-

The BSL CLO will have two-year noncall and five-year reinvestment periods, and brings Seix' total CLO AUM to $3.8 billion.

January 6 -

Rising leverage levels and prevalence of cov-lite loans raise concerns despite ongoing macroeconomic growth signs.

January 2 -

The FHFA’s attempt to move some of its balance sheet into the private sector could leave investors with greater liabilities than they were initially told.

January 2 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center -

As the 2020s begin, perhaps it’s best to borrow a page from the Fed’s 2019 playbook: Take your best shot at forecasting the road ahead, but don’t hesitate to react to important new information.

January 1 -

The company asserted in the statement that S&P’s action was driven more by the distressed trading levels of Serta’s loans in the secondary market rather than the company’s “financially solvent” status.

December 30 -

A risk-based capital rule for Fannie Mae and Freddie Mac is expected to top the agenda in 2020 as the companies’ regulator executes plans for their release into the private sector.

December 26 -

The Financial Stability Board's report, released on Thursday, falls short of any lofty expectations to clarify risks within leveraged loans and CLOs. If anything, it may only amplify the paranoia around the asset class.

December 19 -

The $458.87 million HalseyPoint CLO1, via JPMorgan, is the first deal by the firm that was launched in May 2018 by two former Columbia Asset Management portfolio managers.

December 18 -

Fitch’s list of loans with growing risks of downgrades reached $110 billion in December, up 53% year-to-date.

December 13 -

The city is folding together separate syndicate and advisor teams on $1.2 billion of general obligation and Sales Tax Securitization Corp. refunding deals.

December 10 -

Family offices—mini-investment firms set up by the super rich to manage their personal wealth—have poured more and more cash into direct lending, Preqin says.

December 10 -

First Eagle, with $99 billion AUM, will expand its presence in structured finance-based direct lending to middle-market firms through the acquisition by uniting the two firms’ credit-business platforms, according to a release.

December 9 -

While undeterred from the market, CLO investors may be skittish enough over price volatility and quality in loans to be more discerning of which managers' BB notes they'll take on.

December 9 -

TPG Sixth Street Partners' Alan Waxman warns investors are turning a blind eye to an epidemic of fake corporate earnings projections.

December 6 -

Wealthfront will add third-party mortgages to its investing platform, while Varo Money says robo advice and mortgages are in its long-term plans.

December 3 -

Shizuoka Bank Ltd. plans to step up its search for yield by buying more U.S. collateralized loan obligations, according to its top executive.

November 27 -

Investors have been demanding significantly higher yields to lend to junk-rated companies in recent weeks - so much so that spreads in an index of the riskiest tier of junk, known as CCC, just breached 1,000 basis points for the first time in more than three years.

November 25 -

The Federal Housing Financial Agency's latest report on credit risk transfers shows Fannie Mae continues to slowly improve a multifamily mortgage risk-sharing metric that lags Freddie Mac's by a wide margin.

November 15 -

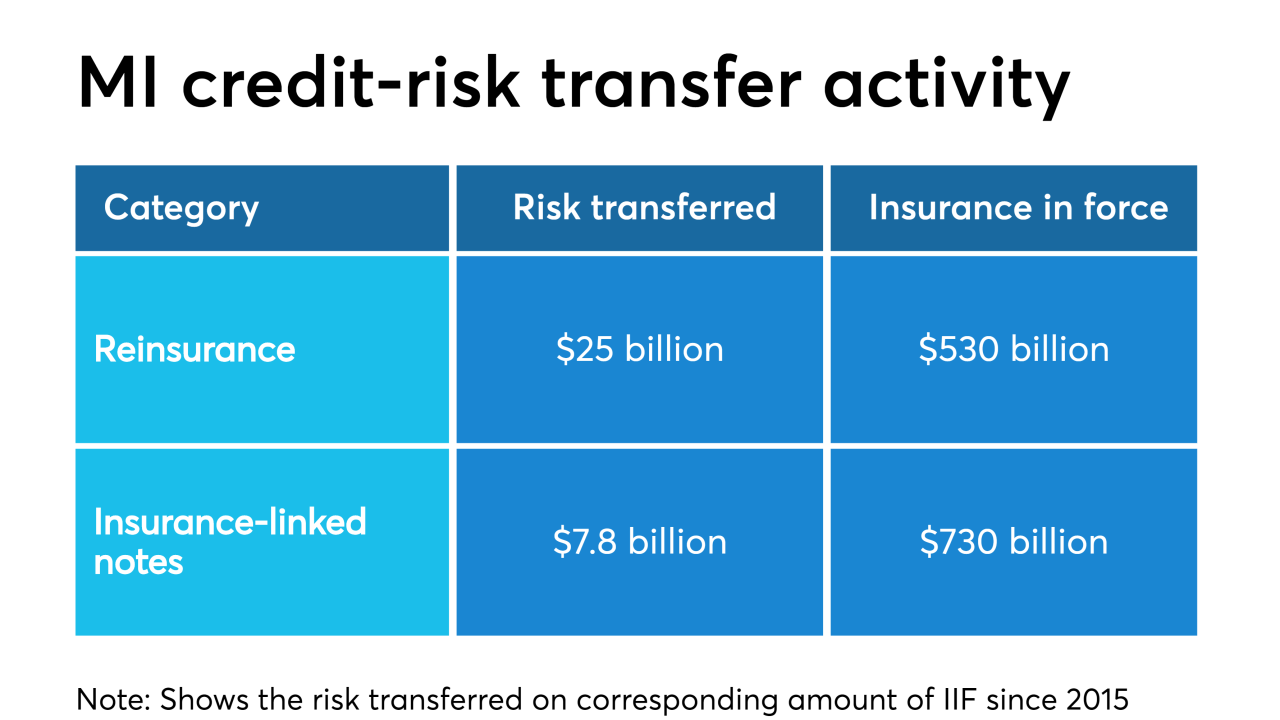

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

Instead of marketing securities backed by commercial property mortgages, STORE Capital chooses the more esoteric option of securitizing the income from its triple-net leases – a similar strategy to REITS such Spirit Realty Capital and SCP Financial.

November 5