-

The performance of outstanding transactions issued via the Capital Auto Receivables Trust platform is weakening, so rating agencies are demanding additional investor protections.

March 8 -

Credit enhancement on the senior notes has risen to 36.25% from 28.7% to account for higher expected losses on the collateral; Kroll's base-case range is for 6.75% to 8.75% over the life of the deal.

March 8 -

DriveTime's improving loss performance in recent securitizations allowed it to relax the enhancement levels on its first securitization of the year.

March 2 -

Despite riskier terms, rising delinquencies and falling used car values, investors keep buying bonds backed by prime and subprime auto loans and leases.

February 28 -

The three offerings push the first-quarter volume of subprime auto loan asset-backeds past $5 billion, an indication of unwavering demand for the risky asset class.

February 9 -

The Detroit company recorded an 11% increase in car loans and leases originated during the fourth quarter, as well as a jump in yields. Ally appears to be benefiting from Wells Fargo's substantial retrenchment in auto lending.

January 30 -

The credit quality of the collateral appears to have improved, but investor protections have also decreased; as a result, Kroll is only assigning an 'A' to the senior tranche of notes.

January 26 -

The Salt Lake City-based lender homes in on troubled borrowers whose subprime status is primarily tied to a recent bankruptcy protection filing.

January 23 -

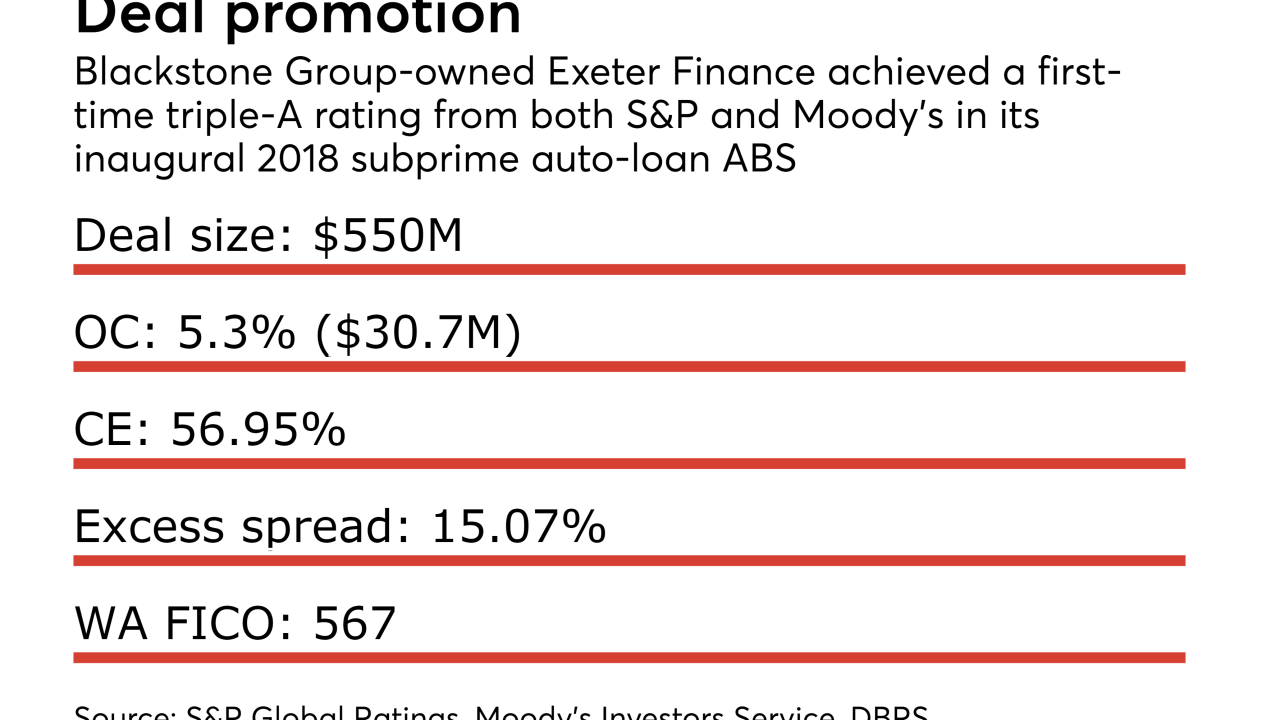

The Irving, Tex.-based specialty lender boosted senior-note credit enhancement levels and has stabilized portfolio losses to break the AA ratings cap on its deals, according to S&P Global Ratings.

January 19 -

Improved underwriting allowed the lender to secure AAA ratings despite offering the lowest credit enhancement on senior SDART notes in three years.

January 11 -

The lender's first deal of the year is sized at $750 million, in line with its two prior offerings, but the amount of collateral has been significantly increased, to over $1 billion.

January 11 -

The first issuance on its Finsbury Square platform marks the specialty mortgage originator's seventh securitization since 2010.

January 8 -

The first subprime auto ABS deal for 2018 is the 30th overall for Consumer Portfolio Services, with caters to deep subprime borrower pools.

January 5 -

Despite boosting credit enhancement, the sponsor was only able to earn an 'A' from S&P Global Ratings, which cited heightened competition and adverse borrower selection.

December 1 -

In its third securitization of cash-out auto loans, OneMain will for the first time include originations from the 1,000 legacy offices acquired from CitiFinancial.

November 30 -

Kroll expects cumulative net losses on the collateral for American Credit Acceptance 2017-4 to be as high as 29.9%; the senior notes have 66.35% initial credit enhancement.

November 29 -

More stringent underwriting is the likely reason banks and credit unions are seeing relatively low levels of delinquencies on car loans to high-risk borrowers.

November 14 -

Nearly one-third of the vehicles in CIG Financial's $172 million transaction have mileage above 100,000; the highest-mileage car financed has 197,387.

November 13 -

The company increased the concentration of sub-550 Beacon score borrowers to more than 13%, and cut the share of prime 700-plus loans by more than two-thirds from its prior deal.

November 8 -

The Dallas consumer lender says it plans to boost subprime originations again after retooling its portfolio and taking stock of the economy.

October 27