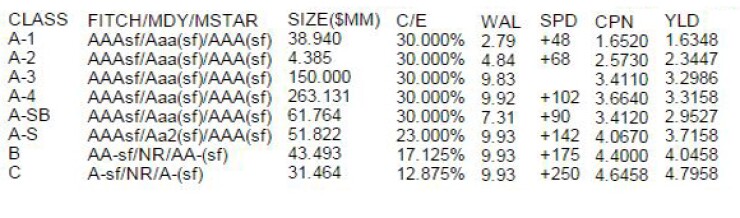

Wells Fargo Commercial Mortgage Trust 2015-C30 has priced, with the largest tranche, the $263.1-million A-4 notes, coming out at 102 basis points over swaps.

This was a tad higher than a comparable tranche in a

While the Wells deal had a good portion of collateral in the multifamily sector — deemed safer than other property types — the Deutsche/Cantor CMBS likely benefitted from three investment-grade loans that made up 15% of the deal’s pool.

The Wells CMBS contains six super-senior tranches, each with a credit enhancement or cushion against losses of 30%.

A $51.8-million, 9.93-year, junior-senior tranche, which is hybrid-rated, priced at a spread of 142 basis points. Fitch Ratings and Morningstar gave that slice of the deal AAA’ but Moody’s Investors Service rated it Aa2,’ two notches from the top.

Details on the offered notes and their pricing are below.

In addition to the pieces sold to the public market, the deal had a class D tranche of private, 144A notes. Pricing was undisclosed for that $39.8-million slice, rated 'BBB-' by both Fitch and Morningstar.

About 34% by volume of the underlying loans in the Wells transaction

Wells Fargo Securities was the sole bookrunner, while Deutsche Bank Securities and Morgan Stanley acted as co-managers.