-

The triple-A rated senior tranche of Ares European CLO X has a coupon of 85 basis points above Euribor, an indication that a four-month widening trend in Europe CLO spreads continues; the deal is expected to close in September.

July 23 -

The transaction, Shelter Growth CRE 2018-FL1, is backed by 22 properties with a total balance of $415.1 million; it is static, meaning the only new loans to be added to the trust will be "companion” interest in loans secured by existing assets.

July 23 -

The New York State Supreme Court has ruled that Sound Point is within its rights to enforce a 90-day noncompete agreement with a manager who joined GoldenTree two weeks after his resignation.

July 22 -

That's a departure from the firm's existing fund, which acquires controlling stakes in CLOs through "equity" holdings; the new fund will be advised by the same principals, Tom Majewski, Daniel W. Ko and Daniel M. Spinner.

July 18 -

Tikehau CLO IV B.V. will control €400 million (UA$466.5 million) in mostly European leveraged loans and high-yield bonds (with an allowance for up to 25% of non-euro-denominated assets), according to Fitch Ratings.

July 17 -

Unusually for a debut transaction, the $329.7 million M360 2018-CRE1 will be actively managed: For the first 12 months after the closing date, funds from repaid principal can be used to purchase new loans, subject to eligibility criteria.

July 17 -

When the transaction closes on July 23 it will be renamed Fortress Credit VSL VI; additional collateral, nearly half (48%) of the total, in fact, will come from another CLO, Fortress VI.

July 17 -

The €414.2 million CVC Cordatus Loan Fund XI will issue exchangeable shares for four classes of notes; this allows the fund to hold bonds without putting itself off-limits to U.S. banks.

July 12 -

The lack of concrete lobbying victories had become an issue with some members in the group, possibly leading to a splintering of support among members and the board for continuing the executive director's tenure.

July 9 -

Most managers are looking to add three to five years of investable life through CLO resets and refis, but Apollo is sticking with a four-year reinvestment window in a refinancing of its 2016 ALM XVII portfolio.

July 6 -

Annisa CLO was originally issued in August 2016, just before risk retention regulation took effect, but was the firm's first deal to be dually compliant with both U.S. rules (which no longer apply to CLOs) and European rules.

July 3 -

GoldenTree Loan Opportunties XII was one of nine CLOs that were reset or refinanced on Friday alone, as managers rushed to lower payment prior to July quarterly payments to investors; the tally for June as a whole is $30.9 billion.

July 2 -

The deal, which is expected to close this summer, would bring THL Credit’s assets in collateralized loan obligations under management to approximately $12 billion and its total assets under management to over $15.5 billion.

June 27 -

HPS Loan Management 9-2016 will be backed by a $750 million portfolio of broadly syndicated loans and other assets, up from $500 million originally; Moody's is only rating the two senior tranches of notes to be issued.

June 26 -

That level is wide of the six new-issue CLOs that priced last week at triple-A spreads of 110 basis spoints; CLO senior notes have widened 10 basis points, on average, over the past three months.

June 22 -

The $470 million transaction has some features rarely seen now that the market for bridge loan securitization has been rehabilitated, including a "blind ramp" and a "blind reinvestment" period.

June 21 -

It's another example of what appears to be tailoring tranches to meet the tenor and yield requirements of specific investors; the deal, GMS Euro CLO 2014-1, was also upsized to €508 million from €368.3 million originally.

June 20 -

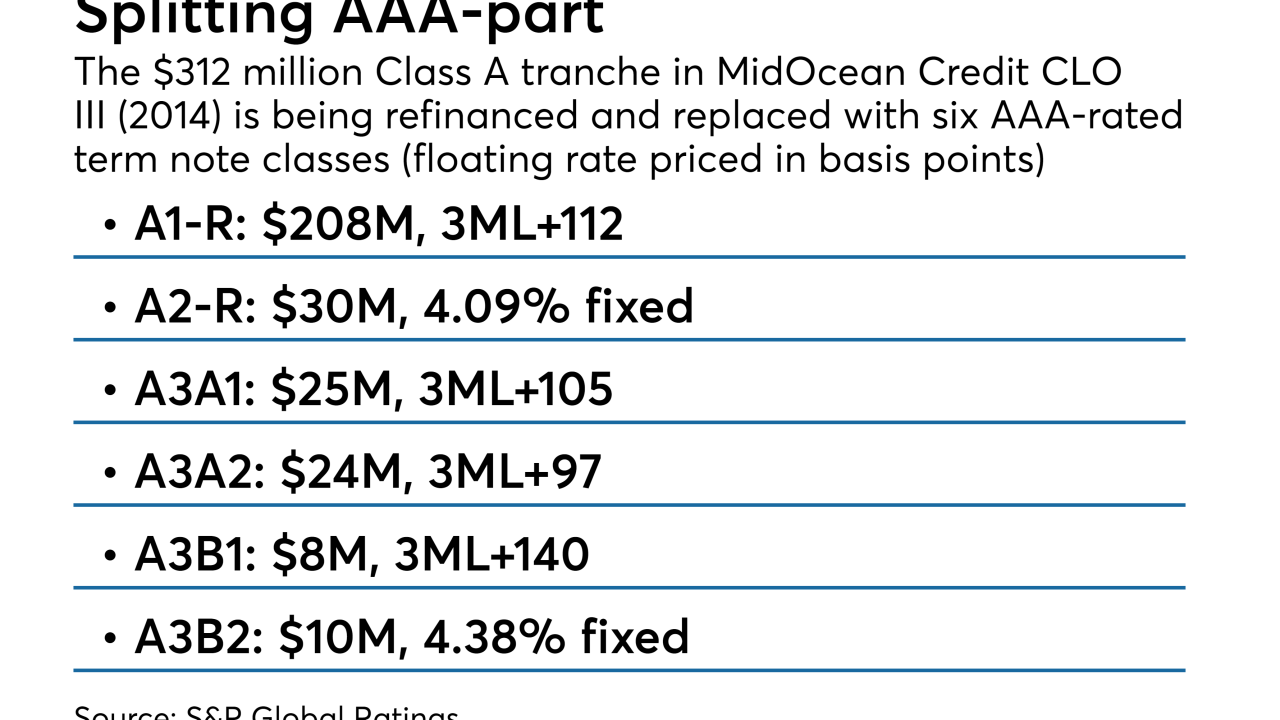

The original $312 million triple-A notes are being replaced with six separately priced Class A note tranches, including two fixed-rate securities classes

June 18 -

CLO securities pay out interest pegged to the three-month London interbank offered rate, but loans used as collateral are increasingly switching to one-month Libor and the spread between the two benchmarks has widened significantly.

June 14 -

The $278.3 million RCMF 2018-FL2 also has unusually heavy exposure to apartment buildings, offices and industrial properties that are either vacant or have low occupancy levels, according to Kroll Bond Rating Agency.

June 14