-

Fino 1 is backed by collections on more than €5.34 billion in bad loans originated by the Italian banking giant. Most were issued between 2010-2017.

November 28 -

The deal could put downward pressure on market lease rates and renewals in wireless tower ABS portfolios serviced by Crown Castle, American Tower, and SBA Communications.

November 20 -

The two prospective pools of loans have nearly identical average FICO scores (769 for the $1 billion pool, 770 for the $1.25 billion) and weight average APR (2.13% and 2.11%, respectively).

November 16 -

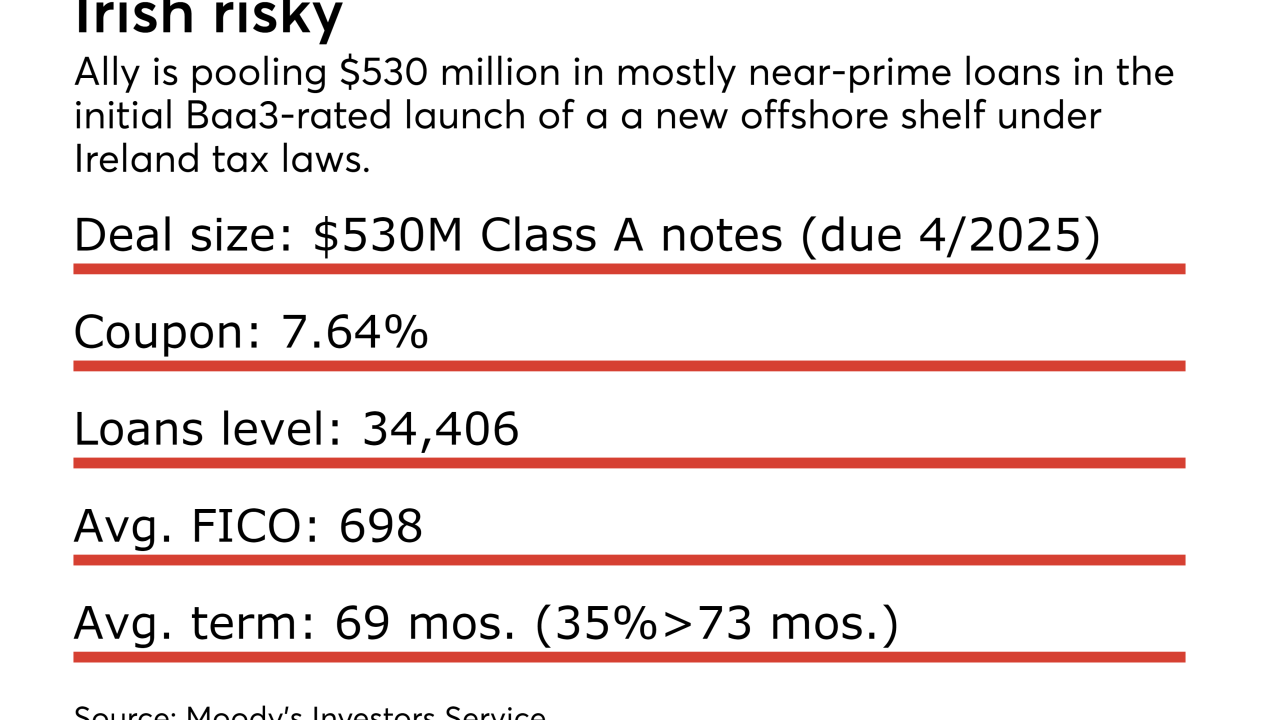

Juniper Receiveables DAC, a new offshore shelf for Ally U.S. auto-loan receivables, has received an early 'Baa3' rating from Moody's Investors Service on its initial $530 million issuance.

November 14 -

Nearly one-third of the vehicles in CIG Financial's $172 million transaction have mileage above 100,000; the highest-mileage car financed has 197,387.

November 13 -

That's only half as large as the lender's four previous deals, which ranged from $1.02 billion and $1.12 billion; company executives recently touted a shift toward more financing from deposits.

November 9 -

For the first time in five years, MassMutual has a second securitization within a calendar year backed by loans and leases to large corporates, including federal government agencies.

November 8 -

CarMax, BMW, Santander and Credit Acceptance Corp. all launched deals Thursday; they add to the $35 billion in prime auto, $12.31 billion in prime lease, and $19.4 billion in subprime auto loan ABS so far this year.

October 12 -

Issuing bonds backed by credit-card receivables was formerly a bi-annual occurance for First National Bank of Omaha. This year, FNBO has served up a pair of transactions of its direct-issue and co-branded cards.

October 12 -

Over 80% of the cars are diesel-engine vehicles, bringing potential volatility to the portfolio cash flows given the public debate over potential panning such cars in several European urban centers.

October 11