Wells Fargo is securitizing a pool of smaller commercial mortgages on highly leveraged properties.

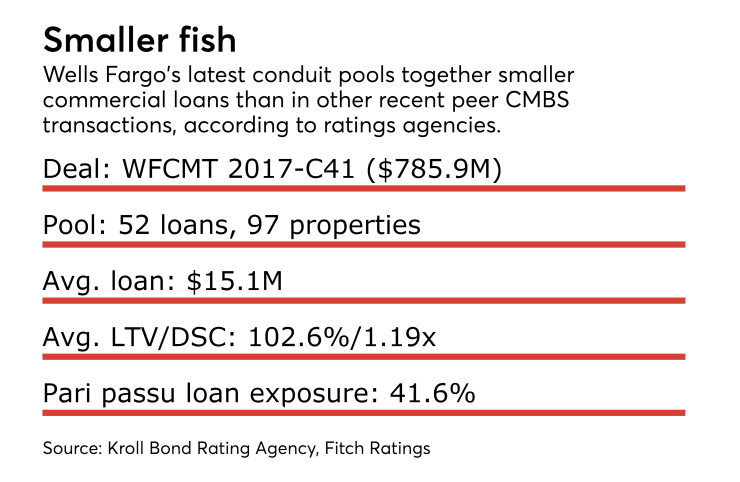

Wells Fargo Commercial Mortgage Trust 2017-C41 will issue $785.9 million in bonds backed by a pool of 52 loans secured by 97 properties. The loans in the pool average just $15.1 million, well below the average $20.1 million of most 2017 CMBS deals, according to Fitch Ratings

By property types, the deal is most heavily exposed to retail (27.1% of the collateral pool), lodging (20.4%) and office (18.4%).

Among the properties is the renovated 729,516-square-foot hotel/office/retail Headquarters Plaza in Morristown, N.J., a 36-year-old structure that is securing a new $50 million interest-only loan that was 6.4% of the pool.

According to Kroll Bond Rating Agency, the loans have a weighted average loan-to-value ratio of 102.6%, higher than average for conduits it has rated so far this year. Thirty of the loans (or 62.8% of the pool) have LTVs in excess of 100%.

The debt service coverage ratio of 1.19x is also worse than average for most conduits Kroll has rated this year, which averaged 1.26x on multiborrower deals.

The transaction has 12 pari passu loans (41.6% of the pool), including seven (30.6%) which are among the top 10 largest by balance. This is below the average (46.2%) of the CMBS conduits rated by Kroll over the past six months.

In addition to the Headquarters Plaza loan, other notable mortgages in the pool include the Marriott LAX with a $44.06 million loan (5.6% of the pool) that funded recent renovations at the 1,004-room airport hotel; and the $41 million loan for the Mall of Louisiana, making up 5.2% of the conduit pool.

There is exposure to 13 properties in hurricane-damage regions in Florida and Texas, with minimal property damage reported. The properties under repair include the Hilton Houston Galleria, making up the 20th largest loan in the pool. The hotel had damages to guest rooms, meeting rooms and maintenance spaces. Five of seven damaged guest rooms had been repaired and all the remaining damages were to be repaired within 90 days of closing.

All of the loans were contributed by Barclays, Argentic Real Estate Finance, Ladder Capital Finance and Wells Fargo. The deal was underwritten by Wells Fargo, Barclays and Academy Securities.

Six classes of super-senior and junior Class A notes totaling more than $550 million will be issued in the transaction. The notes are supported by 30% credit enhancement levels, and carry preliminary triple-A ratings from Kroll and Fitch Ratings.