-

Because automated valuation models have not been subjected to a stressed housing market, their increased use holds negatives and positives for residential mortgage-backed securities credit quality, a Moody's report said.

June 24 -

Alternative investment manager Pretium plans to buy Deephaven, a residential mortgage-backed securities issuer that operates outside the qualified mortgage market, from Varde Partners.

June 18 -

Cerberus affiliate FirstKey Mortgage will pool outstanding first- and second-lien loans totaling $277.7 million drawn from 1,732 seasoned and performing HELOCs.

June 14 -

OBX 2019-INV2 is a private-label RMBS pool of 1,087 of agency-eligible investor-property loans.

June 12 -

The pool of 497 loans includes first-lien fixed- and adjustable-rate mortgages for single-family homes and multifamily properties, primarily underwritten to self-employed borrowers.

June 10 -

With prospects for government-sponsored enterprise reform improving, players in the private residential mortgage-backed securities market are starting to think about how they could better compete against the GSEs while awaiting change.

May 20 -

Shawbrook's debut securitization of "buy-to-let" mortgages issued to UK landlords will pay coupons based on the sterling-based overnight index average benchmark, rather than Libor.

May 14 -

After issuing five RMBS deals of prime jumbo loans in 2019, JPMorgan has gathered a pool of 919 investor-only properties for its next mortgage securitization.

May 14 -

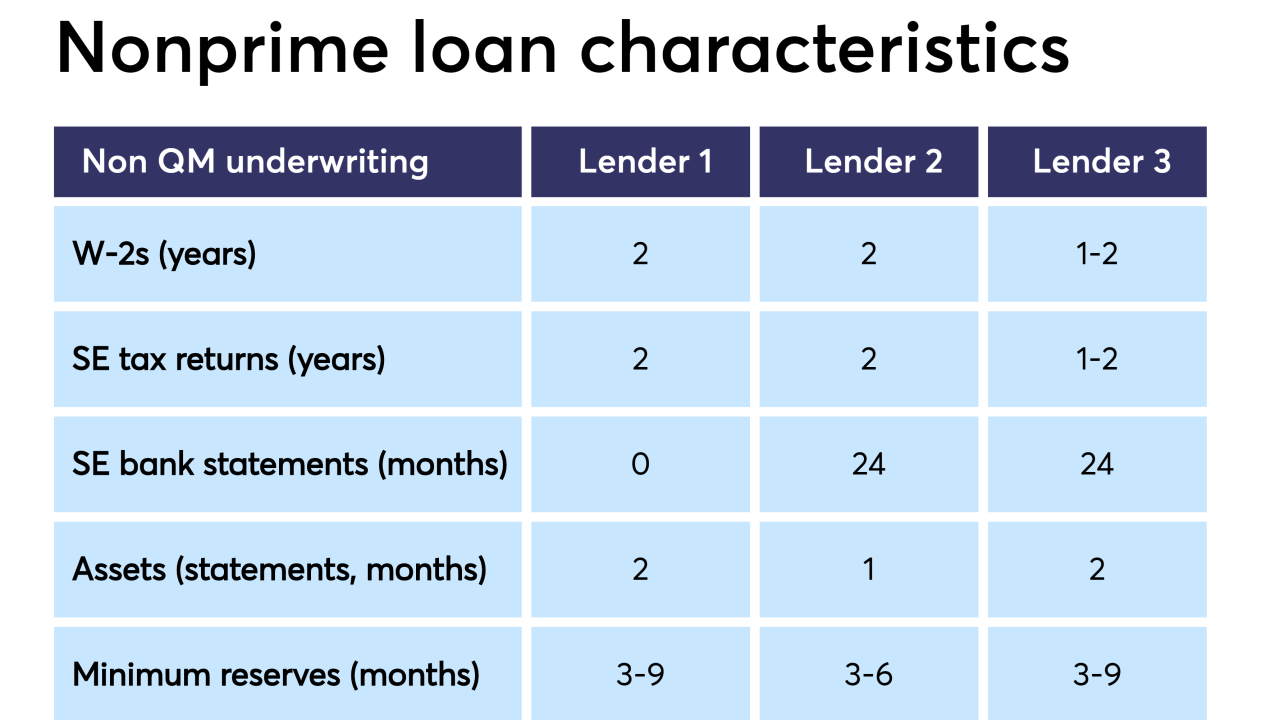

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6 -

Private-label mortgage securitizations with variable servicing fee arrangements could become more common going forward as issuers look to increase investor cash flow while reducing the loan servicer's economic exposure, Fitch said.

May 6