Banks, credit card companies and debt collectors pushed for an overhaul of federal debt collection rules, and they are poised to reap the benefits of unlimited contact with consumers by email and text messages.

But with the Consumer Financial Protection Bureau's rules set to take effect Nov. 30, many creditors and collectors are scrambling to make changes that require a high degree of coordination with each other.

Though the rules do not apply specifically to banks and other lenders seeking to collect debts, they do require technology changes and the sharing of information in order for third-party debt collectors to take advantage of certain "safe harbors" that will protect them from legal liability.

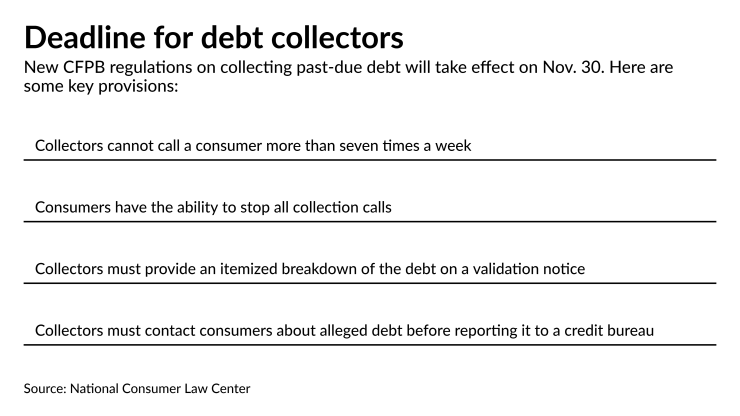

Under the rules, debt collectors will be allowed to call consumers up to seven times per week. But other provisions, including requirements that consumers be given an itemized list of their debt and told how to opt out of electronic communications, are proving to be a challenge.

“It's a bit of a tsunami for creditors and debt collectors who are trying frantically to get ready for November 30th,” said Joann Needleman, an attorney at the law firm Clark Hill who represents both creditors and debt collectors.

Debt collectors hope the rules will reduce the thousands of lawsuits filed each year for alleged violations of the Fair Debt Collection Practices Act, enacted in 1977, including many cases alleging violations related to notices sent to consumers validating a debt. But the rules have also raised concerns at creditors about what will be required in terms of ongoing oversight and monitoring of third-party vendors.

Incoming CFPB Director Rohit Chopra, who is expected to be sworn in next week,

“There's the potential for a perfect storm for original creditors given the current administration and in particular Director Chopra,” said Jonathan Pompan, a partner and co-chair of the consumer financial services practice group at the law firm Venable. “What policies, procedures, and activities does the creditor engage in that potentially fall under the rule in order to make the potential for UDAAP claims? It will vary depending on the creditors' practices, but it runs the gamut from call frequency restrictions to notices.”

The CFPB

The bureau had proposed extending the compliance date for the rules by 60 days but

“There wasn’t much interest from industry in extending that deadline,” said April Kuehnhoff, a staff attorney at the National Consumer Law Center.

The bureau has said it

The

Under the new rules, debt collectors will be required to provide understandable disclosures and accurate information about the balance due on a debt. For example, the rules require debt collectors to disclose to the consumer the debt balance as of a specific date (of which there are five options) and an itemization of all fees, interest, credits and other charges after that date. Consumers must also be given information about their right to dispute a debt.

This is more information than consumers currently receive when collectors first communicate with them about a debt. Currently, collectors send a validation notice with only the debt amount plus other statutory disclosures.

Providing a breakdown of the debt is proving to be a hurdle.

“The validation notice requirement is the most data-intensive,” Pompan said.

The CFPB created a model form that collectors can use in an effort to get a limited safe harbor from lawsuits. Collectors must provide accurate information to qualify, and use of the model form for the validation notice is not mandated as long as any alternative form is substantially similar.

The difficulty lies in the fact that lenders must transfer accurate information on a consumer's debts to collectors, who then must ensure that the same information is given to the consumer. Many see this as a heavy lift given the large volume of accounts in the collection process.

“It's not easy when you’re working on millions of accounts at a time,” said Needleman.

Consumer advocates say the rules provide consumers with added rights, but they are concerned that unlimited communications by email and text will lead to harassment and abuse.

A major benefit to consumers under the rules is that if a consumer asks a collector to stop using a specific method of communication, including phone calls, emails or texts, the collector is required to stop.

But the limit of seven calls per week per debt could result in some heavily indebted consumers being deluged with calls.

“We’re really concerned about excessive phone calls especially where you have consumers with medical debt, who have multiple accounts in collection,” the NCLC's Kuehnhoff said.

Another concern of consumer advocates is that the rules allow collectors to provide validation notices orally in an initial communication. The notices do not have to be in the language that the consumer uses.

Consumer advocates have also objected to the unlimited use of emails and texts, and raised concerns about whether creditors and collectors have accurate contact information, such as the consumer's email address.

Consumers can choose to opt out of such communications, but advocates question whether the right person will be contacted.

"Are [collectors] going to be reaching the right person or somebody else who might be a third party?” asked Kuehnhoff. “When you're not getting consumer consent, there's a concern if this is really the right email address."

The CFPB spent roughly eight years, from start to finish, to enact rules around modern communications. But the actual work of carrying out the changes has just begun.

“At a minimum, vendor oversight expectations necessitate creditors that use debt collectors be very familiar with the debt collection rule and all of its elements,” Pompan said.