Mortgage volumes dipped last week, with both conventional and government activity coming in lower, while interest rates kept rising across all major types, according to the Mortgage Bankers Association.

The MBA’s Market Composite Index, a measure of loan volumes based on surveys of the association members, dropped a seasonally adjusted 8.1% for the weekly period ending Feb. 4, following a

The Refinance Index dropped 7% week over week and was 52% below activity from the same period in 2021 when interest rates were under 3%. Meanwhile, the Purchase Index fell 10% on a seasonally adjusted basis from the previous week, with volume 11% below its level from a year ago.

“Purchase activity slowed after the previous week's gain,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting. “Both conventional and FHA purchase applications saw proportional declines.”

Average loan sizes continued increasing, though with the mean amount of new purchase loans climbing higher for the fifth straight week. The average size of new purchase applications came in at $446,900, up another 1.2% from the previous week’s mean amount of $441,400. Expanding average purchase-loan amounts have set a new record high for four straight reporting periods. While the pace of

“Activity continues to be dominated by larger loan balances, as inventory remains tight for entry-level buyers,” Kan said.

The average refinance loan amount, however, retreated by 1.7% to land at $303,400 compared to $308,700 a week prior. The mean size of total application volume for the week edged up 0.2% to $366,200 from $365,300.

The refinance share of the week’s activity also fell to 56.2%, compared to 57.3% in the previous period. Adjustable-rate mortgages accounted for a similar share week over week, with 4.5%.

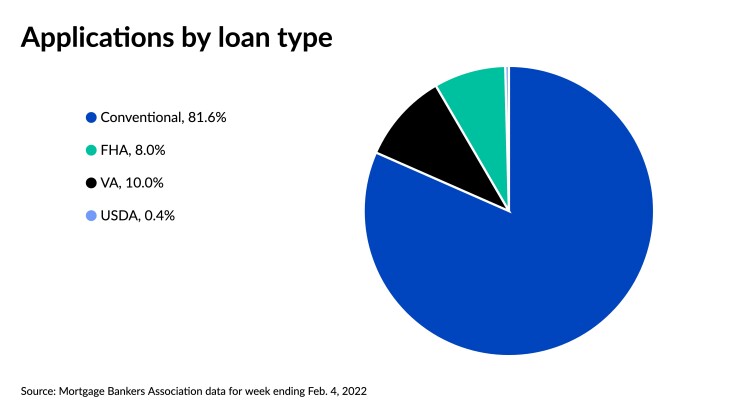

Seasonally adjusted government-backed activity declined 3.4% from the previous week, but grabbed a bigger percentage of overall volume. Loans backed by the Federal Housing Authority accounted for 8% of activity, up from 7.7% a week earlier. Mortgages sponsored by the Department of Veterans Affairs took a 10% share, compared to 9.1% in the prior period, while the percentage of U.S. Department of Agriculture loans remained at 0.4%.

The impact of higher interest rates has applied constant downward pressure on loan activity so far this year, particularly for refinances, according to Kan, and they continued their upward movement last week. Averages across all major categories increased over the seven-day period.

The average contract interest rate for 30-year fixed mortgages with conforming balances of $647,200 or less rose five basis points, coming in at 3.83%, compared with 3.78% the prior week. The average is 87 points higher from where it was at the same point last year, Kan said.

The contract average of 30-year fixed-rate jumbo loans exceeding the conforming balance climbed to 3.62% from 3.59% week over week.

Average rates for 30-year FHA-backed mortgages increased to 3.93% from 3.86% one week earlier.

The average contract interest rate for the 15-year fixed mortgage came in at 3.16%, up fifteen basis points from 3.01% the prior week.

After falling to 3.09%, the 5/1 adjustable-rate mortgage average climbed upward again, rising four basis points to 3.13%.