Vistana Signature Experiences next timeshare loan securitization has a higher exposure to Westin-branded resorts, and that prompted Fitch Ratings to trim its forecast for cumulative net losses.

Westin loans account for 52.9% of receivables for the $287.33 million VSE 2018-A VOI Mortgage, and the remaining 47.1% of receivables are loans tied to Sheraton resorts; Vistana has excluded receivables tied to Hyatt from the deal.

That’s the primary reason that Fitch expects losses on the pool of collateral to reach just 11.75% over the life of the transaction, down from 12% for Vistana’s prior deal, completed in 2017.

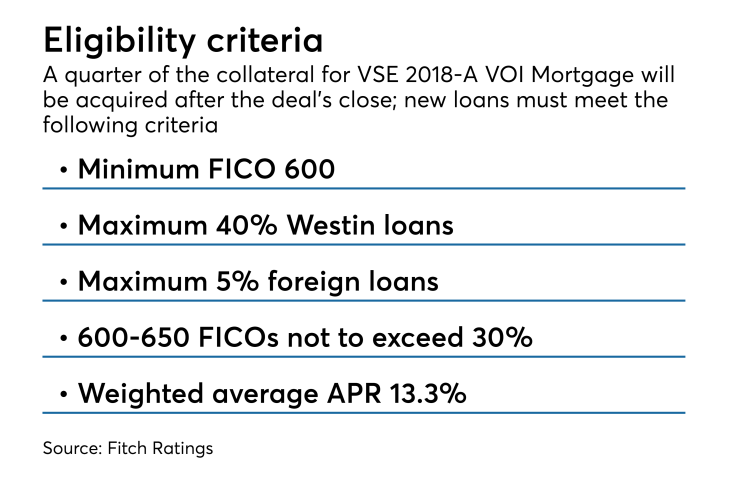

Fitch’s forecast for cumulative net losses on the initial pool of collateral are even lower, at 11.26%, but it adjusted its forecast upward to account for a prefunding account; Vistana has another six months after the deal’s closing to acquire the remaining 25% of the collateral. By comparison, the prefunding account for the 2017 deal was only 25% of the collateral.

Among other notables changes, the pool of receivables for the new deal has a has a higher weighted average FICO than the two prior deals, at 727, which Fitch views favorably.

It also has the highest concentration of loans with terms longer than 15 years, 32.1%, which have experience higher cumulative gross defaults than loans with 10-year terms.

Finally, 11.7% of the collateral for the new deal comes from a deal originally competed in 2012 that has been called and is seasoned 72 months, on average.

Despite the lower loss expectations on the collateral, Vistana has increased the credit enhancement for the senior tranche of Class A notes, which will be rated AAA by Fitch, to 29.3% from 28.95% for the comparable tranche of the prior deal. Credit enhancement is also higher at 12.4% for the Class B notes, which are rated A, but lower for the Class C notes, which are rated BBB, at 2.5%.

Wells Fargo Securities is the lead underwriter.