-

Angel Oak was able to secure triple-A credit ratings for its next offering of nonprime residential mortgage bonds, despite offering considerably less credit enhancement.

June 28 -

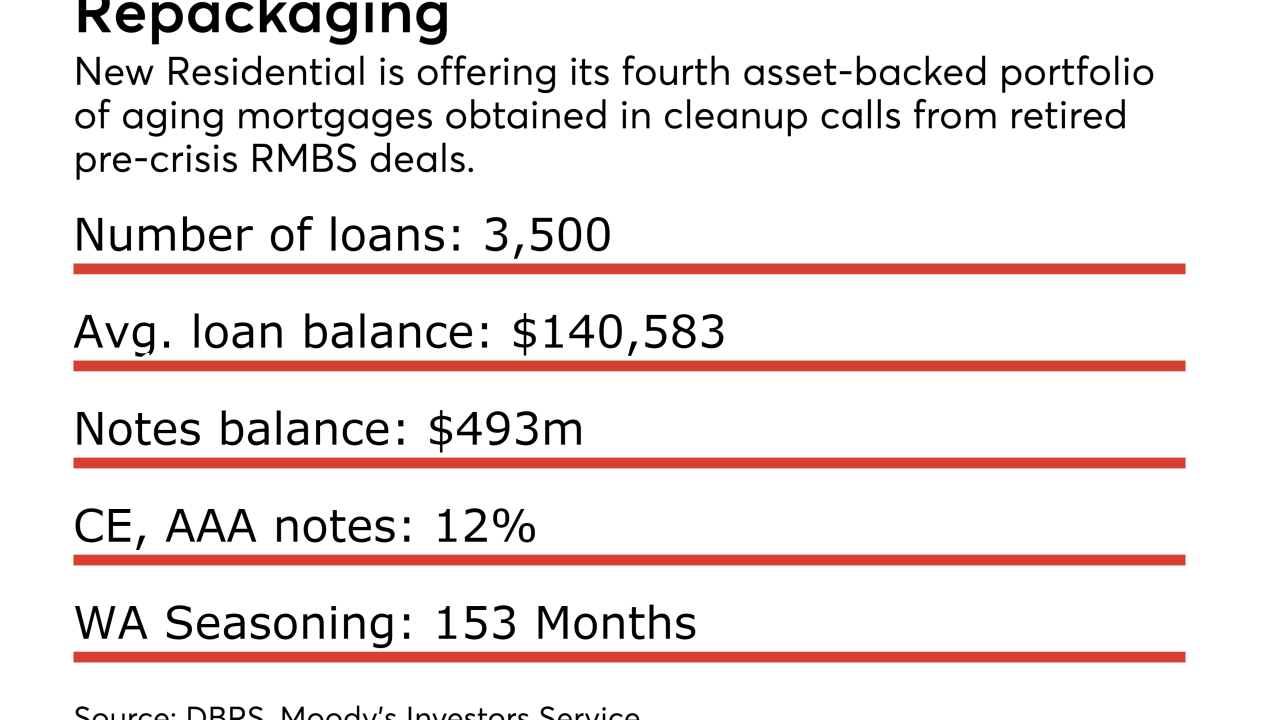

The real estate investment trust is issuing its fourth securitization of older performing and non-performing loans of the year, and 13th since 2014.

June 28 -

Lanark's UK RMBS and Obvion's Dutch deal are as yet unsized; Optimum's £242.3M deal is backed by UK second-lien loans

June 22 -

American International Group is accessing the securitized market through a Credit Suisse deal backed by loans that were generally originated less than a year after TRID.

June 21 -

Housing finance reform discussions are heating up and there's a growing sense that legislation can be enacted sooner rather than later. Here's why.

June 21 -

The properties backing the $336 million transaction average 23 years of age, with valuations averaging $303,727 per property and an average monthly rent of $2,229. Most require pre-lease rehabilitation costs that amount to an average of $8,318.

June 14 -

The deal is the second this year from the Mill City shelf; all told, five issuers have completed 15 deals totaling $8.4 billion; the consistent supply is attracting strong investor interest

June 9 -

American International Group Inc. could securitize through a unit it has previously used to buy jumbo loans.

June 6 -

MFA Financial launched a debut offering of bonds backed by rehabbed loans Monday; several other firms have begun aggregating residential mortgages in preparation for possible securitization.

June 5 -

CMSC 2017-FHA1 is the first transaction of 2017 from this issuance shelf, and the deal by anyone backed by reperforming FHA mortgages since 2010, according to Moody’s Investors Service.

May 30