Second in a two-part series examining destabilizing trends in the marketplace lending sector.

In April former Treasury Secretary Lawrence Summers stood before a large audience in New York and delivered a

The speech was titled "New Lending for a New Economy." In it, Summers argued that following the wreckage of 2008 and 2009, the burgeoning marketplace lending industry had the ability to contribute to U.S. financial stability.

"Platform lending doesn't have the central connection to leverage that traditional banking does. There is no entity that carries a balance sheet with leverage. There's nothing there that is too big to fail," Summers told an industry conference.

This was true, as far as it went. Firms like Prosper Marketplace and Lending Club, where Summers serves on the board of directors, do not take credit risk. If scores of loans on their platforms go bad, the losses will be spread widely among an array of individual and institutional investors.

But Summers did not mention the numerous ways in which the young industry that had gathered to hear his speech has begun to resemble more traditional, riskier forms of finance.

The conference's attendees included big banks that provide leverage to institutional investors in marketplace loans. It also included online lenders that use leveraged balance sheets to earn more sizable returns on their loans, in much the same way that nonbank lenders have done during previous periods of credit expansion.

The use of leverage, once rare in a sector that was built on the idea of linking everyday borrowers and savers, has today become routine. And some in the industry are issuing warnings about the risks being taken.

"I think there are many very savvy investors. But there are also some folks without pants on," said James Wu, chief executive of MonJa, an analytics firm that caters to institutional investors in marketplace loans.

Leverage is entering the online lending world in multiple ways. In some cases, institutional investors securitize the loans they purchase and hold onto the riskiest bonds.

Another common arrangement involves institutional investors borrowing from banks in order to achieve higher yields.

Brendan Ross, president of Direct Lending Investments, which does not use leverage, said that the yields on marketplace loans to consumers have narrowed in recent years. That has led some investors to turn to leverage.

"You used to be able to get double-digit returns without leverage," Ross said, referring to the consumer lending side of the business. "Now you need leverage to get double-digit returns."

The leverage is often provided by large banks, including Citigroup, Capital One Financial, Deutsche Bank and Morgan Stanley, according to sources familiar with the market.

Citi and Deutsche Bank declined to comment. Capital One and Morgan Stanley did not respond to requests for comment.

Several observers said that as the marketplace lending industry has become better established, banks have gotten a better understanding of how the loans are performing, and are therefore more prepared to lend to institutional buyers of the platforms' loans.

"I think banks and sophisticated investors and institutions have become much more comfortable with the asset class," said Don Davis, founder of Prime Meridian Capital Management.

Prime Meridian recently announced that it is merging with Poise Lending, which runs a levered investment fund. Davis said that roughly two-thirds of the money in the Poise Lending Fund, which will invest in consumer loans, will be borrowed.

He expects the fund to yield about 12%, net of fees, which compares to 7.6%-7.7% yields in the unlevered consumer loan fund that Prime Meridian manages.

Davis said that his firm is using leverage responsibly, but he warned that other fund managers are taking unwise risks.

"Some people are just tripping over themselves to make as much money as they can while the sun's shining," he said. "And then during the bad times, the investors are left holding the bag."

Wu, the CEO of the analytics firm, said that some institutional investors who are new to the marketplace lending sphere are applying large amounts of leverage in hopes of earning outsized returns.

As an example of the wishful thinking that he said is prevalent among certain investors, Wu cited an unnamed fund that has advertised unlevered returns of 15%, and significantly higher yields once leverage is applied.

Wu warned that in a downturn, some investors will suffer significant losses. "And the use of leverage obviously magnifies the effect," he added.

Other market participants were more sanguine about the rising use of leverage in marketplace lending.

Simon Champ, CEO of Eaglewood Europe LLP, said at an industry conference in November that leverage has allowed his fund to invest in lower-risk credits than it could otherwise.

"I've actually de-risked the fund by doing that," he said.

Frank Rotman, founding partner of QED Investors, a venture capital firm that makes equity investments in online lenders, argued that today's leverage ratios are not high enough to set off danger signals.

