-

Players as small as Oxford Lane and as large as the Carlyle Group have money to put to work funding risk retention and investing opportunistically; trends could attract more first-time managers.

February 8 -

The deal is backed by an unusually concentrated portfolio of just 19 loans on properties being rehabbed or converted to a new use; by property type, the biggest exposure is to hospitality, at 19.7%.

February 8 -

Voya Alternative Asset Management is replacing and consolidating seven fixed- and floating-rate tranches with five new variable-rate classes that each gained lower rates than predecessor notes.

February 7 -

The Los Angeles-based distressed-debt specialist has $20.5 billion in dry powder, including over $8.8 billion in uncommitted capital stored in a dormant opportunities fund.

February 7 -

S&P Global Rating's London office made the rare move to downgrade the junior-most notes in a 2016 CLO issued by a Danish credit manager due to a deterioration in portfolio maintenance levels.

February 2 -

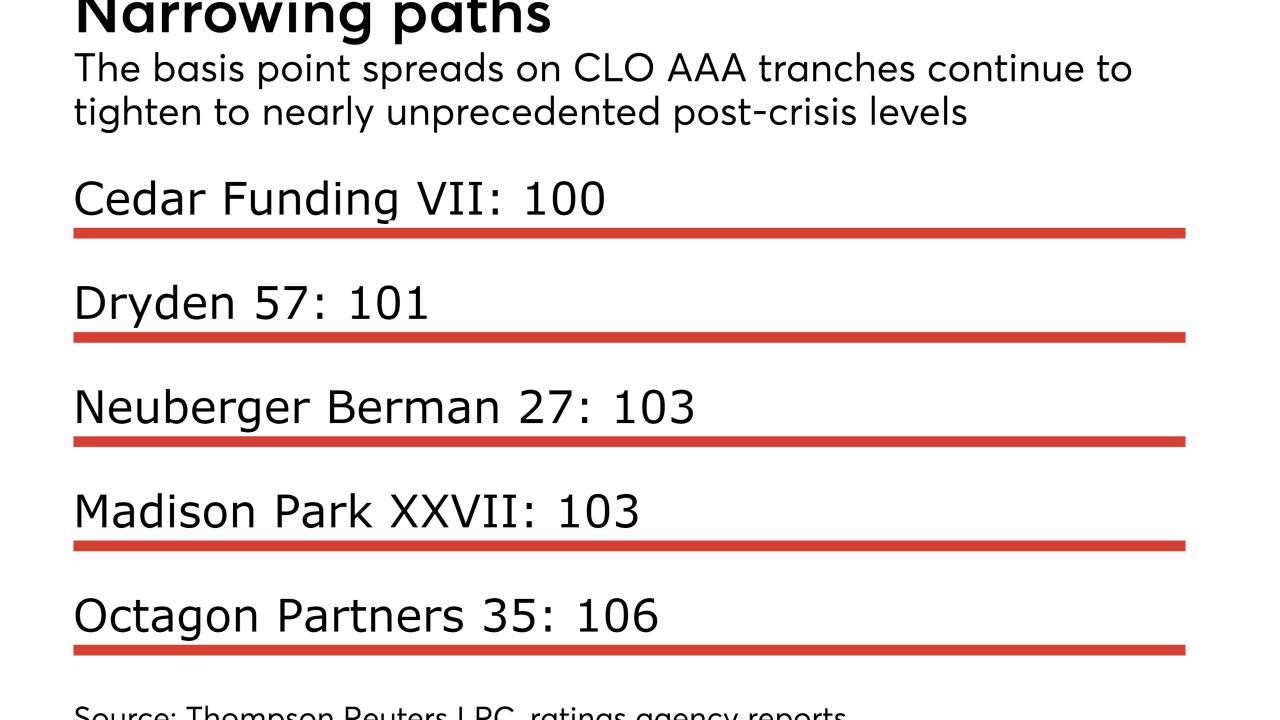

Aegon Asset Management's new Cedar Funding CLO VII is expected to price its senior triple-A notes at 100 basis points above Libor, carrying on a 2017 trend of tightening spreads.

January 31 -

While tightening down on cov-lite and subordinate loans, Marathon CLO XI's rules give the asset manager more room to trade in lower-credit and DIP loans.

January 31 -

Returns for equity investors are increasingly under pressure because of demand for the underlying loan assets, but strategies to boost returns can investors in other CLO securities at risk.

January 29 -

The $407 million Crown Point 4 is also the first CLO in nearly three years for Valcour, which was last in the market with the $400 million Crown Point III in March 2015.

January 26 -

Traditional refinancings are document intensive, time-consuming and costly; the SEC has given the green light to more efficient mechanism that resets coupons at periodic auctions.

January 22 Seward & Kissel’s Structured Finance and CLO Group

Seward & Kissel’s Structured Finance and CLO Group -

The New York-based alternative asset manager is first out of the gate with a new-issue deal amidst a flurry of early reset/refinancing activity totaling $3.4 billion.

January 19 -

The Carlyle Group, Blackstone/GSO and Investcorp have reset or refinanced a trio of 2014 and 2015 vintage, euro-denominated deals.

January 17 -

The $165 billion of collateralized loan obligations that were refinanced in 2017 as a whole account for more than one-third of all U.S. CLO assets under management, according to Thomson Reuters LPC.

January 10 -

Tralee CLO IV is a $409.2 million portfolio that immediately more than doubles the assets under management for Par-Four Investment Management.

January 9 -

With ideal macroeconomic fundamentals of economic growth and low interest rates still in place, S&P Global sees no reason for issuance to slow in 2018.

January 3 -

Carlyle has raised an additional $800 million for "opportunistic" debt and equity investments of third-party CLOs, in a planned expansion of its $19.4B in structured credit business assets under management.

January 2 -

AXA Investment Advisors' two primary-issue CLOs in 2017 were each priced within the past month.

December 29 -

Many raised large amounts of capital to put to work in the equity, or riskiest slices of their deals, allowing them to resume issuing new deals just as new loan issuance was taking off.

December 22 -

Exposure to PetSmart's now triple-C rated loan will strain the distressed debt limits of 24 collateralized loan obligations, while two other deals face potential interest-diversion test failures.

December 21 -

The collateralized loan obligation market is ending the year at nearly full throttle with nearly $18 billion in new deal/refi volume month-to-date, with more on the way.

December 20