A lot has happened since Mosaic first tapped the securitization market in February.

The company, which lends homeowners money to purchase and install solar panels, made an accounting change at the end of 2016 that forced it to restate interim quarterly profits and report a loss for the full year. Mosaic lost money in the first half of 2017, as well.

Two of its top installers, Sungevity (May) and American Solar Direct (June), filed for bankruptcy, raising questions about whether the equipment they installed would be maintained.

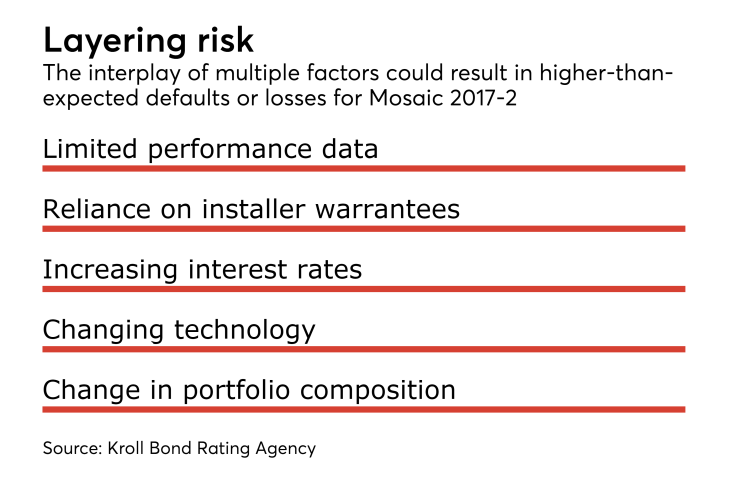

Oh, and a federal trade agency ruling in September could result in new

Undeterred, Mosaic is coming to market with a solar loan securitization that, at $307.5 million, is more than twice the size of the

Like the first transaction, this one is rated solely by

The deal also includes a prefunding account equivalent to roughly 21% of the transaction. Only $275 million of the expected $350 million of receivables will be in the securitization trust at closing. Mosaic has three months after the close of the deal to acquire the additional $75 million of collateral. This introduces some risk that there will be a drift in the credit quality of the overall portfolio, though assets purchased after the close must comply with certain criteria.

Due to changes in the pool composition and worst case pool mix allowed in the prefunding eligibility criteria, KBRA expects that cumulative gross defaults for this deal could be 7.85%, which is higher than its base-case estimate of 6.65% for the February transaction.

In order to offset this additional risk, the senior tranche of A rated notes benefits from higher credit enhancement, 29.35%, up significantly from 20.53% for the single tranche of notes issued in February, also rated A.

Also, the senior, Class A notes amortize until the “required hard credit enhancement” target is met. At this point, both Class A and Class B notes will receive principal to maintain the target, while the Class C and Class D notes will receive 45% of excess cashflow each and the residual interest will receive 10% of excess cash flow.

Deutsche Bank Securities is the structuring agent and lead bookrunner.

As a privately held company with negative cash flow, Mosaic is ultimately dependent on securitization for financing. To date, it has relied heavily on private equity, most recently raising $220 million in August 2016; it also has several lines of credit totaling $650 million that allow it to warehouse loans to be bundled into collateral for bonds. In addition, the company has commitments with large investors to purchase a total of $800 million of whole loans on a forward flow basis. Still, it is originating approximately $80 million in solar loans a month, according to Kroll, and so is running through this financing fairly quickly.

Net proceeds from the latest offering of notes will be used to pay down existing warehouse debt and for general operating purposes.

Mosaic originates solar loans through a network of independent and franchised third-party installers. As consideration for arranging and financing loan, installers typically pay Mosaic a fee based on a percentage of the original loan amount. This fee is generally netted from the first payment disbursed to the dealer.

Since completing the February transaction, Mosaic has adjusted how it account for installer fees; previously it used a fair value loan accounting method where the fee was recognized upfront regardless of whether the loan is repaid by the borrower. This allowed the company to report an interim quarterly profit during 2016. Currently, the fee is amortized on the company's books over the life of the loan. As a result, it reported a consolidated net loss of $22.7 million for 2016 and a consolidated net loss of $19.2 million for the first six months of 2017.

As the price of solar equipment drops and the pace of installations decreases, the installers that Mosaic works with are coming under financial pressure. Two of them filed for bankruptcy this year. Sungevity, the original installer on 2.78% of loans in the latest deal, has sold its assets to Solar Spectrum, a company supported by private equity firm Northern Pacific Group.

Mosaic is implementing new internal processes to assess and monitor the financial strength of their installers.