Community banking

Community banking

-

A Northwest credit union announced plans this week to buy a community bank, lifting the 2024 total of such deals to 13 and putting the year on track to set a record. The all-time annual high of 16 was set in 2022.

August 14 -

The Federal Housing Finance Agency wants to update the dual mission of the Federal Home Loan Banks. Members of the private bank cooperative say their regulator has no authority to redefine the mission.

August 8 -

The agency admitted navigating the different rules and regulations involved in its four existing lines of credit proved time consuming and confusing and kept some lenders from offering them altogether.

August 2 -

The Hammond, Louisiana, company, which announced changes to its business strategy, cut 71 jobs and reduced its dividend to 8 cents per share.

July 30 -

There were 27 bank acquisitions worth $5.45 billion announced in the second quarter as of mid-June. That was more than the $5.2 billion combined value of deals announced over the previous five quarters.

June 24 -

Atlanta Postal Credit Union's bid to acquire Affinity Bank marked the 11th deal overall this year involving a credit union buying a bank, matching the total for all of 2023. Separately, members voted against the merger of two credit unions in Indiana.

May 31 -

West Coast Community Bancorp agreed to acquire 1st Capital Bancorp in an all-stock deal slated to close in the fourth quarter.

May 21 -

Bank stocks are up this year as interest rates have leveled off and there are hopes that pressure on lenders' profits could moderate.

May 8 -

The Federal Reserve, Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency issued a 30-page guidebook on managing affiliate risks. The report builds on formal guidance issued last year.

May 3 -

In talks with OCC officials, "it became obvious that we would not gain near-term approval given their recent experience with multifamily and CRE positions," FirstSun CEO Neal Arnold says. The companies announced other revisions to their deal, too.

May 3 -

Consolidation has slowed since the pandemic, but UMB's agreement to buy Heartland Financial — the largest deal in three years — is one of several merger announcements in the past two weeks. Talks among other potential buyers and sellers are said to be picking up.

April 30 -

The Philadelphia-based bank's parent company, Republic First Bancshares, had been roiled by a yearslong proxy battle involving activist investors groups and its former CEO.

April 26 -

Should the all-stock transaction close as planned later this year, Wintrust Financial in the Chicago area would gain about $2.7 billion of assets.

April 15 -

A solid majority of decision-makers at these companies expect to expand their workforces again this year, a Citizens Financial survey found. Loan losses are normally low in eras of economic expansion.

April 9 -

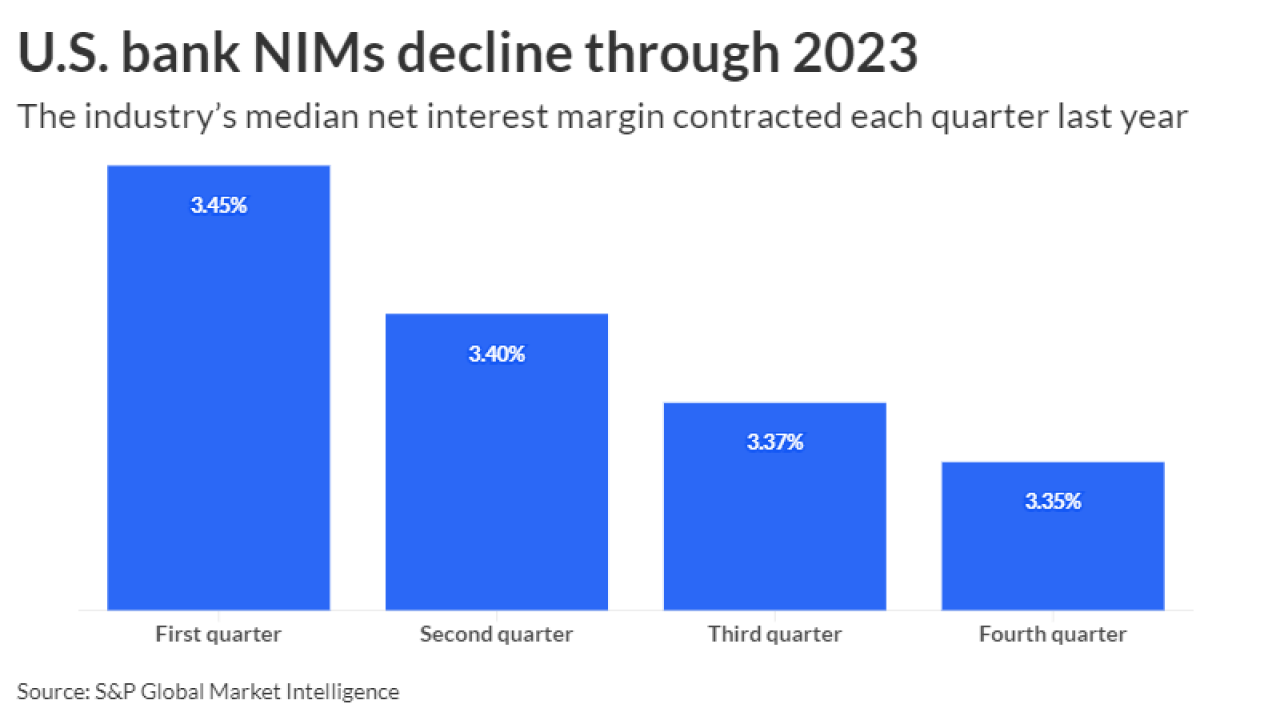

With high deposit and borrowing costs persisting amid the Federal Reserve's campaign against inflation, lenders face stress on their net interest margins and the potential of troubled loans ticking up.

April 2 -

First National has agreed to buy Touchstone Bankshares. The combined company would have more than $500 million each of deposits and loans.

March 26 -

Bank mergers and acquisitions have slowed in recent years amid recession fears and other economic uncertainties. But bank consolidation is a century-old trend that's expected to rev up again as early as this year due to higher costs, tougher regulation and fierce competition.

March 15 -

The USDA forecasted farm profits will plunge 26% this year, potentially creating credit quality challenges for lenders.

February 23 -

The deal involving Southern California Bancorp and California BanCorp, expected to close in the third quarter, would form a $4.6 billion-asset lender with a footprint spanning San Diego, Greater Los Angeles and the San Francisco Bay Area.

January 30 -

As part of a settlement with the Justice Department, Patriot Bank must invest more than $1 million of the total in a loan subsidy fund for minority homeowners and take other corrective steps in its everyday business. The bank denied any wrongdoing.

January 17