Unprecedented cooperation between numerous parties in the U.S. RMBS market is resulting in real progress towards establishing a solid framework for future private label issuance. All sides are seeking ways to repair investors’ confidence that was badly shaken several years ago. This is not to say that the substantial headwinds are over.

Better underwriting, clearer representation and warranty resolution procedures and more reliable data quality at issuance have made the credit quality of post-crisis securitizations the best in the history of the sector. Despite this, investor demand for securitizations of newly originated loans remains limited. Yield and prepayment risk are the biggest current challenges, but many investors are also seeking further structural improvements.

Industry working groups continue to focus on further standardization of reps and warranties, and new servicing fee structures that could better align interests. Another development that has gained traction is the role of a transaction manager’ (TM) to give investors greater confidence that their interests are being represented and protected.

In an effectively designed framework, the TM would bear responsibility for coordinating with all transaction parties, including servicers, trustees, custodians, specialty vendors, and investors. Importantly, the TM would have the ability to replace underperforming servicers, which would heighten servicer accountability and mitigate losses on distressed loans. Additional responsibilities would include servicer and vendor oversight, investor reporting, enforcement of transaction governing agreements, resolution of breaches of representations and warranties, and credit risk management.

While it is unclear whether the benefit of a TM would outweigh the compensation cost for high credit quality pools in a benign economic environment, we believe that a TM would add value in pools with riskier loan attributes or in stressful economic environments. Consequently, a TM could be an important step in allowing investors to remain comfortable with a healthy expansion of credit quality.

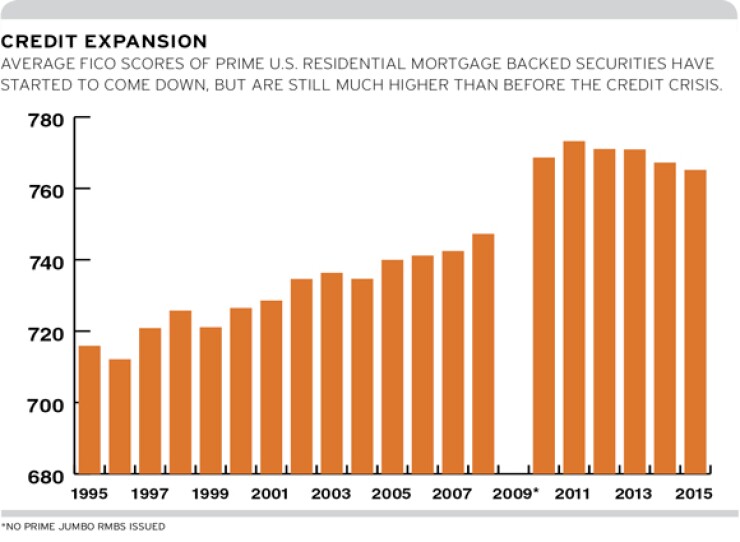

This will be a necessary step in the rebuilding of the sector. Since the financial crisis, the private label securitization of newly originated loans has been limited to exceptionally strong borrowers with high incomes and high liquid reserves. Borrowers in the transactions to date have had average annual household income over $350,000 and average verified liquid reserves over $900,000. The average credit score of 768 remains well above the aggregated average score of 715 in the traditional prime RMBS transactions issued between 1993 and 2003, which performed well, with only 12 basis points of cumulative loss to date.

There is currently room to prudently expand the credit quality in the sector. The risk of overly aggressive underwriting, while always present, has been lowered by recent legislation that has completely eliminated some problem loan types, such as no-documentation’ loans, and increased the liability of lenders that make irresponsible loans.

Grant Bailey is head of Fitch Ratings’ U.S. RMBS group.