-

The GSEs are on their way to paying back the money they owed the government under the original bailout deal made at the height of the financial crisis, making 2018 an opportune time for an overhaul of the housing finance market.

December 29

-

Fannie Mae and Freddie Mac will be allowed to build capital buffers to protect against losses under an agreement between the Treasury Department and the Federal Housing Finance Agency announced on Thursday.

December 21 -

The two government-sponsored enterprises have relied on the “classic” FICO credit scoring model for the past 12 years. But the Federal Housing Finance Agency is weighing whether the GSEs should upgrade to more recent scoring alternatives.

December 20 -

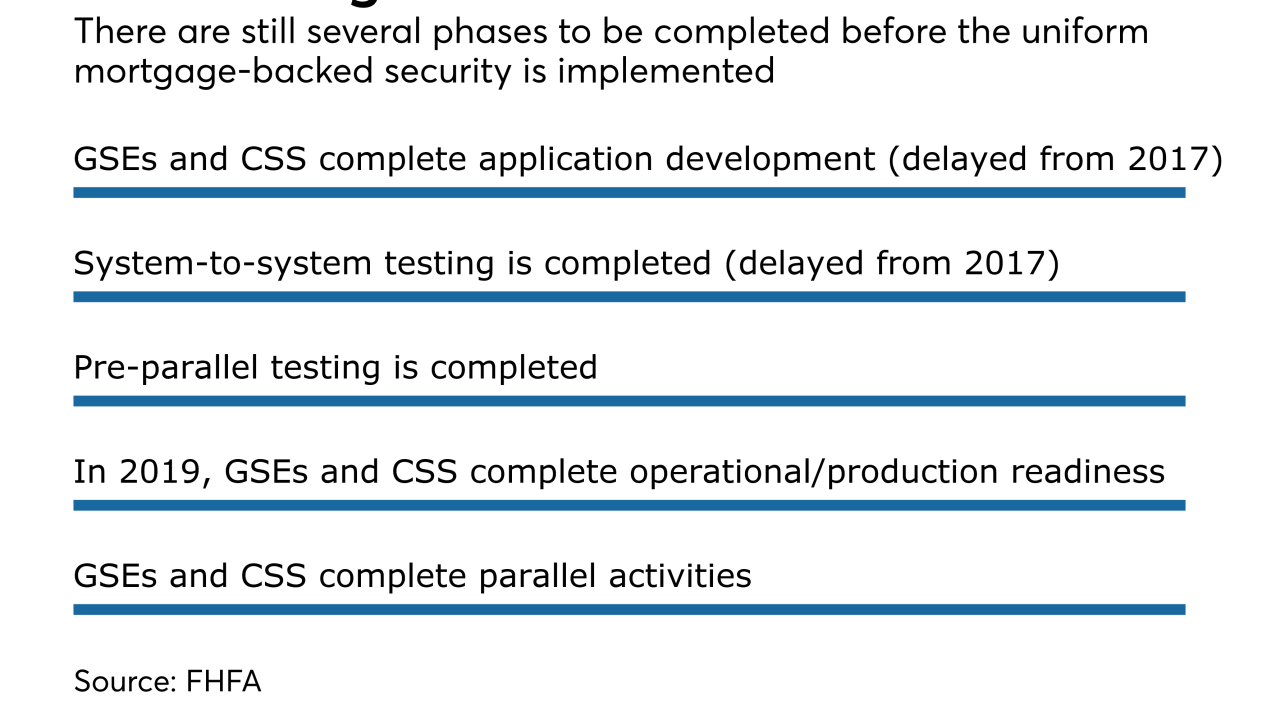

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4 -

Conforming loan limits for mortgages bought by Fannie Mae and Freddie Mac will increase for the second consecutive year in response to the rapid rise in home prices, the Federal Housing Finance Agency said.

November 28 -

Though FHFA Director Mel Watt stopped short of saying he would break with a Treasury agreement that forces all profits of the GSEs to go to the government, he emphasized that it couldn’t continue indefinitely.

October 3 -

Mortgage investors want Freddie Mac to align its policy with Fannie Mae's when it comes to how delinquencies related to Hurricane Harvey affect credit risk transfer deals.

September 19 -

Fannie Mae and Freddie Mac will adjust their risk-sharing deals so that they can accommodate high loan-to-value loans refinanced under the programs replacing the Home Affordable Refinance Program.

August 28 -

The government-sponsored enterprise is still looking for the right balance between offering a product that's attractive to investors and a cost-effective way to reduce risk.

August 3 -

The government-sponsored enterprises transferred $5.5 billion of credit risk on $174 billion of mortgages in their portfolios during the first quarter.

July 26 -

Rather than working with large-scale investors, Freddie Mac said it will focus on assisting community organizations and local institutions to fund single-family properties for renters with special needs.

July 24 -

The Federal Housing Finance Agency made just incremental changes to two of the seven affordable housing benchmarks.

June 29 -

The Senate is set to begin teeing up housing finance reform discussions at a Banking Committee hearing on Thursday, but many are skeptical that Congress will be able to succeed where it has failed in the past.

June 27 -

FHFA Sounds Alarm on Home Loan Bank Funding, Advances

May 30