Tricon American Homes is refinancing two more single-family rental securitizations, including one originally issued by Silver Bay Realty, which it acquired in May 2017.

The new transaction, Tricon American Homes 2018-SFR1, is backed by a single, fixed-rate, seven-year mortgage that in turn is secured by mortgages on 2,509 single-family rental properties, according to rating agency presale reports. Some 1,283 homes (53.8% by broker price opinion) were previously securitized in Tricon American Homes 2015-SFR1 and 277 properties (11.7%) were previously securitized in Silver Bay 2014-1.

The portfolio consists primarily of homes with three or more bedrooms, two or more bathrooms and average square footage of approximately 1,663.

The aggregate value of the properties being rolled over, as determined by a broker price opinion, has increased by 26.6% to $89.2 million since they were first securitized, according to Kroll Bond Rating Agency. While Tricon American is borrowing more heavily against the properties in the new securitization, the combined loan-to-value has nevertheless decreased, to 66.5% from 72%.

Six classes of notes will be issued in the new transaction; the senior $172 million tranche is rated triple-A by Kroll, Morningstar Credit Ratings and Moody’s Investors Service.

Like Tricon American’s last several securitizations, the new transaction permits the issuer to substitute up to 5% of the underlying homes, by property count, as subject to certain provisions.

All three rating agencies cite the geographic diversification of the properties, which are located in 21 metropolitan statistical areas in nine states, as a strength of the transaction, though Moody’s notes that it is less diverse than Tricon American’s three recent securitizations.

(The largest concentrations are in Atlanta, with 27.1%, followed by Phoenix, with 22.7%, according to Morningstar.)

“Although Tricon's portfolio in any given market could constitute a minimal amount of that market, large-scale liquidation of properties by one or more SFR sponsors in a single market could have a significant impact on final recoveries,” Moody’s presale report states.

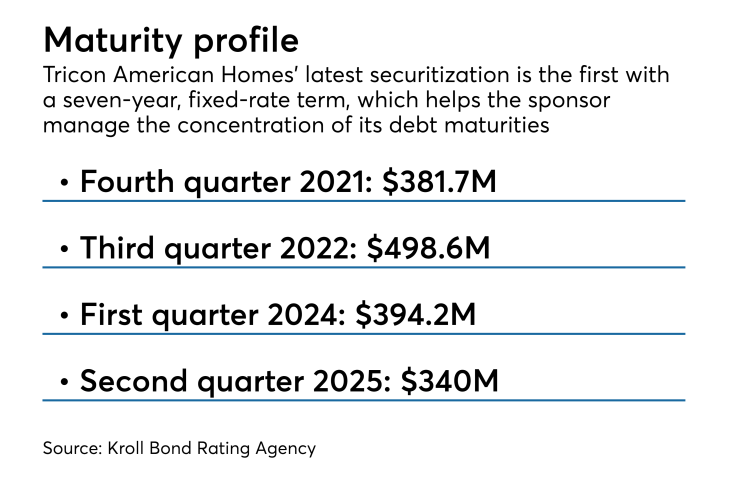

Moody’s also notes that the seven-year term of the loan backing the notes is relatively long for a single-family rental securitization, exposing the trust to the risks of the single-family rental market for an extended period.

Morningstar also cites as a strength the fact that some 38% of the pool’s properties by value are in a homeowners association. “This may help to attract quality tenants looking for certain amenities provided by an HOA, which generally requires the properties to be maintained to a certain minimum standard,” the presale report states.

However, Morningstar takes issue with the fact that actual property-level initial rehabilitation costs were not available for the 964 properties acquired from Silver Bay. This meant the rating agency could not determine the accurate post-renovation cost basis in its analysis.

It also noted that 2.5% of the properties, by value, in the transaction were vacant in January.

Tricon American is an indirectly wholly owned subsidiary of Tricon Capital Group, a publicly traded Canadian company with approximately $4.6 billion of assets under management.