-

The average AAA note coupon of 103 basis points above Libor widened from 98.4 in March, which had been the tightest CLO spread level in approximately five years.

May 8 -

“We’re comforted by the fact our position in the market is so strong, and our ability to gain [loan] allocation is quite important," co-CEO Kewsong Lee says.

May 2 -

Hunton Andrews Kurth LLP (formerly Hunton & Williams and Andrews Kurth Kenyon) has named Robert A. Davis Jr. as special counsel in its tax and ERISA practice.

April 30 -

After the second-busiest quarter for primary European CLO issuance to start 2018, a two-week April lull in the market was ended with deal pricings by Intermediate Capital and Investcorp.

April 16 -

Jay Huang, a longtime Citigroup veteran who joined in January, is developing a high-tech trading-desk operation to enhance the company's portfolio of CLO investments.

April 16 -

The total volume of CLO refinancings for the month to date has reachd $11.3 billion, as managers continue to take advantage of the repeal of skin-in-the-game rules for this asset class.

April 13 -

With no more concerns about triggering risk retention on its large pile of older deals, Blackstone is dusting off CLO portfolios that have long been eligible for a refi makeover.

April 11 -

The LSTA has declared the era of risk retention for open-market CLOs is over, pending an unlikely U.S. Supreme Court intervention. "We believe we can exhale," the trade group said in a statement.

April 6 -

The $31.7 billion in collateralized loan obligation deals priced year-to-date is the most in a first quarter in the post-crisis era.

April 4 -

Fortress Investment Group's $702.8 portfolio of SME loans is the first since Softbank Group acquired Fortress in December.

April 3 -

Managers are regaining the ability to amend older deals that they previously locked down to maintain risk-retention exemptions.

April 2 -

The U.S. CLO manager breaks the ice with its first euro-denominated deal, which priced Friday and will close in May when it is about 75% ramped up.

March 27 -

The deadline to seek an en banc hearing has now passed, and skin-in-the-game rules for collateralized loan obligations could be off the books by April 2.

March 27 -

The deadline to appeal the rollback of risk-retention requirements for CLO managers expired at midnight last night, but Voya Alternative Asset Management is not taking advantage.

March 26 -

The sponsor has only identified $552 million of collateral for the $610 million deal; it has another four months to put the remaining $88 million to work in additional assets.

March 26 -

The money manager is preparing to refinance a $400 million deal originally printed in March 2016 that is currently grandfathered from risk retention rules - without bringing the deal into compliance.

March 21 -

The €413.5 million BlackRock European CLO V is the fourth euro-denominated CLO to launch this month, and asset manager's first since BlackRock Euro CLO IV priced in November.

March 20 -

Octagon is refinancing a 2013-vintage CLO for the second time, while Anchorage is using the assets of a deal issued in 2012 (and later refinanced in 2016) for its first new-issue deal of 2018.

March 20 -

The gap between long and short reinvestment periods for U.S. collateralized loan obligations that reset rates has widened in 2018 as managers contend with different market signals, says Fitch.

March 19 -

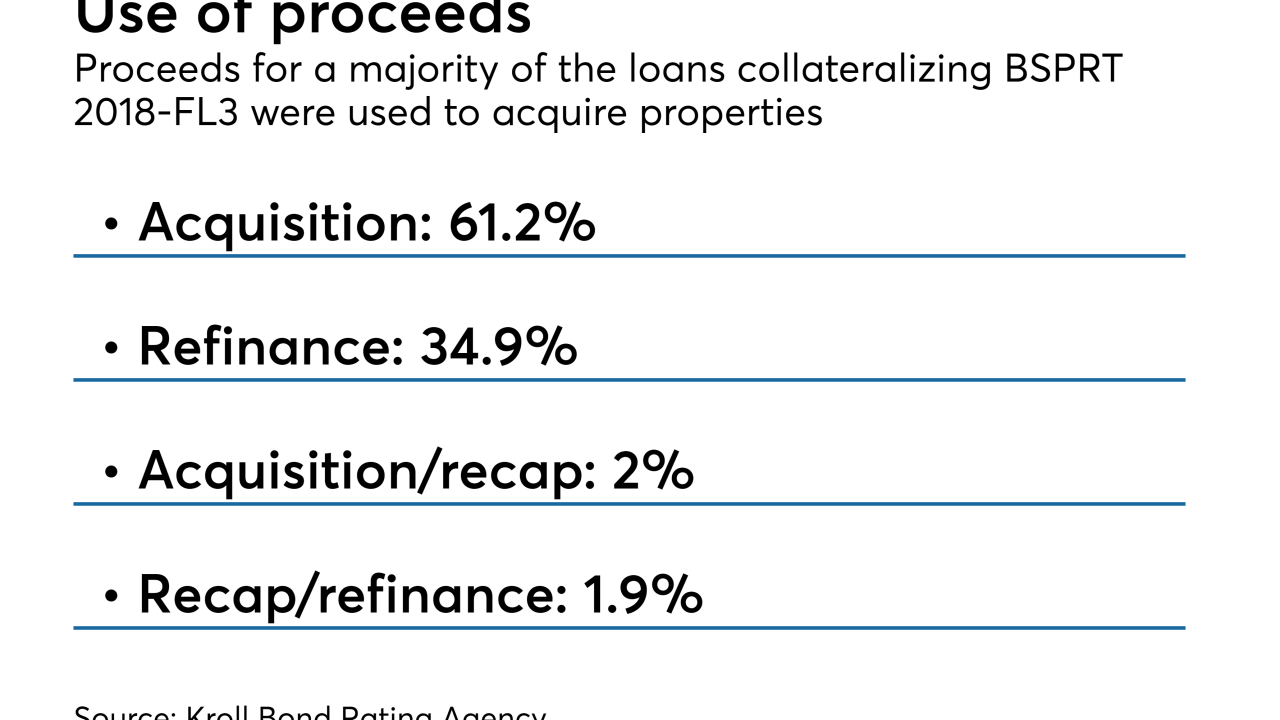

Nonbanks are originating more commercial mortgages on fixer-uppers in response to a sharp drop in the cost of funding in the securitization market. These deals are said to be "vastly different" than other CRE instruments that sustained big losses in the crisis — so far.

March 16