-

Mortgage professionals interviewed say there should be more focus on increasing housing supply.

August 21 -

Vice President Kamala Harris outlined a raft of populist economic proposals in her first major economic speech since securing the Democratic presidential nomination, including some aimed at lowering housing costs and boosting supply.

August 16 -

The Federal Housing Finance Agency wants to update the dual mission of the Federal Home Loan Banks. Members of the private bank cooperative say their regulator has no authority to redefine the mission.

August 8 -

The parent company of Fulton Bank announced the creation of three new management roles and promoted existing employees into those jobs. The changes follow the recent hiring of an outsider to be CFO.

August 6 -

Vice President Harris' surprise elevation to the top of the Democratic ticket and the ascent of Ohio Sen. J.D. Vance to be the Republican vice presidential pick brings renewed vigor to each party's economic vision.

July 22 -

Investors are set to start the week scrambling to decide if President Joe Biden's decision to end his reelection campaign and endorse Vice President Kamala Harris increases or decreases Donald Trump's chances of regaining power.

July 21 -

The irony is, Trump's platform — including tax cuts, tariff increases and a crackdown on immigration — would, in the view of many economists and investors, stoke price pressures.

July 17 -

There's been no discussion among Cabinet members about invoking the 25th amendment of the US constitution, which covers the potential removal of a president due to disability.

July 9 -

The plan from the Heritage Foundation, a group the first Trump administration was largely in line with, would shutter CFPB, break up HUD and raise FHA premiums.

June 27 -

There were 27 bank acquisitions worth $5.45 billion announced in the second quarter as of mid-June. That was more than the $5.2 billion combined value of deals announced over the previous five quarters.

June 24 -

The CEO of the Hauppauge, New York credit union is one of American Banker's 2024 Innovators of the Year.

June 21 -

Rep. Andy Barr, R-Ky., is introducing a bill to establish an Office of Supervisory Appeals at each of the banking regulators that would give banks more power over the appeals process.

May 7 -

Congressional Review Act resolutions are ramping up ahead of the 2024 election cycle. Experts say that, although none are likely to become law, the resolutions are still powerful messaging and political tools.

April 24 -

Institutions and their investors are facing pressure from climate activists, cautiously awaiting interest rate cuts and adjusting to new Federal Reserve and FDIC policies.

April 23 -

The House Financial Services Committee also sent to the full House two bipartisan bills, including one that would prevent large banks from opting out of having to recognize Accumulated Other Comprehensive Income in regulatory capital.

April 18 -

The Federal Home Loan Bank System stepped up advances by 37% or more to Silicon Valley, Signature and First Republic banks ahead of their failures, the GAO says in a post-mortem on last year's banking crisis. The findings add to the debate about whether the system should be a lender of last resort.

April 16 -

-

Mortgage rates rose this week as investors priced stronger than expected inflation and jobs affecting Fed moves into the 10-year Treasury.

April 11 -

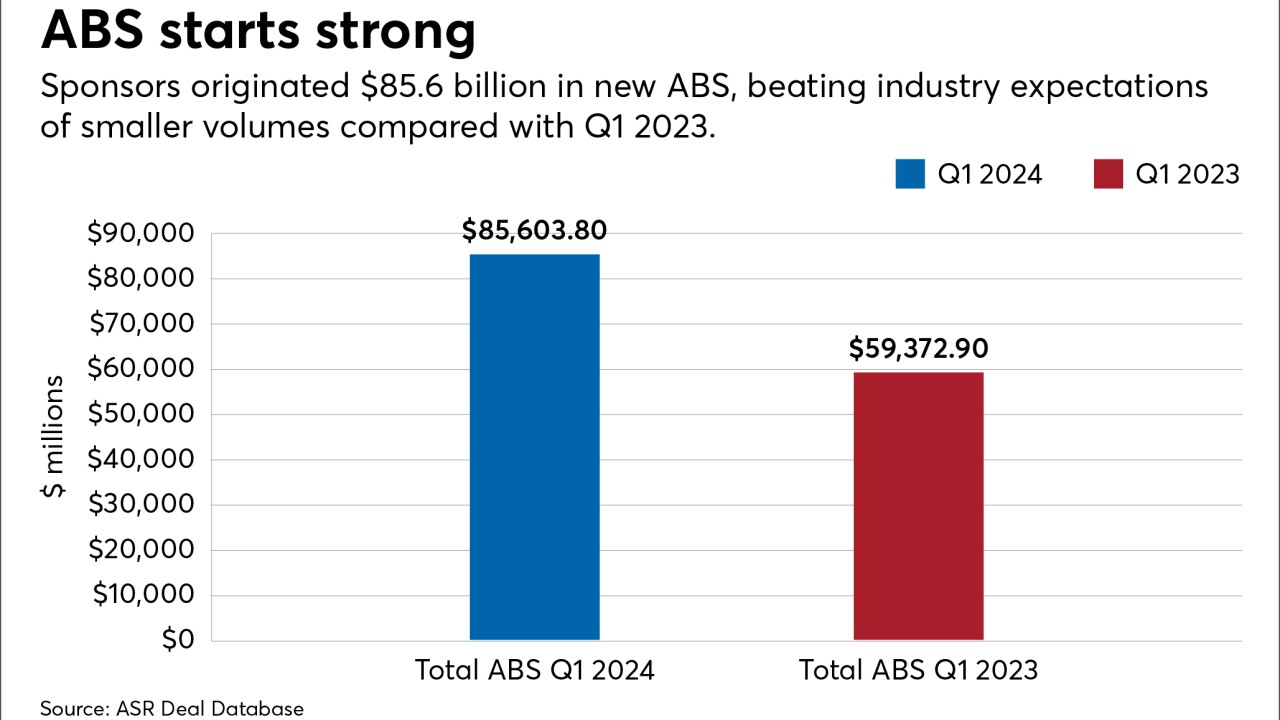

New originations exceeded last year's tally by 30.5%, despite concerns about how rates might impact consumer financial strength. Auto ABS production revved up overall performance.

April 9 -

Mortgage lenders offered more cash-out refinance programs at a time when consumers might be coming to terms with the rate environment.

April 9