"The leverage ratios that you're talking about are like, one-to-one or two-to-one. You're not talking about massive amounts of leverage, like in the banking system," he said. "So yes, leverage is creeping into the next-gen funding solutions for loans, but it's creeping in at a very managed rate."

For their part, operators of the lending platforms also seemed unconcerned about the degree to which buyers of their loans are employing leverage.

"The amount of leverage on the platform today is not significant, and I think we're going to continue to see that coming down over time," said Renaud Laplanche, CEO of Lending Club, the world's largest lending platform.

Albert Periu, global co-head of capital markets at Funding Circle, a small-business loan platform with operations in the U.S. and Europe, said: "I wouldn't want all of our investors relying on leverage. I think it's important to have a diversified base."

But leverage is entering the online lending sphere in other ways, too.

Many of the nonbank firms that are frequently described as marketplace lenders are actually balance-sheet lenders that finance their loans with credit lines from large financial institutions. Those credit lines serve as a form of leverage, which magnifies both the risk and return for the lenders.

Other firms, including the publicly traded small-business lender OnDeck Capital, have a hybrid business model that includes both marketplace lending and balance-sheet lending.

"I think as some newer platforms saw the returns that could be made on the loans, and saw the willingness of banks and other finance providers, even the platforms have started taking on leverage," said Jahan Sharifi, a lawyer at Richards Kibbe & Orbe.

The balance-sheet lending model looked more attractive in 2015 than it did a year earlier, as the two publicly traded lending platforms — Lending Club and OnDeck — did not sustain the lofty valuations from their initial public offerings.

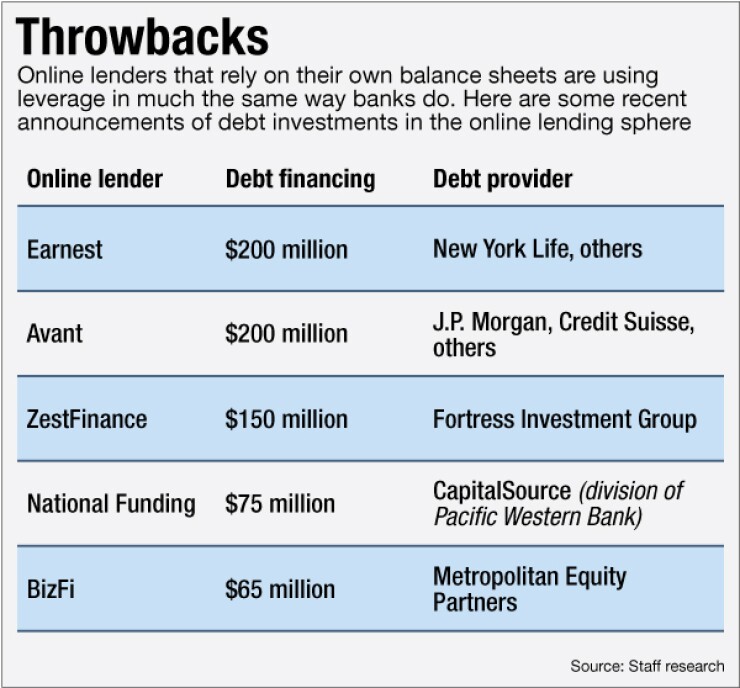

Since August, the list of online lenders that have announced debt financing includes: Avant, which focuses on subprime borrowers and got a $200 million revolving credit facility from J.P. Morgan, Credit Suisse and others; ZestFinance, another subprime consumer lender that got $150 million in debt financing from Fortress Investment Group; and Earnest, which refinances student loans and received $200 million in lending capital from New York Life Insurance and others.

Todd Baker, principal at Broadmoor Consulting, argues that the current crop of online lenders is similar to previous generations of nonbank finance companies. Such companies typically offer niche loans that banks are not interested in making, and they are heavily dependent on the capital markets for liquidity, he said.

"From a business model standpoint, they're finance companies," Baker told an industry conference in November. "Historically, [finance companies have] had rapid growth and a shorter life span than other types of financial service companies. They've had very high, but highly cyclical returns."