-

Cadogan Square CLO XIII DAC will be Credit Suisse Asset Management's fourth euro-denominated CLO issued in the past 12 months.

January 24 -

That's significantly wider than 121 basis points average for new CLOs backed by broadly syndicated loans that were issued in December.

January 22 -

GoldenTree's $757 million CLO is the first deal seeking to price in the 2019 primary market, while Octagon Credit Investors is refinancing a $791.5M, 2014-vintage CLO (for a second time).

January 18 -

It may not signal a recession, but structured finance pros are still preparing for a more risk-off environment.

January 16 -

The Japan Financial Services Agency is considering increasing capital requirements for holdings of securitizations if the sponsors do not have "skin in game."

January 16 -

A few took advantage of deep discounts to scoop up collateral for new deals on the cheap; others swapped out some of their weakest credits for more highly rated loans.

January 15 -

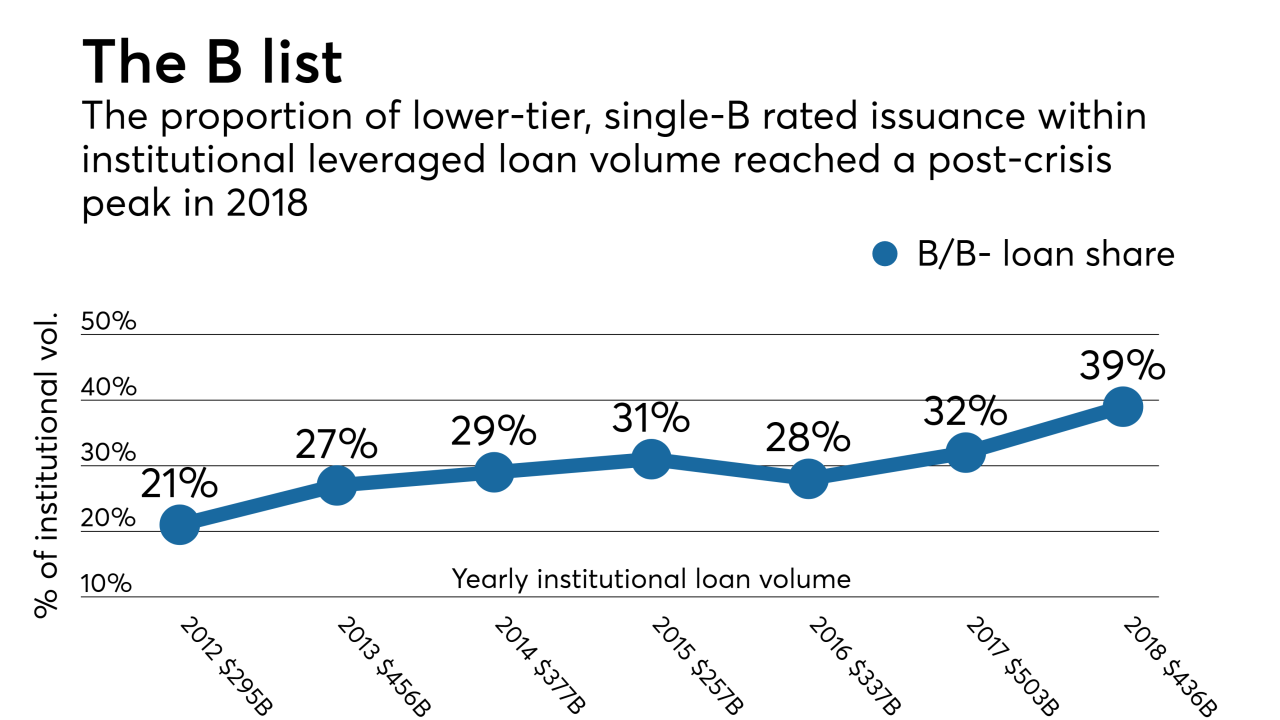

Z Capital's $350M CLO can hold up to 50% of its assets in risky triple-C rated assets, giving it a wide cushion to bulk up on the growing supply of single-B loans near the CCC-rating threshold.

January 9 -

The market has not seen a prolonged period of widening spreads since an eight-month period before early 2016, which was the launching point for a nearly two-year run of AAA spread narrowing.

January 8 -

The deal, dubbed Hercules Capital Funding Trust 2019-1, comes just two months after the business development company completed a $200 million transaction.

January 8 -

Steven Mastrovich joins the firm a week after the departure of partner and CRE/CLO specialist Steven Kolyer for Sidley Austin.

January 7 -

The global asset manager is sponsoring its first post-crisis CLO in a €409.8 million transaction that priced through Barclays on Monday.

