-

And the government-sponsored enterprises could hold initial public offerings in 2021 or 2022 to ensure they hold adequate capital, FHFA Director Mark Calabria said.

November 13 -

So far farm loans are holding up well, but bankers gathered at an industry conference this week said they are growing increasingly concerned that credit quality will weaken if the U.S. and China don’t reach a deal soon.

November 12 -

Fannie Mae and Freddie Mac’s exemption from the Qualified Mortgage rule is on borrowed time, but a House bill would allow lenders to use the mortgage giants’ guidelines for documenting borrower income.

November 12 -

At a forum convened by the CFPB, several bank and fintech executives argued that long-delayed rules required under the Dodd-Frank Act can help fight discrimination and shine a light on unsavory practices in the market for small-business credit.

November 6 -

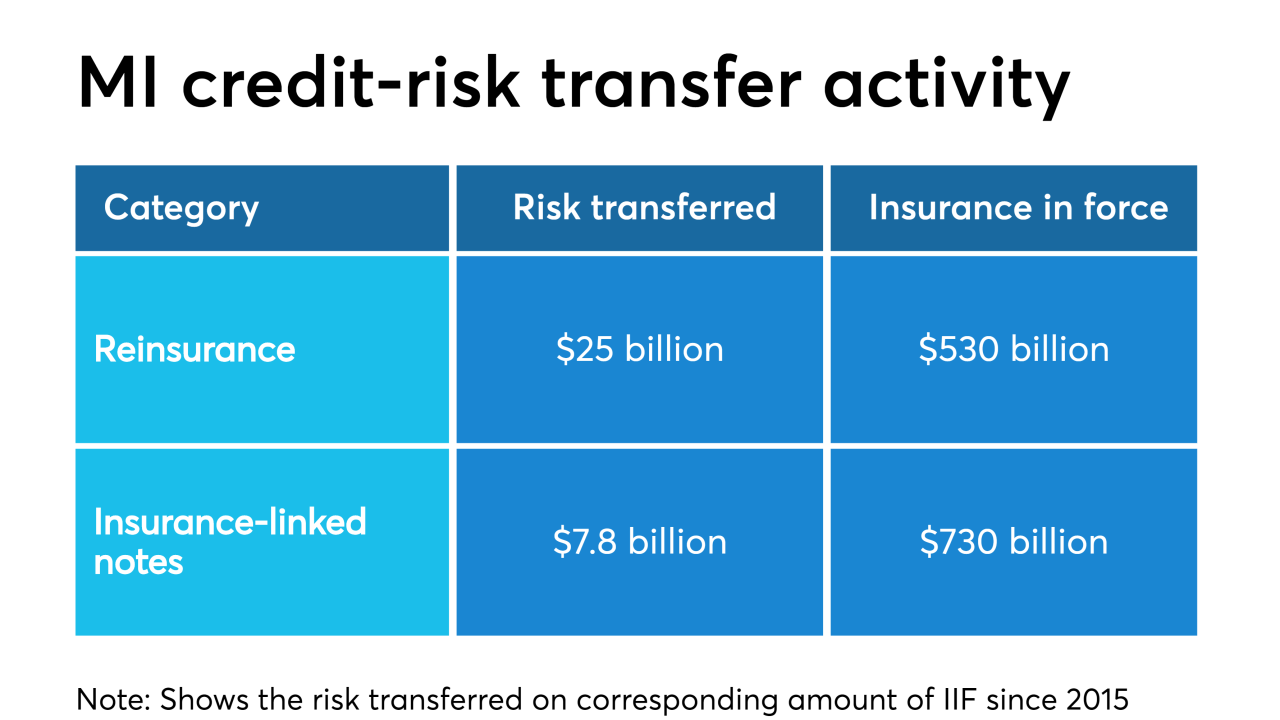

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

The Supreme Court is ready to weigh in on the CFPB’s leadership structure, but both agencies are facing similar constitutional challenges, suggesting a broader impact of any decision.

November 4 -

The Federal Housing Finance Agency is seeking comment on a proposal that could pave the way for potential Fannie Mae and Freddie Mac competitors to use the uniform mortgage-backed security structure.

November 4 -

Freddie Mac is now forecasting back-to-back years of $2 trillion in mortgage loan originations rather than a drop-off in 2020.

November 1 -

A risk management model revision that decreased single-family loan-loss allowances and a strong mortgage lending environment contributed to consistent earnings results at Fannie Mae in the third quarter.

October 31 -

Freddie Mac will make haste to leave conservatorship in line with new regulatory directives, but it's uncertain how quickly it can move, CEO David Brickman said in an earnings call.

October 30 -

A lower court “erred” when it sided with Fannie Mae and Freddie Mac’s investors, the Justice Department said in its petition to the high court.

October 30 -

When it comes to possible new competitors in the secondary market, the heads of the two current outlets more than welcomed the possibility of additional players in their space because of housing finance reform.

October 28 -

Ginnie Mae is looking for input on its proposed guidelines for electronic promissory notes and other mortgage documents that it plans to test through a digital collateral pilot.

October 28 -

Concerns over banks’ level of preparation have led to worries about disruptions in the lending market, and some financial institutions warn that a new interest rate benchmark could cause lenders to pull back on credit.

October 27 -

The outlook for hotels and suburban offices is still questionable, but the prognosis for other property types in the securitized commercial real estate market remains fairly strong, according to Moody's Investors Service.

October 23 -

GameStop's plan to shutter up to 200 stores could adversely affect commercial mortgage-backed securities loans with a combined allocated property balance of almost $42 million, according to Morningstar Credit Ratings.

October 21 -

Executives sent a letter to the federal banking regulators last month expressing concern that an alternative to the London interbank offered rate could limit credit availability.

October 16 -

As apps like Uber and Lyft gain more traction, the need for new cars — and loans — is expected to diminish.

October 11 -

A year after Fannie Mae launched its first credit-risk transfer securitization using a real estate mortgage investment conduit, Freddie is now electing to also opt for a REMIC format in offloading the credit risk to private investors.

October 10 -

The developer of the newly constructed Washington, D.C., headquarters for Fannie Mae is securitizing part of its $525 million, 10-year mortgage through a single-asset, mortgage-backed transaction.

October 10