-

Following its deadline for written comments on the topic last month, the Federal Housing Finance Agency is scheduling events that will focus on two key themes emerging in responses.

September 1 -

Arch's second CRT transaction this year to obtain indemnity reinsurance for mortgage-insurance premiums comes at a time it is also experiencing rising 60-plus-day delinquencies on its outstanding securitized pools.

August 31 -

There were questions about the GSEs' use of structured credit risk transfers in the single-family market given an earlier pandemic-related market disruption.

August 21 -

A bond market once thought to be key to the futures of Fannie Mae and Freddie Mac — and the roughly $5 trillion of home loans they backstop — could instead find itself on the scrap heap due to their own regulator.

July 8 -

The FHFA looks to shed light on the amount of funds Fannie and Freddie will need to hold for their risk-sharing deals.

June 3 -

While Freddie Mac stabilized liquidity in mortgage markets, coronavirus-related credit losses drove the GSE's income down in the first quarter of 2020.

April 30 -

Freddie Mac saw a decline in net profit in 2019 due to decreased interest rate income, lower amortization revenue and risk-reducing investment costs, but its consecutive-quarter results improved.

February 13 -

Eagle Re 2020-1 is backed by the performance of a reference pool of 156,065 loans with an outstanding balance of $40 billion.

January 27 -

Fannie Mae is sponsoring a $1.03B CRT transaction, while Caliber Homes Loans, New Residential and Onslow Bay fill the non-QM pipeline

January 14 -

The FHFA’s attempt to move some of its balance sheet into the private sector could leave investors with greater liabilities than they were initially told.

January 2 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center -

A risk-based capital rule for Fannie Mae and Freddie Mac is expected to top the agenda in 2020 as the companies’ regulator executes plans for their release into the private sector.

December 26 -

The Federal Housing Financial Agency's latest report on credit risk transfers shows Fannie Mae continues to slowly improve a multifamily mortgage risk-sharing metric that lags Freddie Mac's by a wide margin.

November 15 -

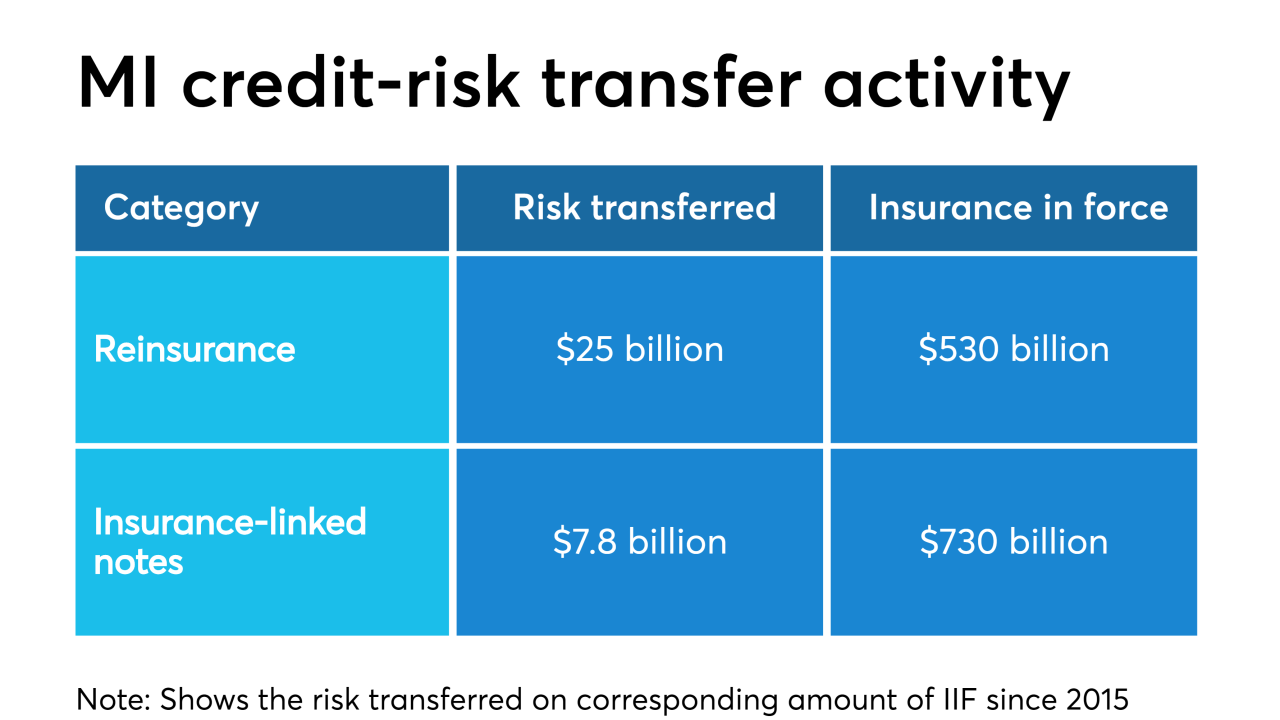

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

Freddie Mac continues to churn out steady financial returns, with the growth in first-time home buyers and credit risk transfers providing the GSE stable footing when a recession comes, according to new CEO David Brickman.

July 31 -

The post-crisis operational improvements at both Fannie Mae and Freddie Mac have resulted in stronger mortgage loan performance, a Fitch Ratings report said.

July 3 -

Director Mark Calabria urged lawmakers to grant the agency chartering authority similar to that of bank regulators to boost competition in the mortgage market.

June 12 -

Delinquencies associated with the government-sponsored enterprises high loan-to-value ratio programs that target low-to-moderate income homebuyers are slightly better than expected, at least early on, according to Fitch.

May 23 -

Government-sponsored enterprise executives say they want to continue to offer credit risk transfers and guarantee-fee parity after the GSEs are released from conservatorship, but they might not be able to.

May 22 -

Freddie Mac will keep building on the financial reforms that produced profitability during conservatorship as broader government-sponsored enterprise proposals take shape, according to departing CEO Don Layton.

May 1 -

Fannie Mae is considering sharing more risk with the private sector to reduce future strain on its earnings from the implementation of the Current Expected Credit Loss accounting standard next year.

May 1