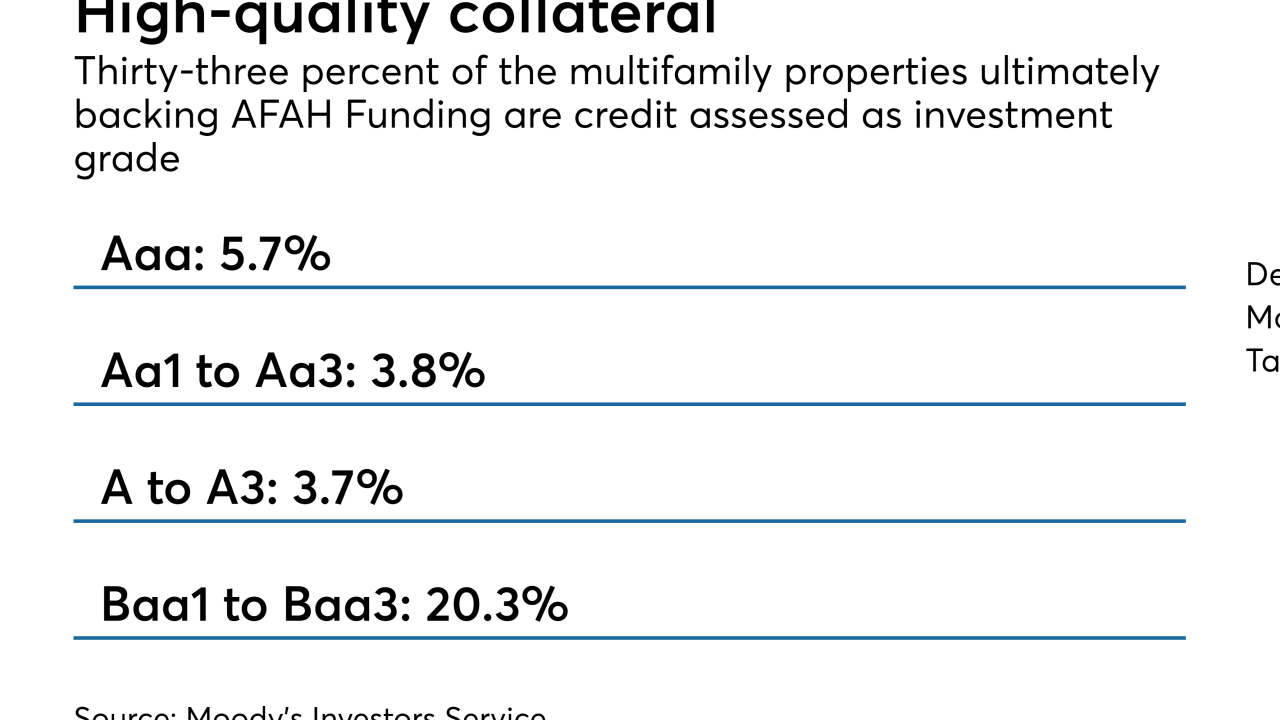

AFAH Funding is not your typical CRE CLO: It is backed by entirely by long-dated mezzanine interests in multifamily properties that are eligible for low-income housing tax credits.

December 24 -

A Wells Fargo report this week shows that market spreads for the triple-A notes backed by collateralized loan obligation assets are at 128, a level not seen since May 2017.

December 21 -

The $500 million AIG CLO 2018-1, AIG's first deal since selling off its asset management business in 2010, is priced at 132 basis points over three-month Libor.

December 20 -

The €350 million Providus CLO II is backed exclusively by loans to mid-market firms that meet the private equity firm's sustainability criteria; at closing, 90% of the collateral has been identified.

December 20 -

Dividing the transaction into two tranches allowed the GSE to tailor the transaction to the risk appetite of participants, lowering the cost of reinsurance.

December 17 -

The LA-based manager is pricing the replacement AAA notes of Oaktree EIF III Series 1 inside recent market averages through a limited, brief noncall extension.

December 17 -

RBC Capital Markets hired Paul Sheldon, founder of the advisory firm S L Capital Strategies, as a managing director in the municipal finance student loan group.

December 17