-

Veros is based in California but recently expanded on the East Coast, resulting in a dip in credit performance; Kroll capped its rating in the senior notes of the $165 million deal at single A.

October 23 -

Fitch and KBRA have slightly lower estimates for cumulative net losses for 2017-3, allowing the marketplace lender to offer slightly lower credit enhancement on the senior notes; concerns remain about poorly performing legacy loans.

October 19 -

Coping with merging two securitization platforms and the integration of GE Capital's former fleet lease and management business, the Canadian lessor has seen 30-plus and 60-plus delinquencies more than triple.

October 18 -

The $605.5 million transaction is notable for its exposure to turboprops, which are noisy and uncomfortable, but can be more fuel efficient on shorter flights, and to emerging markets.

October 13 -

The deal does not even merit a BBB-plus, according to Fitch, which cites insufficient credit enhancement, exposure to high-risk obligors, and the servicer's lack of experience.

October 11 -

The proportion of collateral that will be acquired after the CPS Auto Receivables Trust 2017-D closes is 33.3%, or $66 million, from the 29.7% level from the sponsor's prior deal in July.

October 6 -

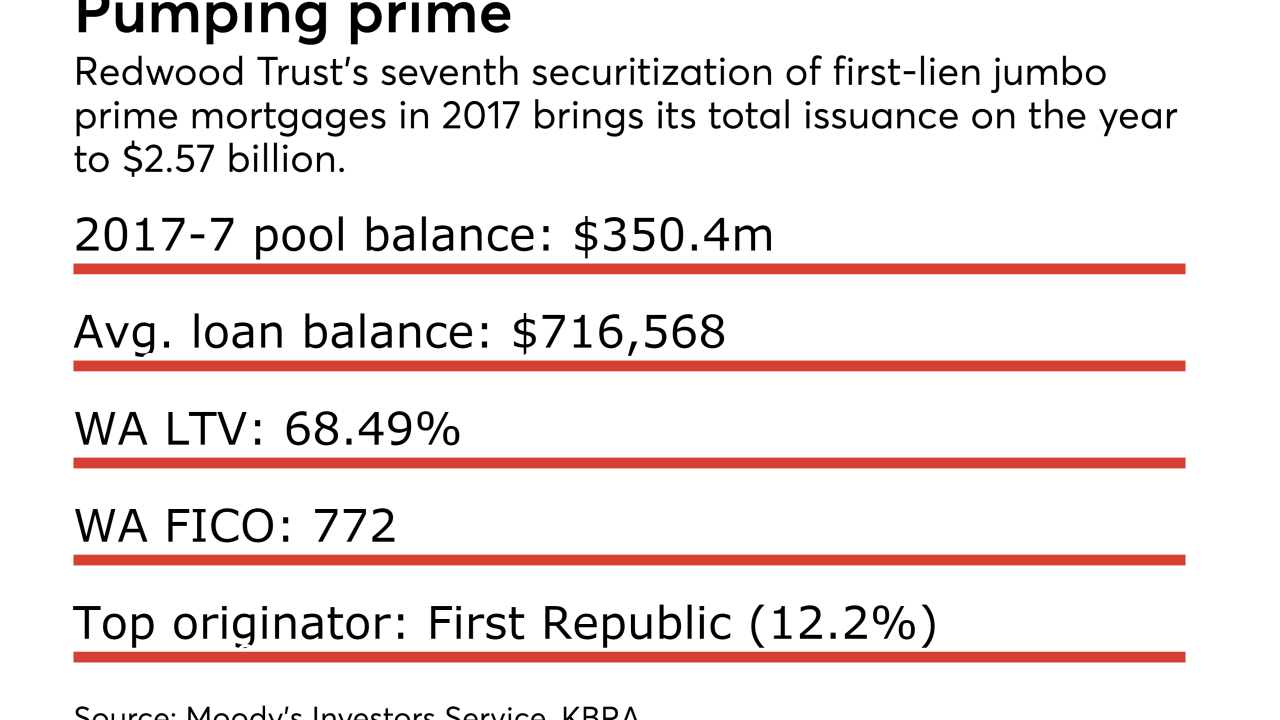

The deal is the real estate investment trust's seventh of 2017; the collateral was contributed by 135 originators, including Quicken Loans and First Republic Bank.

September 28 -

The latest round of Freddie-backed mortgages for the development, acquisition or rehabilitation or affordable multifamily housing includes 67 properties, with the highest concentration in California.

September 21 -

Hurricane Irma could potentially affect more private-label mortgage securities collateral than any other recent storm.

September 11 -

The 4,443 single-family rental homes securing Starwood Waypoint Homes 2017-1 have an average age of 30 years, older than any previous transaction by the sponsor, but are bringing in more than $1,700 apiece in monthly rent.

September 6