-

While undeterred from the market, CLO investors may be skittish enough over price volatility and quality in loans to be more discerning of which managers' BB notes they'll take on.

December 9 -

TPG Sixth Street Partners' Alan Waxman warns investors are turning a blind eye to an epidemic of fake corporate earnings projections.

December 6 -

Wealthfront will add third-party mortgages to its investing platform, while Varo Money says robo advice and mortgages are in its long-term plans.

December 3 -

Shizuoka Bank Ltd. plans to step up its search for yield by buying more U.S. collateralized loan obligations, according to its top executive.

November 27 -

Investors have been demanding significantly higher yields to lend to junk-rated companies in recent weeks - so much so that spreads in an index of the riskiest tier of junk, known as CCC, just breached 1,000 basis points for the first time in more than three years.

November 25 -

The Federal Housing Financial Agency's latest report on credit risk transfers shows Fannie Mae continues to slowly improve a multifamily mortgage risk-sharing metric that lags Freddie Mac's by a wide margin.

November 15 -

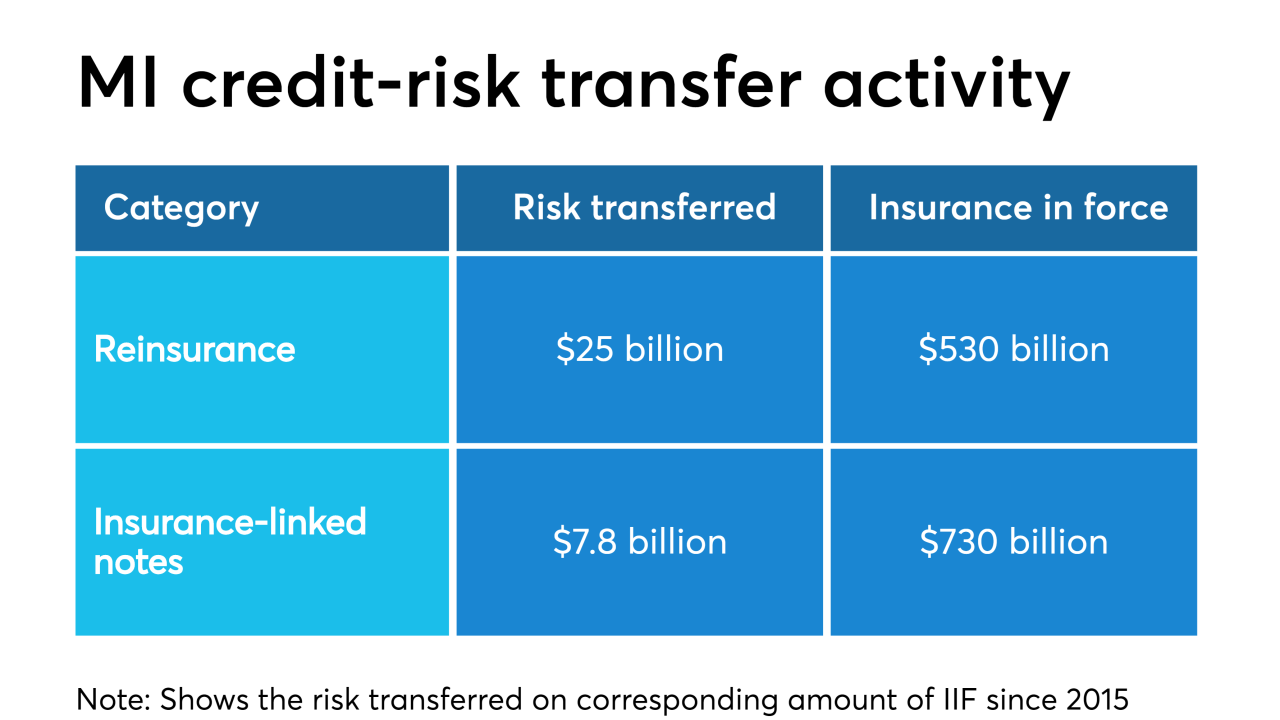

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

Instead of marketing securities backed by commercial property mortgages, STORE Capital chooses the more esoteric option of securitizing the income from its triple-net leases – a similar strategy to REITS such Spirit Realty Capital and SCP Financial.

November 5 -

Tetragon's announcement reveals the firm will complement its equity strategy by also focusing on the debt-note structure of deals, in hopes of gaining returns on the performance lowest-rated mezzanine and subordinate tranches.

October 29 -

No investor wants to touch the riskiest high-yield debt. The bank’s asset manager says it’s cheap enough that there are opportunities.

October 22