-

Bank of Nova Scota's third overall deal in its brief auto-loan securitization history will feature $500m in U.S.-dollar denominated bonds.

September 25 -

The total includes over $78 billion in new transactions; collateralized loan obligations issued post-crisis have lmited exposure to Toys R Us, which filed for bankruptcy last week.

September 25 -

Credit enhancement for the senior, triple-A-rated notes is in line with recent Honda transactions, but the pool of collateral is concentrated (12%) in Texas and Florida, making it vulnerable to economic disruption from hurricanes.

September 21 -

The San Francisco-based bank's first prime auto loan securitization in two years includes a sizable portion of loans (60% of the pool) with terms exceeding six years.

September 20 -

The €684.8 million transaction is backed primarily by new-car leases to German prime borrowers. It's the 21st German securitization by FCE Bank, Ford's UK-based captive finance arm.

September 13 -

The federal savings institution is pooling more than 33,000 well-seasoned auto loans to its armed services-linked membership base.

September 10 -

The credit quality of the collateral is lower, by several metrics, than that of Exeter's prior deal; however, S&P Global expects cumulative net losses to be in the same range, from 20.1%-21.1%.

September 7 -

Ford Motor Credit, GM Financial and Fifth Third Bancorp are marketing a combined $3.4 billion in prime auto loan and lease asset-backed securities, according to presale reports published Thursday.

September 7 -

The parent company of Dunkin' Donuts and Baskin-Robbins will use $733 million of proceeds to repay debt issued in 2015; the remainder will be used for general corporate purposes, including funding a dividend to shareholders.

September 5 -

S&P says exclusion of the value of "personal contract purchase" balloon payments from Santander's Motor 2017-2 transaction will benefit the deal through excess spread and recoveries from contract defaults.

September 4 -

The new Motel 6/Studio 6 deal is collateralized by the fee income of a refi commercial loan, as well as cash-flow pledges from company-owned and franchised properties.

August 30 -

The pricing of BlueMountain Fuji's second-ever transaction pushed the monthly new issuance total to $10.1 billion - only the third time since last November the market has eclipsed the $10 billion barrier.

August 27 -

The number of junk-rated companies downgraded fell to 19 in July, comparedwith an average of 30 for the trailing 12 months. The upgrade count also fell 10, down from 19 in June.

August 24 -

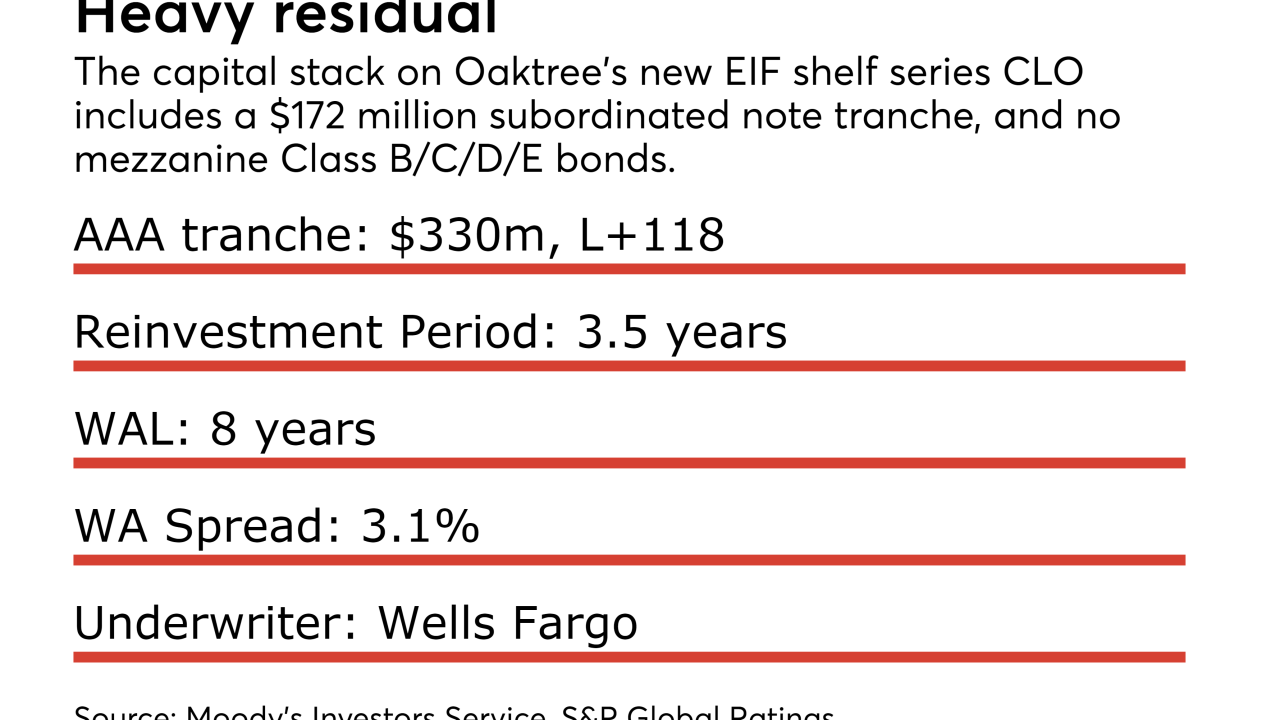

The $533.1 million collateralized loan obligation portfolio has an unusual capital structure; just two senior tranches will be issued, along with a single subordinated tranche comprising more than one-third of the notional value.

August 22 -

A joint venture between Nightingale and WCP acquired the property, which is well known for the Claes Oldenburg Clothespin sculpture in its front plaza, for $328 million in July.

August 17 -

The shipping container lease company is marketing $350 million of notes backed by its largest-ever portfolio of dry bulk container lease receivables.

August 13 -

Average FICOs are declining in both lenders' pools, and Nissan Motor Acceptance Corp. is including more borrowers with sub-700 scores in its prime portfolio than in three prior auto-loan securitizations.

August 10 -

Shipping companies need more units to meet a rise in global trade, and they’re not in a position to add to their own fleets.

June 12 -

The deal is the second this year from the Mill City shelf; all told, five issuers have completed 15 deals totaling $8.4 billion; the consistent supply is attracting strong investor interest

June 9