Another month, another RMBS.

If it seems like WinWater Home Mortgage has been coming to the securitization market pretty regularly, that’s no coincidence. The loan aggregator, which was formed last year by certain principals of hedge fund Premium Point Investments and completed its inaugural deal in June, has set a goal of tapping the market on a monthly basis in 2015, a spokesman confirmed.

WinWater is currently in the market with its third deal of the year, after completing one in February and another in January.

By comparison, Redwood Trust, one of the most active RMBS issuers over the past two years, has only brought a

With some $2 billion in RMBS under its belt, WinWater plans to expand its platform by adding origination partners. It currently has over 60 approved mortgage loan sellers; growth will come from partnerships with major jumbo originators that don’t have their own securitization conduits.

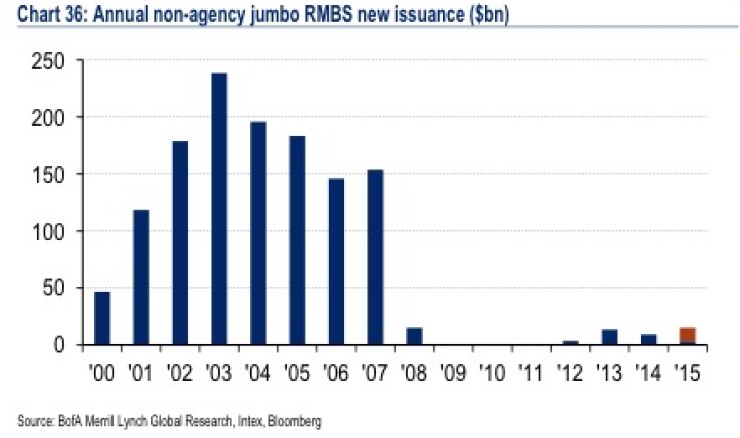

It’s not the only mortgage aggregator stepping up the pace. RMBS issuance as a whole is off to a much stronger start this year, totaling $3.5 billion for January and February. That’s more than double the $1.5 billion seen in the first two months of 2013 and several times the $900 million in the same period of 2014, according to Bank of America Merrill Lynch.

Two Harbors, for example, is already working on its

BofAML recently revised its 2015 RMBS new issue forecast from $10 billion originally to $15 billion. That would mark the biggest vintage since the financial crisis. The $5 billion increase reflects the strong start to both jumbo mortgage origination and private-label securitization of these mortgages.

The Bank of America Merrill Lynch chart below shows RMBS issuance since 2000.

WinWater Mortgage Loan Trust 2015-3 is structured similarly to the sponsor’s previous deals, according to the Kroll Bond Rating presale report. A $287 million pool of 382 jumbo, 30-year, fixed-rate mortgages, backs the deal. Borrowers have strong credit and significant equity in their properties. The weighted average FICO score of borrowers in the pool is 768 and the WA loan-to-value ratio of the loans in the pool in 70.3%, which according to Kroll, provides a safety cushion against home price declines.

The rating agency has assigned preliminary ratings of AAA’ to the class A notes, AA’ to the class B-1 notes, A’ to the class B-2 notes, BBB’ to the class B-3 notes and BB’ to the class B-4 notes.

The triple-A notes are sold to investors, while WinWater retains the subordinate tranches of the transaction, according to Chris Gillick of Peppercomm, WinWater’s spokesperson.

Ditech Mortgage, Prospect Mortgage and LoanDepot.com are the top three mortgage originators contributing to the pool.

WinWater’s current business strategy is to aggregate and securitize 30-year fixed rate jumbo mortgages that meet new ability-to-repay rules, through a combination of bulk and flow purchases. However in its recent deals, the mortgage loan aggregator has shown signs of a "very gradual expansion of its credit box,” according to Gillick. Win 2015-3 includes three loans (0.6% of the pool) that do not meet Qualified Mortgage standards that would give them a legal safe harbor.

Non-QM mortgages are at greater risk of litigation-related losses. However Kroll stated in the presale report that the loans were originated to borrowers with substantial equity in their properties and a significant amount of reserves. “Based on the high quality of these mortgage loans, and the small amount they contribute to the WIN 2015-3 transaction, KBRA’s non-QM analysis resulted in a minimal adjustment to the loss severity and expected loss,” according to the presale report.

Another three loans in the pool are not subject to ability to repay rules because they were originated as investment properties for business purposes.