-

Family offices—mini-investment firms set up by the super rich to manage their personal wealth—have poured more and more cash into direct lending, Preqin says.

December 10 -

First Eagle, with $99 billion AUM, will expand its presence in structured finance-based direct lending to middle-market firms through the acquisition by uniting the two firms’ credit-business platforms, according to a release.

December 9 -

While undeterred from the market, CLO investors may be skittish enough over price volatility and quality in loans to be more discerning of which managers' BB notes they'll take on.

December 9 -

TPG Sixth Street Partners' Alan Waxman warns investors are turning a blind eye to an epidemic of fake corporate earnings projections.

December 6 -

Wealthfront will add third-party mortgages to its investing platform, while Varo Money says robo advice and mortgages are in its long-term plans.

December 3 -

Shizuoka Bank Ltd. plans to step up its search for yield by buying more U.S. collateralized loan obligations, according to its top executive.

November 27 -

Investors have been demanding significantly higher yields to lend to junk-rated companies in recent weeks - so much so that spreads in an index of the riskiest tier of junk, known as CCC, just breached 1,000 basis points for the first time in more than three years.

November 25 -

The Federal Housing Financial Agency's latest report on credit risk transfers shows Fannie Mae continues to slowly improve a multifamily mortgage risk-sharing metric that lags Freddie Mac's by a wide margin.

November 15 -

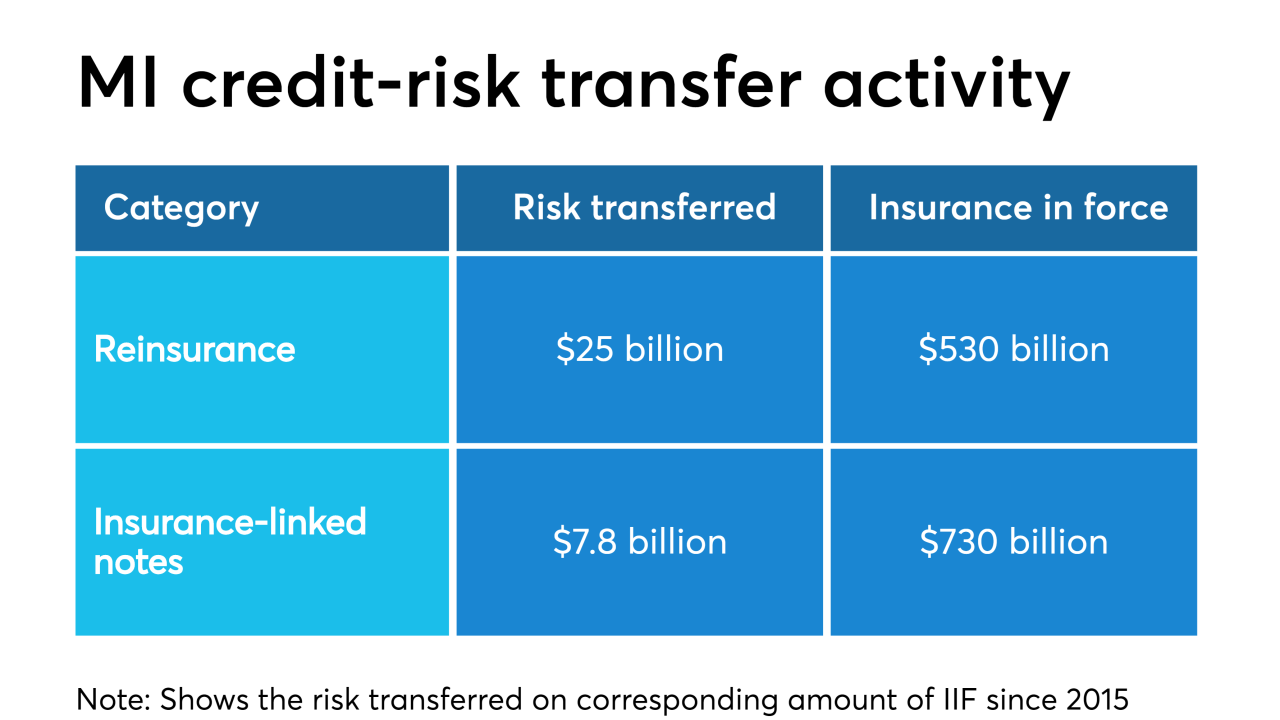

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

Instead of marketing securities backed by commercial property mortgages, STORE Capital chooses the more esoteric option of securitizing the income from its triple-net leases – a similar strategy to REITS such Spirit Realty Capital and SCP Financial.

November 5 -

Tetragon's announcement reveals the firm will complement its equity strategy by also focusing on the debt-note structure of deals, in hopes of gaining returns on the performance lowest-rated mezzanine and subordinate tranches.

October 29 -

No investor wants to touch the riskiest high-yield debt. The bank’s asset manager says it’s cheap enough that there are opportunities.

October 22 -

S&P's review of leveraged-loan deals across multiple sectors found only 17% of lenders have provisions that would disallow borrowers from transferring collateral assets to unrestricted subsidiaries outside lender reach.

October 21 -

The attractions of Grande Canal Shoppes, a luxury shopping center property in Las Vegas, are not just bringing in the tourists. It is the 14th-largest loan in the GS Mortgage Securities Trust 2019-GSA1, a Goldman Sachs deal.

October 21 -

According to Kroll, this is the middle-market lender's first securitization of growth-opportunity loans made to venture-capitalized software firms that have yet to develop earnings or substantial assets.

October 18 -

The $5 billion financing package may also include around $1 billion of secured debt that would be sold to investors, as well as about $1.7 billion in letters of credit that would be split among participating banks

October 14 -

Members of the House Financial Services Committee cited leveraged lending, cybersecurity and the switch to a new interest rate benchmark among potential systemic risks that keep them up at night.

September 25 -

Natalya Michaels, recently of Artisan Partners, will be a managing director with a focus on marketing, investor relations as well as expanding the firm's investor and product base.

September 25 -

An opening day panel for ABS East focused on the growing number of choices investors have in asset classes and structural options.

September 23 -

Collateralized loan obligations in Europe are running low on fuel, prompting some investors to seek greater protection that may slow the market even further.

September 20