-

The $300 million transaction has a six-month prefunding period during with the last $50 million of loans will be acquired; it can be actively managed for three years.

September 10 -

TCI Capital assigned two CLO deals totaling $1 billion that it was managing for Columbia Management Investment Advisers, after Columbia resigned its subadvisory role.

September 7 -

Collateralized loan obligations denominated in pounds sterling were once a tough sell; two recent deals from Barclays and PGIM indicate that this is changing.

September 4 -

The credit arm of the $24 billion asset H.I.G. Capital is marketing a $458.1 million BSL CLO, its first deal since April 2015.

August 31 -

The $408.4M Anchorage Capital CLO 2018-10 adds to the $5.2B-asset manager's 2018 tally of three re-issues and a refinancing — not to mention a debut European CLO.

August 29 -

The percentage of CCC "buckets" in CLOs increased in the second quarter and they are now at levels similar to 2016, when managers struggled with concentrations of troubled energy-sector assets.

August 28 -

The first two transactions were initiated in March, just a few days before skin-in-the-game rules were lifted for this asset class; this time, the CLO manager is not exactly sticking its neck out.

August 28 -

Jeff Weinstein and Patrick Lampe join from the Chicago office of Sidley Austin; Morgan Lewis partner Philip Russell is relocating from the firm’s New York office.

August 28 -

DFG Investment Advisers, led by former Goldman and HVB Group veterans, will exceed $4.2B in CLO assets under management with the latest deal.

August 26 -

The $502 million Diamond CLO represents the first securitization of small/medium enterprise loans since Blackstone in the second quarter relaunched a direct lending business.

August 21 -

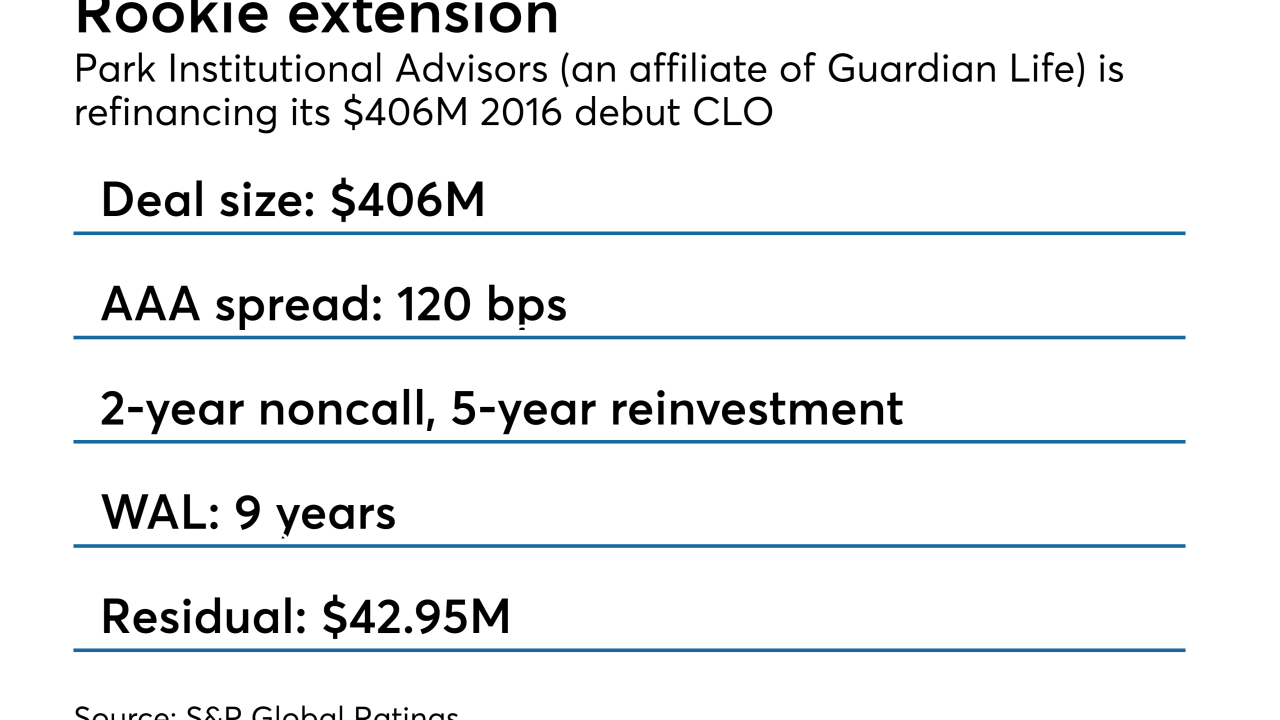

Once refinanced, the $406 million Park Avenue Institutional Advisors CLO 2016-1 will be non-callable for two years and can be actively managed for up to five years.

