The latest store closures announced by J.C. Penny and Macy’s will impact around $479 million in securitized commercial mortgages, according to Fitch Ratings.

J.C. Penny plans to shutter 40 stores by April. Fitch said in a report published today that nine of these stores are tenants in malls backing commercial mortage bonds rated by Fitch; another four are real estate owned (REO) and the remaining 27 represent less than 3% of exposure in their respective CMBS deals.

Macy’s plans to close 14 stores by spring, two of which show up in Fitch-rated deals.

Last year, J.C. Penny closed 33 stores and Macy’s closed five stores. The latest closings are likely to widen the divide beween top-performing malls, the so called "tier-A" malls, and inferior malls. “In 2015 we believe second- and third-tier malls will continue to be at greater risk as the economic recovery for low-income consumers will remain slow, online competition continues and store traffic declines remain,” Fitch stated in the report.

Simon Mall’s Upper Valley Mall in Springfield Ohio, for example, will loose both of its anchors.

The Upper Valley Mall loan, recently listed as an REO after missing payment on a $22 million loan issued to work out the borrower’s missed payments on the original real-estate loan included in BACM 2004-6, is secured by the 497,000 square-foot mall. The loan backs over 40% of the collateral behind BACM 2004-6, according to a Barclays report.

Although the property leased by Macy's is not part of the loan collateral, its closure is expected to further strain cash flows for the Springfield mall. That is because other mall tenants, facing a reduction in foot traffic and ultimately revenue once the anchors close, are likely to seek a reduction in rent. “The closings can quickly strain the performance of malls and retail centers that contain the stores, as they can potentially trigger co-tenancy clauses for other tenants in the properties,” stated Barclays.

The closures of retail stores, like J.C. Penny and Macy’s haven’t had much impact on missed payments of CMBS loans. Trepp reported this month that the delinquency rate on retail commercial mortgages sank to 5.66% in December from 6.06% a year earlier. However, if the trend continues, missed payments could lead to losses in CMBS, Fitch warned.

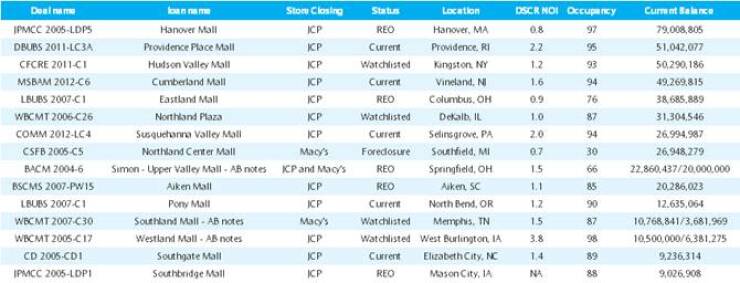

In the chart below Barclays lists deals exposed to loans secured by stores that JCP and Macy's plan to close.