January 3 -

Since Nov. 21, investors have withdrawn a net $14.88B from the loan fund market amid concerns the Fed will limit rate hikes in 2019; the exodus makes loans even more of a buyer's market for CLOs.

January 2 -

Steven Kolyer, a 27-year veteran of law firm Clifford Chance, was recruited to build out the burgeoning practice advising lenders and arrangers in bridge-loan CRE financing.

January 2 -

This year saw elation over the rollback of risk retention for CLOs give way to concerns about leveraged lending, the 1st post-crisis downgrade of a subprime auto deal, the 1st AAA for commercial PACE, and much, much more.

December 31 -

They differ slightly from those released earlier by the Fed-convened ARRC, including language making it easier to ditch a SOFR-derived benchmark in favor of a new benchmark that has yet to be developed.

December 26 -

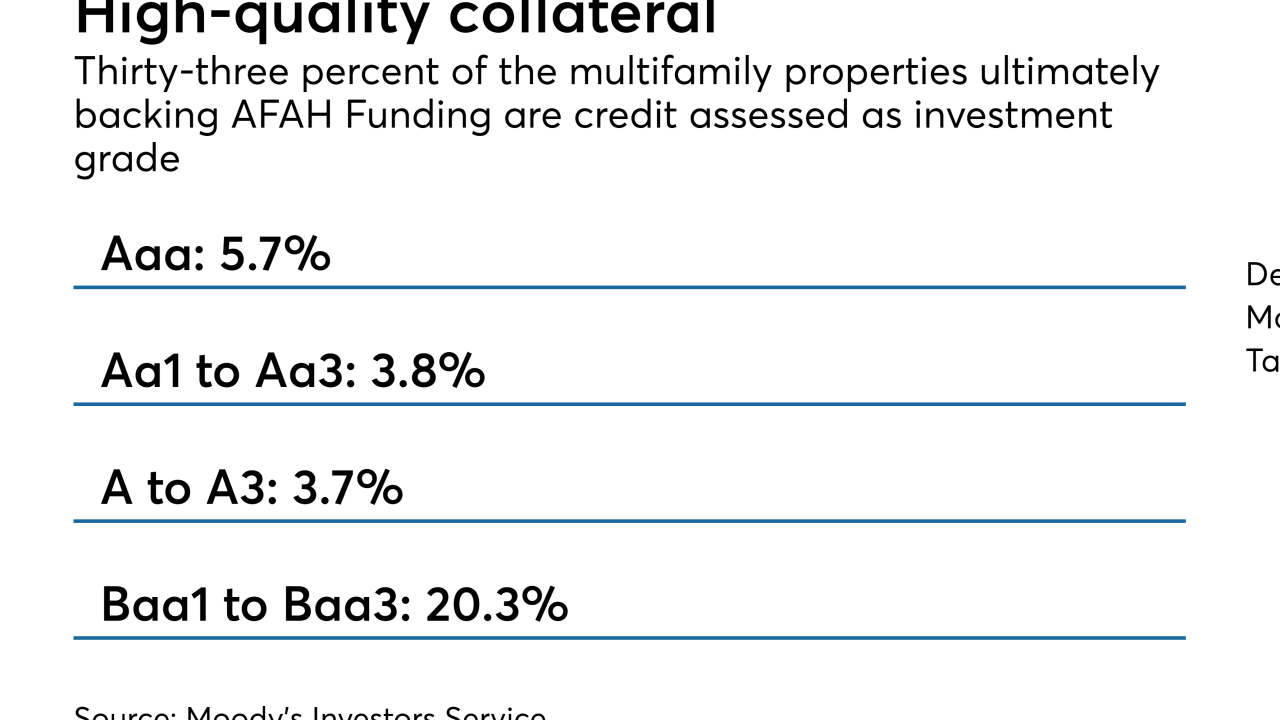

AFAH Funding is not your typical CRE CLO: It is backed by entirely by long-dated mezzanine interests in multifamily properties that are eligible for low-income housing tax credits.

December 24 -

A Wells Fargo report this week shows that market spreads for the triple-A notes backed by collateralized loan obligation assets are at 128, a level not seen since May 2017.

December 21 -

The $500 million AIG CLO 2018-1, AIG's first deal since selling off its asset management business in 2010, is priced at 132 basis points over three-month Libor.

December 20 -

The €350 million Providus CLO II is backed exclusively by loans to mid-market firms that meet the private equity firm's sustainability criteria; at closing, 90% of the collateral has been identified.

December 20 -

The LA-based manager is pricing the replacement AAA notes of Oaktree EIF III Series 1 inside recent market averages through a limited, brief noncall extension.

December 17