-

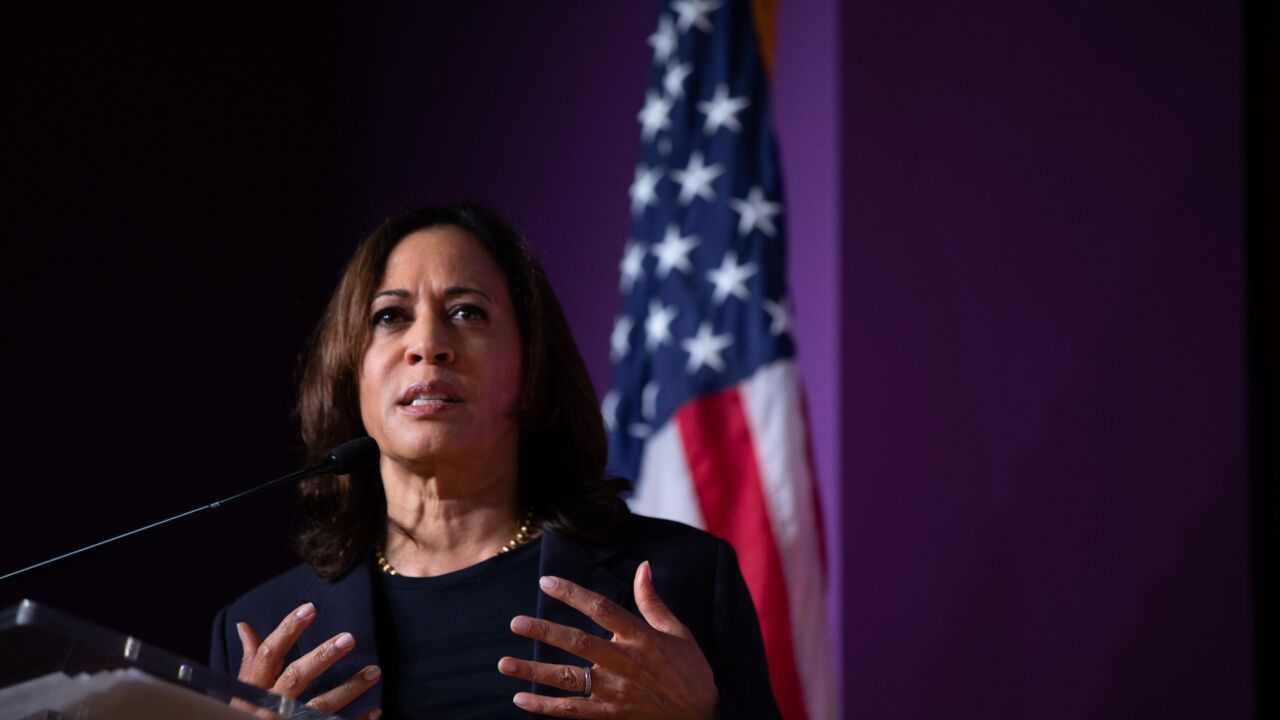

The House Financial Services chair is sponsoring a bill with one of the Democratic presidential contenders aimed at alleviating the public housing capital backlog.

November 21 -

Regulators have long warned the credit bureaus about deceptive marketing that causes consumers to sign up unwittingly for paid monitoring services. But the practice has persisted, according to complaint data.

October 20 -

A hearing on legislative proposals exposed a sharp partisan divide over a regulatory plan to restrict the frequency of collection calls.

September 26 -

All Democrats supported the bill focused on the decisions of former acting CFPB Director Mick Mulvaney, while all Republicans opposed it.

May 23 -

Ahead of testimony by the CEOs of the major bureaus, House Financial Services Committee leaders proposed sweeping changes for the credit reporting industry and credit-score protections for furloughed government workers.

February 25 -

The agency's acting director said he welcomes lawmakers' “insight and perspective” on how to end the conservatorships of Fannie Mae and Freddie Mac.

January 30 -

A lapse in rental-assistance funding, an understaffed FHA and other effects of the government shutdown are causing real harm to families, said the chair of the House Financial Services Committee.

January 11 -

The announcement rescinded the agency's earlier guidance issued to industry partners to suspend sales operations as a result of the current lapse in funding from Congress.

December 31 -

Lawmakers and industry groups were caught off guard when FEMA said it wouldn't issue flood insurance policies during the government shutdown, despite an extension passed last week.

December 27 -

The newly sworn-in director’s first public remarks seemed to contrast with the approach of her predecessor, Mick Mulvaney, who at times questioned the role of the agency.

December 11 -

Democrats on the House Financial Services Committee are expected to shine a spotlight on Trump-appointed regulators, but that light might shine brightest on one agency in particular.

December 5 -

The Democrat, who will likely head the Financial Services Committee, has signaled she'll make expanded housing opportunities for lower-income consumers a top priority.

December 3 -

The midterm elections virtually eliminate the chance that progress will be made on financial services legislation.

November 7 -

The senior Democratic lawmaker said the CFPB chief and the Trump administration "are doing everything in their power to roll back consumer protections."

October 2 -

Maybe political winds or another downturn will spark housing finance reform. But 10 years after the conservatorships began, the companies are still in perpetual limbo.

September 3 -

The bill, which also exempts community banks from the trading ban named for former Fed Chairman Paul Volcker, would go a step further than the regulatory relief bill that passed the Senate.

April 13 -

Democratic lawmakers are objecting to acting CFPB Director Mick Mulvaney's decision to strip the fair-lending office of enforcement powers.

February 16 -

The legislation, introduced by Rep. Patrick McHenry, R-N.C., would essentially reverse a court ruling that marketplace lenders say has blocked them from helping more consumers access credit.

February 14