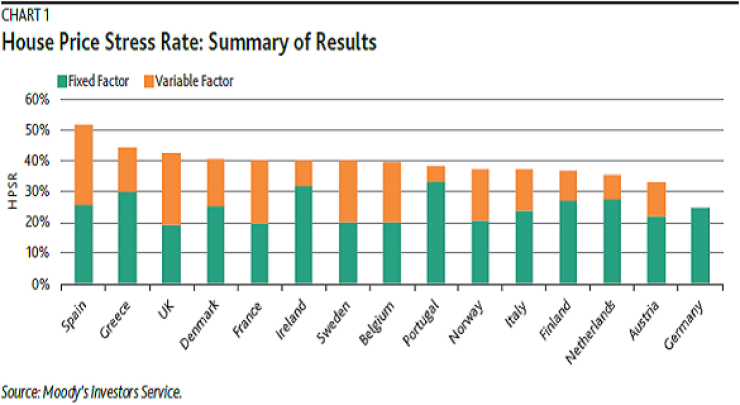

Moody’s Investors Service said that Spain, Greece and the U.K. are the European countries most vulnerable to a precipitous drop in housing prices from an economic shock, according to a report released Thursday on the agency’s methodology for stressing house prices linked to its RMBS transactions.

Prices could plummet 52% in Spain in such a scenario.

In Moody's analysis the severity of a potential decline is conditioned by both a variable factor and a fixed one. The variable factor is defined by how much house price growth in recent years has overshot — if at all — historical fundamentals such as housing supply and the rate of household generation. The fixed factor reflects the prospects for further declines in prices based on the economy’s structural features, such as consumers’ vulnerability to economic shock, the efficacy of monetary policy in buffering the effects of the economic shock, and the economic heft of the real estate sector.

Using these gauges, Spain comes out on top in terms of vulnerability. Its real estate prices have risen 105% in the past ten years (the variable factor) while its fixed factors are also heightened, according to Moody’s. Below is a chart of the projected drop in housing prices in each country that would be triggered by an economic shock. The portion caused by each the fixed and variable factor is included.