-

Sources say the firm has been talking with prospective investors about raising $2 billion to $3 billion for Apollo Infrastructure Opportunities Fund II LP, planning on annual returns of 13%-16%.

May 5 -

Apollo Global Management Inc. faces the prospect of having to hand back earlier profits from several of its funds as its holdings were hit hard by the economic fallout from the coronavirus pandemic.

May 1 -

The buyout giant has already bought billions of investments once managed by GE Capital and is now sizing up GE's insurance and jet-leasing businesses, according to sources.

March 7 -

Not every tranche of notes originally issued by ALM XIX has been upsized by the same amount; in fact, some of the lower-rated tranches have been cut in size.

February 26 -

The €400 million RRE 1 Loan Management DAC has a 4.5-year reinvestment period and two-year non-callable period, according to presale reports.

February 22 -

A growing number of asset managers are waking up to the opportunity to lend to small and medium-sized companies, and much of this direct lending is making its way into the securitization market.

October 2 -

Nineteen of the aircraft collateralizing MAPS 2018-1 were previously securitized in a 2013 Merx-sponsored deal dubbed AABS Ltd.

April 24 -

The New York-based alternative asset manager is first out of the gate with a new-issue deal amidst a flurry of early reset/refinancing activity totaling $3.4 billion.

January 19 -

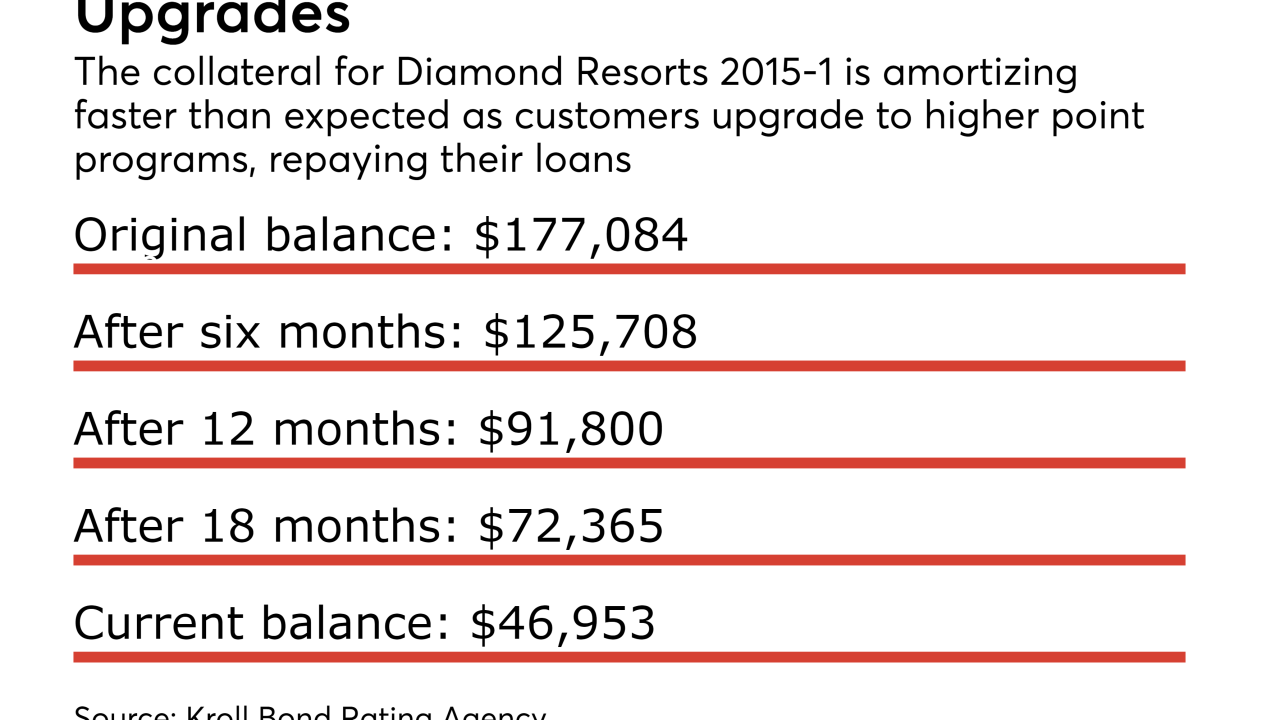

The move convinced Kroll Bond Rating Agency to upgrade $95 million of securities, some of which had been under review for a possible downgrade for over a year; Kroll affirmed the ratings of another $63 million of bonds.

November 20 -

The U.S. Second Circuit ruled that Momentive Performance Materials should use what's known a a "market rates" formula to determine the appropriate payout for a series of replacement notes issued to bondholders.

October 23 -

The sponsor obtained a $1 billion mortgage from JPMorgan, Goldman and Citi; proceeds will be used to repay $715 million of debt taken out in 2015 to acquire the original portfolio from Apollo Global Management.

September 22