August 17 -

The $449.2 million Carlyle Direct Lending CLO 2015-1R is the 11th deal the global alternative asset manager has refinanced this year.

August 16 -

Execs at both closed-end funds say expectations for an eventual rise in defaults are driving their strategy to extend reinvestment periods on CLOs in their portfolios.

August 15 -

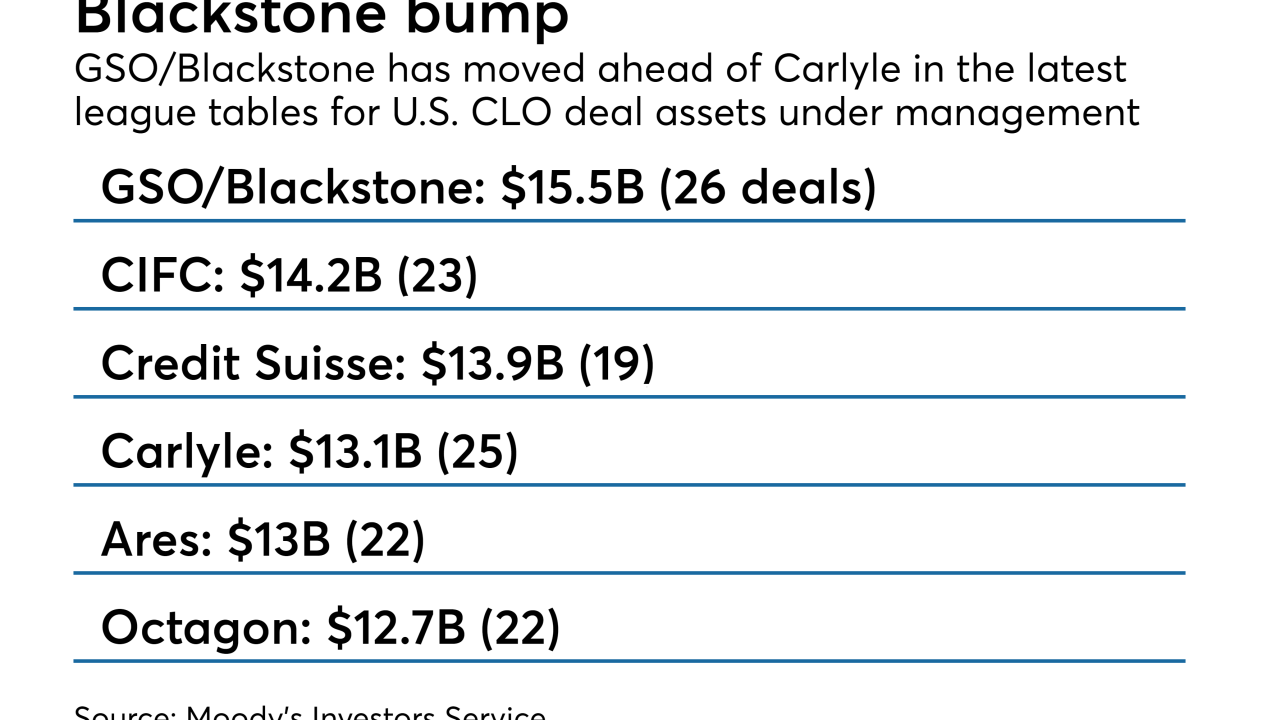

The distressed-debt manager now manages 26 U.S. CLOs totaling $15.5 billion, the most of any domestic CLO market manager.

August 13 -

The £325 million Dryden 63 CLO, sponsored by PGIM, will issue six classes of sterling-denominated notes; Barclays’ £4.5 billion Sirius Funding is issuing three tranches in three different currencies.

August 6 -

The eligibility criteria for loans that can be acquired are “more liberal” than recent CRE CLOs rated by Kroll; they are also more liberal than those of Hunt’s initial CRE CLO, completed last year.

August 3 -

While Carlyle has been judicious with new issuance, it had a busier second quarter in refinancing older deals; several more will be ripe for refinancing in the third quarter.

August 2 -

Mindful Wealth, an investment firm based in Singapore, is raising money to put to work in some of the riskier tranches of U.S. collateralized loan obligations, those rated BBB and B.

August 1 -

Recent documentation tweaks that afford "excessive amounts of flexibility" to CLO managers can introduce "material, and even unquantifiable, risks" into transactions, according to the rating agency.

July 27 -

The Chicago-based corporate small-business lender and CLO management firm also reduced the cost in subordinate notes as it chose to maintain the existing reinvestment and maturity periods limiting the deal's shelf life.

July 24