-

Kroll Bond Rating Agency says the riskiest notes issued in the 2016 transaction are at “substantial risk of loss,” following on the heels of a similar move by S&P last week. Kroll also put a more senior class of notes under review for a possible downgrade.

July 24 -

S&P has cut its credit ratings on a deep subprime loan securitization completed by Honor Finance in 2016, warning that the most subordinate tranche of notes issued in the deal is “at risk of not being repaid.”

July 18 -

OneMain can add qualifying loans to the pool of collateral for the first two years of the transaction; by comparison, its two prior deals featured one-year revolving periods.

July 17 -

The Dallas-based lender's third foray into the deep subprime ABS market in 2018 arrives as recent Santander DRIVE securitizations are performing well with recently lowered loss expectations from S&P Global Ratings.

July 12 -

Loans originally securitized in three 2013 transactions account for some 11.4% of the initial collateral for the $230 million CPS Auto Receivables Trust 2018-C, according to S&P Global Ratings.

July 6 -

Bavarian Sky UK 2 plc is as yet unsized; the collateral will initially consist of 70% new and 30% used primarily BWM and MINI vehicles, 56% of which use diesel fuel, according to Moody's Investors Service.

June 27 -

The rental car giant is issuing approximately $213 million each of notes maturing in July 2021 and July 2023 from its revolving master trust, Hertz Vehicle Financing II LP, according to rating agency presale reports.

June 18 -

In Santander Consumer USA's third subprime shelf offering of 2018, new cars represent 55.8% of the collateral. In previous deals dating to 2013 new-car concentrations did not exceed 40.9%.

June 15 -

Global Lending Services returns to double-A status in its new $299.4M transaction, while American Credit Acceptance issued another AAA-rated deal with a substantial prefunding account feature.

June 7 -

The subprime lender could lose a big partner now that Fiat Chrysler has officially announced it will form its own auto finance unit, and the two are negotiating an end to their 6-year-old relationship.

June 1 -

Despite a steep drop in average FICO and increase in extended-term loans, DriveTime is shaving overcollateralization levels thanks in part to improved performance from its outstanding securitization portfolios.

June 1 -

Fiat Chrysler is expected to announce Friday that it will establish its own captive finance unit in the U.S. The move could be bad news for its lending partners.

May 30 -

The Dallas-based lender, a unit of the global banking giant Banco Santander, was able to lower credit enhancement on the senior notes to 63.55% from 65.25% on the previous deal in February.

May 10 -

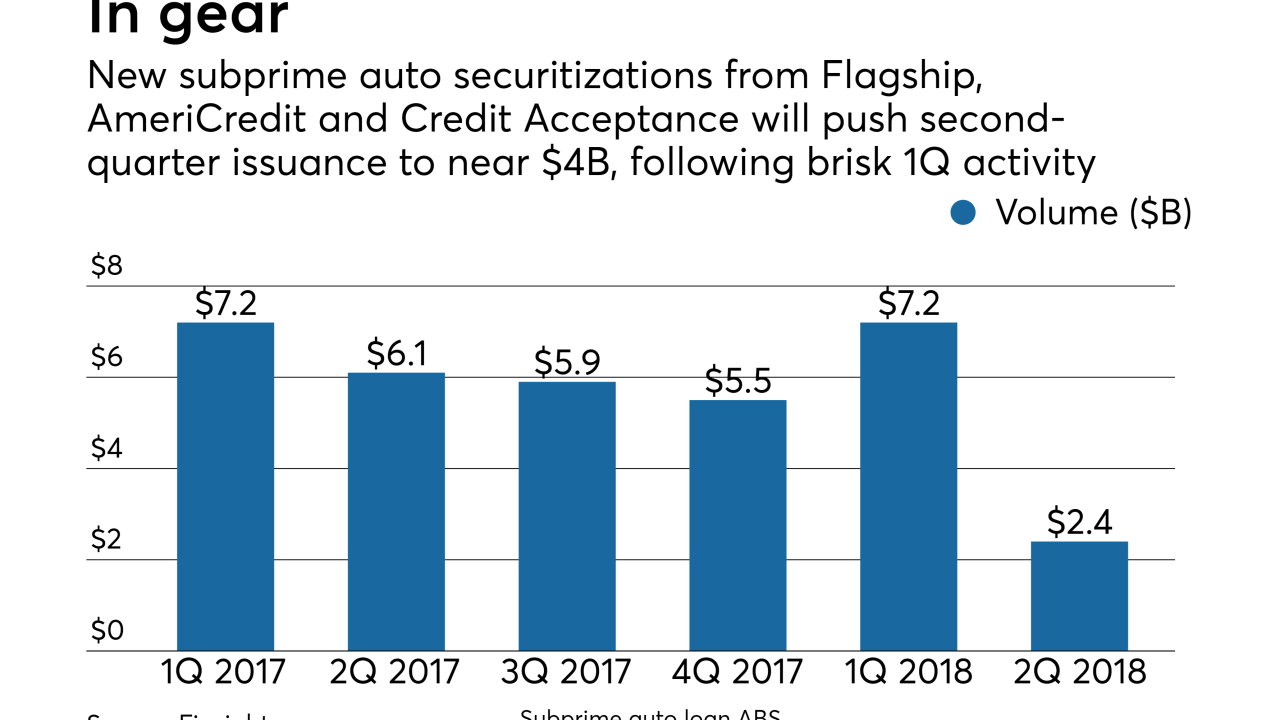

AmeriCredit returns to securitization for the first time since November with a $1.1 billion deal, while Flagship's $223 million deal, its second of 2018, takes a step back in collateral quality.

May 9 -

The senior tranche of Credit Acceptance Auto Loan Trust 2018-2 benefits from initial credit enhancement of 51.61%, up from 49.93% in a February deal; it comes from additional subordination.

May 9 -

RAC King (d/b/a American Car Center) has expanded rapidly since being acquired in a 2016 leveraged buyout; now it's bundling most of its portfolio into collateral for bonds.

April 25 -

The $185 million transaction features a higher exposure to borrowers entering bankruptcy than the sponsor's 2016 deal; it's also more seasoned, since it recycles 2014 collateral.

April 19 -

Higher LTVs and fewer low-risk, new-car loans trumped the recent decline in managed-portfolio delinquencies and improved ABS performance since 2015.

April 16 -

The sponsor is pooling what a majority of customers are buying these days, but future gas-price shocks could depressed used-vehicle prices on the lower MPG models.

April 12 -

The transaction is backed by 6,857 loans with a total balance of $835 million, or roughly 13% of the $6.4 billion of commercial vehicle and equipment loans in Mercedes-Benz Financial Services USA.

March 16