-

But deal sponsors are primarily restricting property assets to the lower risk multifamily and office buildings that lenders are more confident will weather the economic strains brought by the coronavirus pandemic.

June 12 -

Sellers are currently willing to concede discounts of around 5%, while bidders are hoping for about 20% off pre-pandemic prices. That estimated gap, which is likely wider in specific cases, has put a freeze on deals.

May 19 -

PACE sponsors are raising capital and promoting plans to retroactively fund stalled CRE projects amid the COVID-19 outbreak, giving a potential boost to ABS activity in the space.

May 11 -

Goldman Sachs and Morgan Stanley are backing the first commercial mortgage-backed securities activity in two months, through two deals that exclude hotel or department store retail assets that are most exposed to pandemic-related stresses.

May 6 -

Delinquencies in U.S. commercial mortgage-backed securities jumped in April, with the economy battered by the coronavirus pandemic.

April 30 -

Mounting economic fallout from the pandemic is fueling apartment landlords' concerns that more tenants will struggle to make their rent payments, even after most managed to come up with the money for April.

April 29 -

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

The board- and management-level handing of CRE concentration was the chief concern of FDIC examiners, making up more than 56% of all the supervisory recommendations regulators made in the two-year period.

December 23 -

JPMorgan Chase & Co.’s asset management arm is extending a push into the $787 billion private credit market as cash pours into the asset class from yield-hungry investors.

December 13 -

The outlook for hotels and suburban offices is still questionable, but the prognosis for other property types in the securitized commercial real estate market remains fairly strong, according to Moody's Investors Service.

October 23 -

GameStop's plan to shutter up to 200 stores could adversely affect commercial mortgage-backed securities loans with a combined allocated property balance of almost $42 million, according to Morningstar Credit Ratings.

October 21 -

Rising demand and plummeting mortgage rates pushed multifamily origination dollar volume above 2017's record to a new peak, according to the Mortgage Bankers Association.

September 27 -

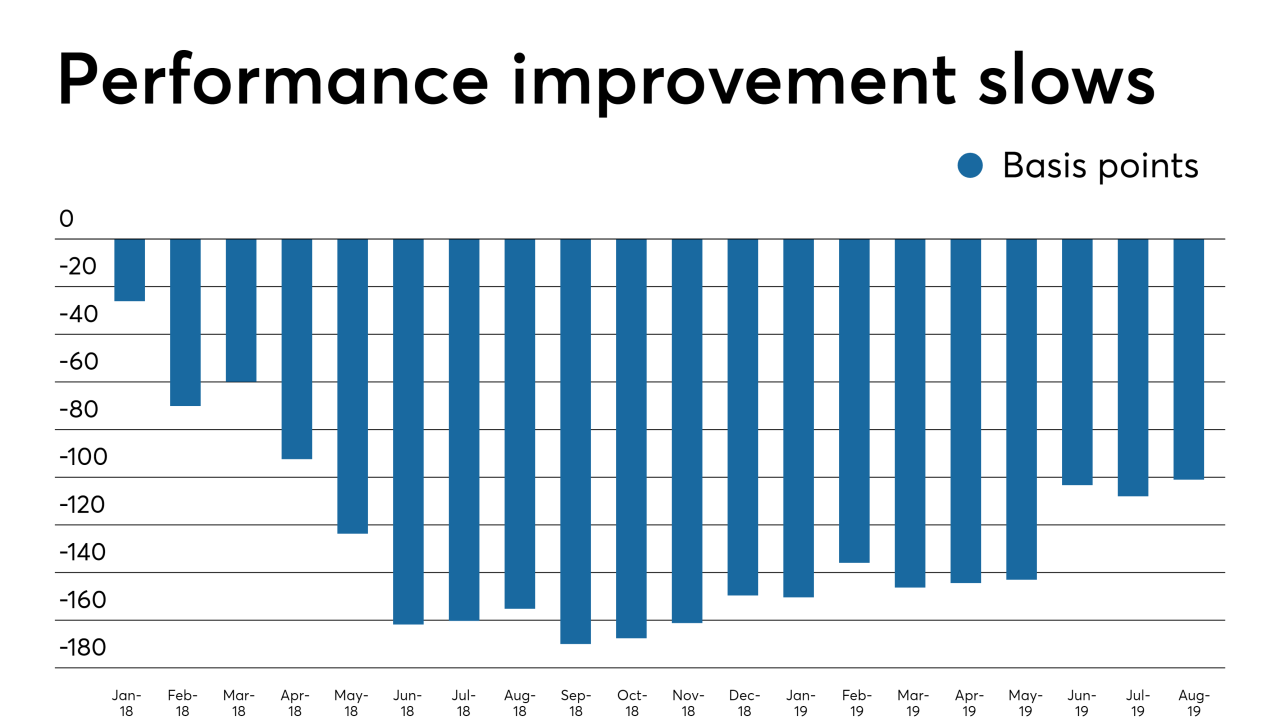

While delinquent loans in commercial mortgage-backed securities continued trending downward overall, there was an uptick in the rate for more recent originations, a Standard & Poor's report noted.

September 6 -

The Delaware company, best known for issuing prepaid cards, has ramped up commercial real estate securitizations. The shift promises to deliver big fees, but it could also cause headaches if defaults spike.

July 30 -

James Cotins and Matthew Lyons will work with lead partners Lee Askenazi and Robert Villani at the New York-based firm, joining from Alston & Bird.

June 14 -

The large number of overleveraged commercial mortgage-backed securities loans coming due in 2019 is likely to cause the payoff rate to drop an additional 9 percentage points by December, a Morningstar report said.

May 29 -

The large single-loan transaction covers two lab-office facilities in the Boston area's crowded life sciences corridor near MIT.

May 9 -

The trio of malls collateralizing the new mortgage include two well-performing mall as well as a troubled Florida super-regional shopping center.

April 23 -

Commercial and multifamily mortgage debt outstanding grew 6.8% in 2018, benefiting from strong employment numbers and strained inventory, according to the Mortgage Bankers Association.

March 14 -

Bancorp 2019-CRE5 contains 46 loans on apartment buildings accounting for 82.4% of the collateral pool; that's up from 78.8% for the sponsor's prior deal.

March 8