-

It can be a more efficient way to raise regulatory capital than relying solely on equity, but lenders that securitize this debt have struggled to get the market back off the ground.

September 26 -

While banking regulators are currently looking the other way when corporate debt packages exceed 6.0 leverage, that could easily change under a new administration or Congress.

September 24 -

A conflict between risk retention rules and prohibitions against self-dealing were limiting options for some lenders to hold skin in the game; a no-action letter issued to Golub Capital creates a "clear path" to compliance.

September 20 -

Tetragon Credit Income Partners is considering a move outside its niche CLO equity investment strategy in expanding its portfolio management team.

September 19 -

The Boston-based firm has refinanced two existing deals within the last 10 months, but hasn't printed a new deal since October 2015, well before U.S. risk retention rules took effect.

September 17 -

The deal will be managed through its BDC, which formed a joint venture last December to fund PE-sponsored firms with unitranche corporate loans.

September 14 -

The deal, which Fitch did not name in its report, appears to be VCO CLO 2018-1. The agency said the transaction might not even merit a single-A rating, given the high single-sector concentration.

September 12 -

J.P. Morgan Asset Management is not disclosing why it is retiring the $1B Palm Lane Credit Opportunities Fund; the fund was previously being considered for a spinoff.

September 11 -

TCI Capital assigned two CLO deals totaling $1 billion that it was managing for Columbia Management Investment Advisers, after Columbia resigned its subadvisory role.

September 7 -

Collateralized loan obligations denominated in pounds sterling were once a tough sell; two recent deals from Barclays and PGIM indicate that this is changing.

September 4 -

The credit arm of the $24 billion asset H.I.G. Capital is marketing a $458.1 million BSL CLO, its first deal since April 2015.

August 31 -

The $408.4M Anchorage Capital CLO 2018-10 adds to the $5.2B-asset manager's 2018 tally of three re-issues and a refinancing — not to mention a debut European CLO.

August 29 -

The percentage of CCC "buckets" in CLOs increased in the second quarter and they are now at levels similar to 2016, when managers struggled with concentrations of troubled energy-sector assets.

August 28 -

The first two transactions were initiated in March, just a few days before skin-in-the-game rules were lifted for this asset class; this time, the CLO manager is not exactly sticking its neck out.

August 28 -

DFG Investment Advisers, led by former Goldman and HVB Group veterans, will exceed $4.2B in CLO assets under management with the latest deal.

August 26 -

The $502 million Diamond CLO represents the first securitization of small/medium enterprise loans since Blackstone in the second quarter relaunched a direct lending business.

August 21 -

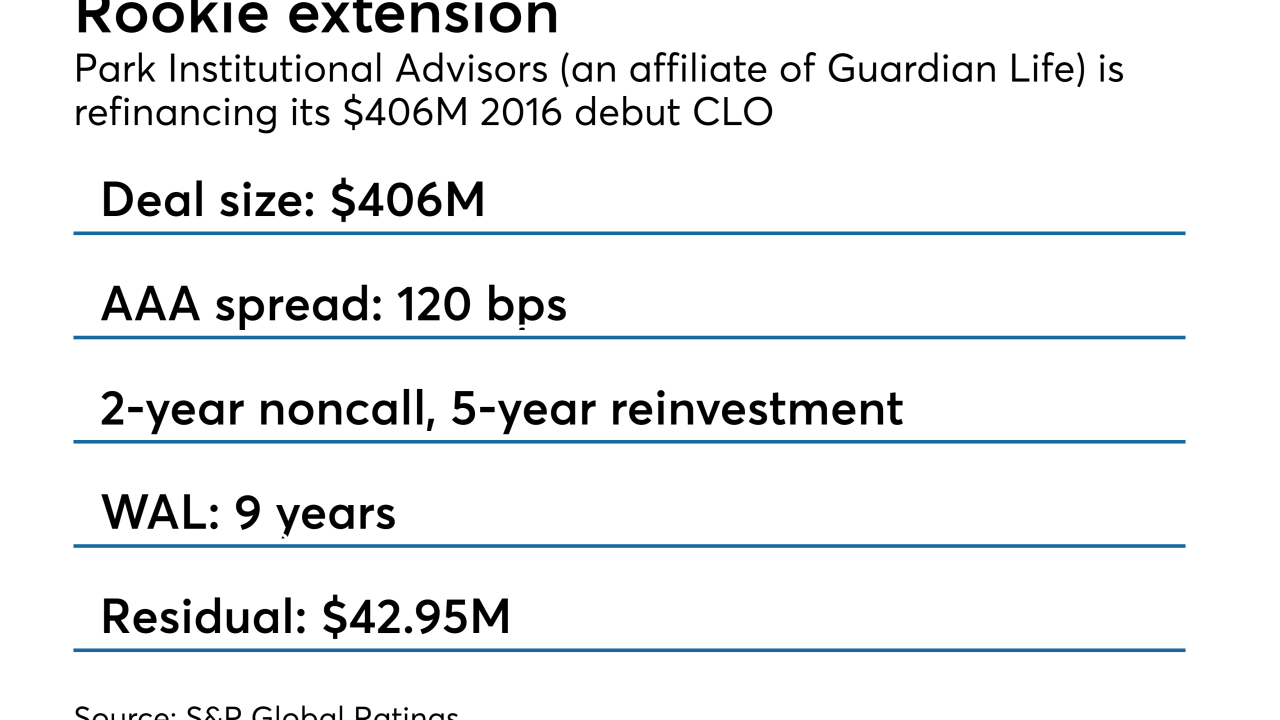

Once refinanced, the $406 million Park Avenue Institutional Advisors CLO 2016-1 will be non-callable for two years and can be actively managed for up to five years.

August 17 -

The $449.2 million Carlyle Direct Lending CLO 2015-1R is the 11th deal the global alternative asset manager has refinanced this year.

August 16 -

Execs at both closed-end funds say expectations for an eventual rise in defaults are driving their strategy to extend reinvestment periods on CLOs in their portfolios.

August 15 -

The investors initially won the right to sue as a group in 2015 before an appeals court reversed the ruling; the $13 billion lawsuit can now proceed as a class action.

August 15