-

HPS Investment Partners is adding a new name to one of its legacy Highbridge CLOs, as well as piling on extensive changes to note structure, deal terms and restrictions on some higher-risk assets.

October 10 -

Nissan's second U.S. lease-securitization of 2017 pools more than 71,000 contracts with $1.5 billion outstanding on cars, SUVs and cross-overs. Delinquencies remain low, but residual values are growing volatile.

October 2 -

GM Financial is following similar actions by American Honda, Santander, Fifth Third and USAA to limit Texas exposure in securitizations, but the captive-finance lender has extended the exclusion to Florida loans as well.

September 28 -

The deal, Sunrise SPV 20 S.r.l., is collateralized by more than 120,000 auto, furniture and personal loans originated by the Italian lender.

September 28 -

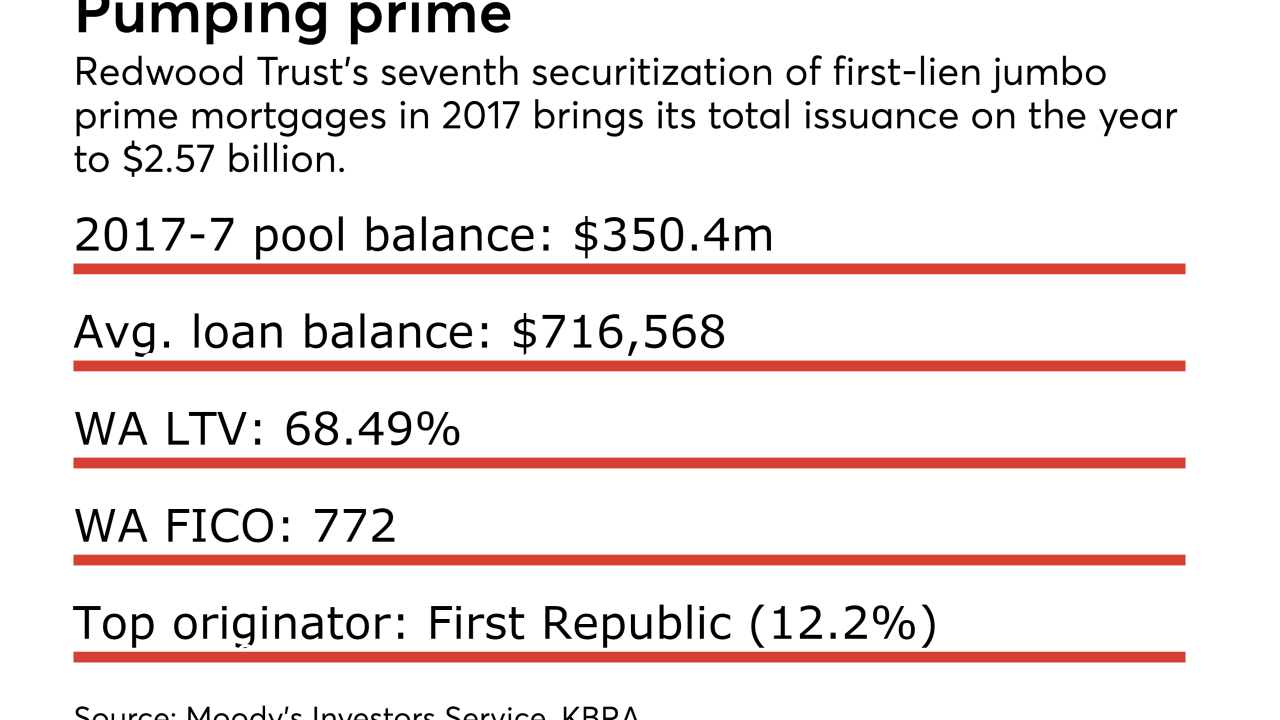

The deal is the real estate investment trust's seventh of 2017; the collateral was contributed by 135 originators, including Quicken Loans and First Republic Bank.

September 28 -

Bank of Nova Scota's third overall deal in its brief auto-loan securitization history will feature $500m in U.S.-dollar denominated bonds.

September 25 -

The total includes over $78 billion in new transactions; collateralized loan obligations issued post-crisis have lmited exposure to Toys R Us, which filed for bankruptcy last week.

September 25 -

The latest round of Freddie-backed mortgages for the development, acquisition or rehabilitation or affordable multifamily housing includes 67 properties, with the highest concentration in California.

September 21 -

The San Francisco-based bank's first prime auto loan securitization in two years includes a sizable portion of loans (60% of the pool) with terms exceeding six years.

September 20 -

RREEF America, the real estate investment unit of Deutsche Asset Management, is securitizing an unusual mix of speculative-grade project finance and corporate in a debut $431.3 million collateralized debt obligation.

September 14