Invitation Homes is planning to refinance two of its outstanding single-family rental securitizations originally issued in 2014.

A large portion of the properties securing these two transactions, Invitation Homes 2014-SFR2 and Invitation Homes 2014 SFR3, will be bundled into collateral for a new transaction, dubbed Invitation Homes 2017-SFR2, according to rating agency presale reports.

The new deal will be backed by an $865 million loan secured by first priority mortgages on 4,419 income-producing single-family homes. Roughly 54% of the properties will be rolled over from IH 2014-SFR2 and 46% from IH 2014-SFR3.

Both of these deals are expected to pay off in full in conjunction with the closing of IH 2017-SFR2, according to Kroll Bond Rating Agency and Morningstar Credit Ratings.

However, both 2014-vintage transactions are currently backed by a much larger number of properties, 3,749 for IH 2014-SFR2 and 4,048 for IH 2014-SFR3, than are being rolled over into the new 2017 transaction. Neither rating agency indicates what will become of the remaining collateral for the 2014 deals, although Kroll noted in a separate report that Invitation Homes recently paid down 80.6% of the balance of the mortgage on IH 2014-SFR3, without selling any of the properties.

So it’s possible that Invitation Homes, which agreed in August to merge with rival Starwood Waypoint Homes, could rollover the remaining collateral from either deal into another new securitization, possibly after it completes the merger. The combined company will have over 82,000 properties. (The combined firm is planned to operate under the Invitation Homes brand.)

Invitation Homes expects the merger to create $45 million to $50 million in synergies from the overlapping of the company portfolios. Both Kroll and Morningstar noted that, while the combined company should benefit from economies of scale, there can be disruptions as the company integrates its work forces and systems.

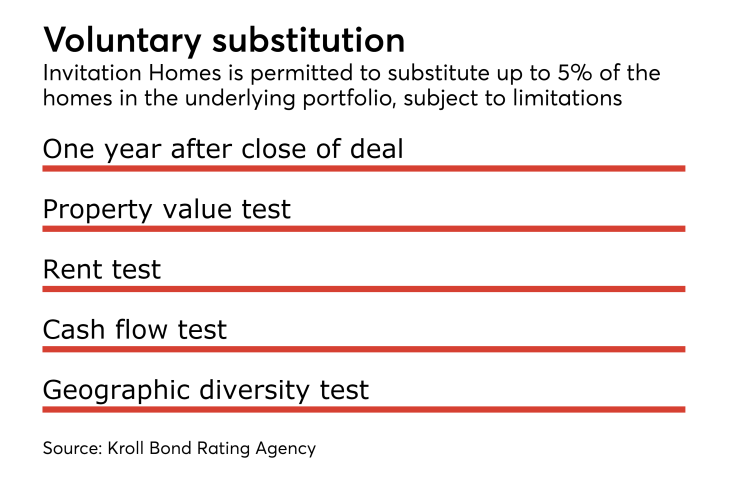

The latest transaction incorporates a feature not present in the 2014 transactions it is refinancing: Invitation Homes can swap out new properties it acquires for those in the portfolio. Beginning one year after the close of the transaction it can substitute property or a portfolio of properties up to a maximum of 5% of the homes. That means the company can replace up to 221 properties over the remaining life of the deal. And since the threshold is by count, not value, it’s conceivable that up to 11.1% of the pool, by value, could be substituted, per Kroll.

In its presale report, Kroll noted that this feature provides Invitation Homes with “operational flexibility to manage its overall portfolio.” Property substitution also could result in deterioration in the credit quality of the transaction, thought substitutions must meet certain criteria.

(Morningstar notes that properties can also be “released” if it is “disqualified” in connection with a condemnation of casualty, among other reasons. In this case, Invitation Homes generally has to pay the trust between 105% and 120% of the amount in the mortgage that was allocated to this loan.)

Another feature that gives Invitation Homes additional flexibility is the longer tenor of the mortgage backing the latest deal. The loan, which was underwritten by Deutsche Bank, has an initial term of two years and can be extended by one year up to five times, for a total term of seven years. By comparison, the loans backing the two 2014 deals being refinanced have extended terms of just five years.

Both the new loan and the loans being refinanced pay only interest, and no principal, for their entire terms.

However, IH 2017 SFR2 is less highly leveraged than the two deals it refinances. Kroll puts the loan-to-value (based on broker price opinions) at 70%. By comparison, the original LTV of IH 2014-SFR2 was 79% and the original LTV of IH 2014-SFR3 was 78%, though the recent partial pay down lowered this to 15.4%, per Kroll.