-

Global yields rose on Thursday as markets around the world adjusted to central banks keeping interest rates higher for longer, with the US two-year yield briefly exceeding 5% for the first time since November.

April 11 -

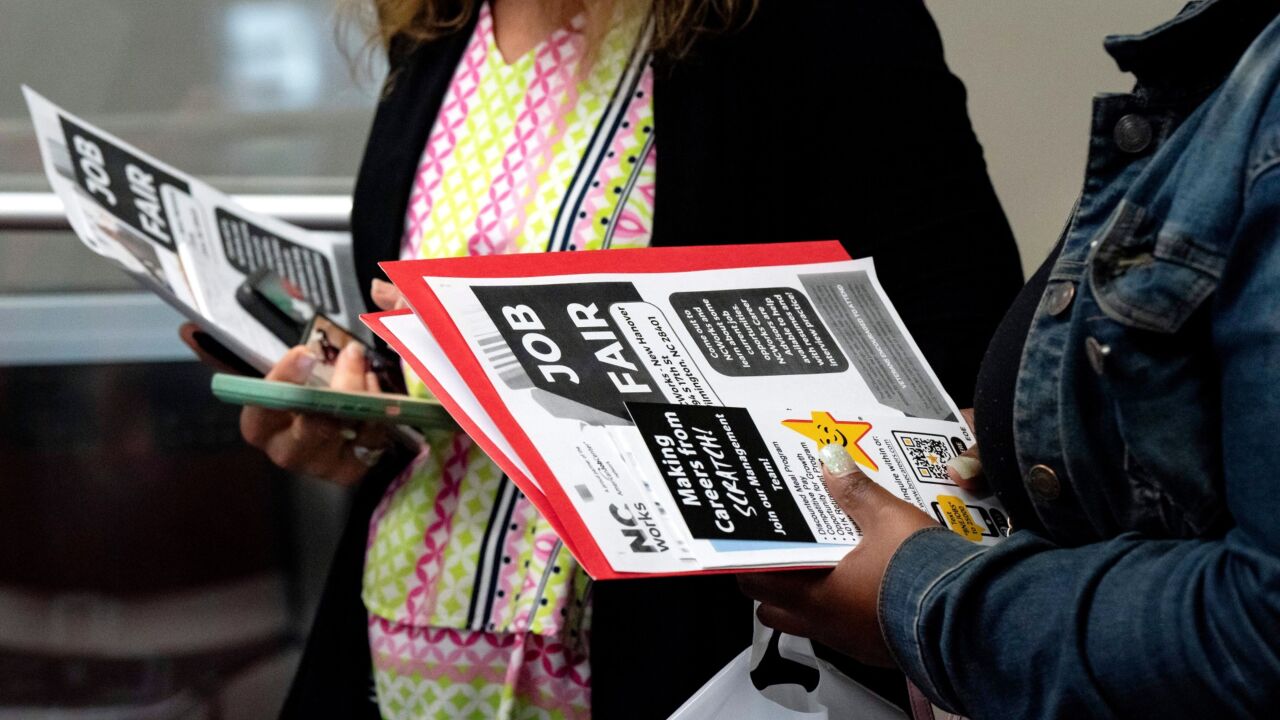

Traders ceased fully pricing in a Fed rate cut before September after the March employment report revealed that US payrolls expanded by the most in nearly a year.

April 5 -

He called the January and February inflation readings "a little bit concerning," and said he needs to see more progress on prices to gain confidence that they're moving toward the Fed's 2% target.

April 4 -

JPMorgan Chase & Co.'s latest client survey showed that outright short positions in US Treasuries rose to the most since the start of the year in the week leading up to April 1.

April 2 -

Treasuries fell across the curve after data showed manufacturing unexpectedly expanded for the first time since September 2022 — while input costs climbed.

April 1 -

Treasuries fell across the US curve, with shorter maturities leading the way after Federal Reserve Governor Christopher Waller said he wants to see "at least a couple months of better inflation data" before cutting rates.

March 28 -

The global shift to a low-carbon world will be "long, hard and complex," but Barclays's commitment is unwavering.

March 19 -

In credit, a risk-taking ebullience has taken hold. The lowest-rated traded company debt is outgunning safer assets.

March 8 -

D.E. Shaw is purchasing credit-linked notes sold by banks that transfer the risk to the buyer in exchange for a coupon payment, while keeping the assets on the lender's balance sheet.

March 4 -

Stickier inflation and deteriorating budget estimates "could start to reverse the 40-year downtrend" of a key measure of how much bond investors are compensated for holding long-term debt.

March 1