As Spanish savings banks known as cajas merge and create new private banks, covered bonds that pooled together the assets of several cajas will disappear, according to a recent report by Moody’s Investors Service.

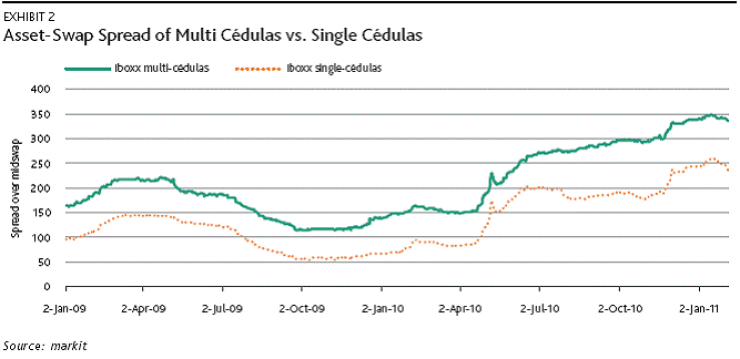

For some time this collective approach helped smaller cajas access the market, but after the crisis the so-called multi-cedulas lost favor among investors because they typically included obscure and unrated cajas. The graph below shows how this discomfort led to a consistent 100 basis point spread between multi-cedulas and single-cedulas (single-issuer covered bonds) placed primarily by leading banks and cajas.

The trend of cajas merging into much larger private banks will create entities able to float single-issuer bonds, and therefore eliminating the need for multi-cedulas.

Moody’s noted that last week several cajas announced they would merge by creating private banks. The agency sees the combination of their covered bond programs as a credit positive, as it enhances transparency and collateral diversity, among other advantages.

Geographic diversity has been an issue for some cajas, as their focus tends to be regional.