While mutual fund investors were wringing their hands about the risks in loans to below-investment grade companies late in 2018, a few CLO managers took advantage of the selloff to scoop up collateral for new deals on the cheap.

Only 12 new collateralized loan obligations totaling $5.7 billion were issued in December, but at least three of them were assembled at the last minute by “printing and sprinting,” or issuing CLO notes and using the proceeds to quickly acquire collateral quickly and cheaply in the secondary market.

By comparison, CLO managers more typically obtain a line of credit and spend several months acquiring collateral in both the new-issue market and secondary trading before issuing CLO securities and using proceeds to pay down credit line.

This helped push new issuance of open-market CLOs for the year as a whole to a record $128.1 billion, according to Refinitiv (formerly Thomson Reuters LPC).

“We were supposed to have a slow end to the year, but we were surprised to get a few of these [print and sprint] deals,” said Larry Berkovich, a partner in the structured finance practice of Allen & Overy in New York. “We had one deal that started in early December and we only had two weeks to price.”

Berkovich did not disclose which client firms printed and sprinted in December, but the total list of managers that completed deals that month included Credit Suisse Asset Management, Neuberger Berman, Voya Asset Management, PGIM, TCI Capital Management, Symphony and Benefit Street Partners.

Other market participants cited the $801 million Madison Park Funding XXXII, which Credit Suisse closed on Dec. 21, as one of the deals. The manager had only identified 64.7% of the collateral when S&P Global Ratings issued a presale report on the deal on Dec. 13, leaving a par balance of $282 million in loans yet to be added. (By comparison, other new-issue deals rated by S&P in December were between 81.2%-96% ramped at the time of presale publication.)

Loan Market Spiral

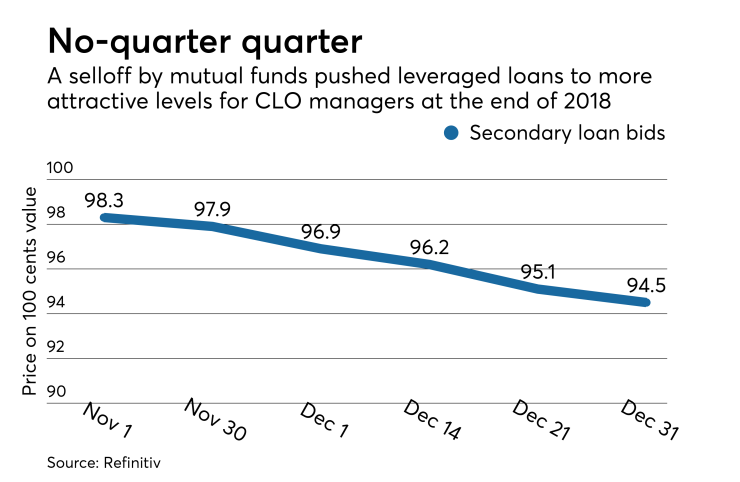

Starting in mid-November, investors began withdrawing large sums from mutual funds that invest in leveraged loans as regulators raised concerns about lax lending standards. Expectations that the Federal Reserve would reduce the number of interest rate hikes in 2019 only added to the exodus. Loans pay floating rates of interest and so tend to perform better when rates are rising. During the month of December, leveraged loans saw a total of $12.6 billion walk out the door, forcing fund managers to sell assets at steep discounts to raise cash to meet redemptions.

Average bid levels on loans, or what a buyer is willing to pay, fell almost 300 basis points during the month of December to 93.84 cents on the dollar, according to the Loan Syndications & Trading Association. And 97% of loans that changed hands had “mark-to-market” price losses – most of them dropping more than 100 basis points.

By year’s end, just 1% of loans quoted by multiple institutions were trading at or above face value, down from 66% in January, according to Refinitiv.

The selloff left CLOs, which already held some 60% of outstanding loans, as one of the few buyers. Unlike mutual funds, CLOs don’t provide investors with daily liquidity, and they don’t have to adjust value of their assets to reflect changes in prices in the secondary market. This made it attractive for some managers to launch new deals.

Acquiring collateral for new deals wasn’t the only way that managers were able to take advantage of the loan selloff. Some existing CLOs that were sitting on cash purchased loans at steep discount, in some cases using the new loans to boost the overall credit metrics of their deals.

Acquiring loans at a discount allowed managers to build the par, or face value, of the collateral in deals, because a loans in CLOs are valued at face value, regardless of the purchase price discounts. In some cases, managers were able to swap out problem loans, such as loans to troubled retailers, for less risky loans, according to market participants.

Jay Huang, the managing director, senior portfolio manager and head of structured products investments for asset management firm CIFC, said that initial January trustee reports on CLOs indicate the credit quality of assets in many deals has improved by several measures, including the average aggregate ratings of loans assets, the weighted average spreads on these loans, and the amount of par in deals.

“When there is macro market-pricing volatility like we saw in December, it can be a huge opportunity for CLOs,” said Huang. “Managers who had cash in their CLOs in December were effectively able to improve the overcollateralization of those CLOs – they picked up par by buying high-quality loans at discounted prices.”

The opportunity arose not just from the quantity of loans that went on sale late last year, but their quality. Fund managers were forced to sell whatever they could to raise cash. “In December, the highest-quality, most liquid loan names sold off almost the same amount as CCC-rated, lower-quality loan names,” said Huang.

Michael Herzig, managing director for CLO manager THL Credit Advisors, said this allowed CLO managers to easily “spin out” problem loans and replace them with higher-rated loans. “The coupon might be lower, but you can sell a credit you’re worried about and buy a credit you’re not worried about at the same dollar price,” he said.

The low prices in December also improved the “arbitrage,” or difference between the interest earned on assets in CLOs and the interest paid on CLO securities, boosting profits for CLO managers. In a report published in early January, Deutsche Bank said that the arbitrage shot out to 367 basis points at the end of December after dipping below 200 basis points earlier in the quarter.

“It’s one of the most opportunistic environments presented to CLO managers in a long time,” Huang said.

Market risks

CLO managers are not entirely indifferent to declining loan prices; if loans sell off too steeply, managers could be forced to mark down their value, though typically not until the loans are sold. And few loans have sold off as much as the market did in late 2015 and early 2016, when many loans to energy companies were pricing at 70 cents on the dollar or even lower.

Still, the decline in the price of a loan could be factor in maintaining a CLO portfolio metric that rating agencies watch closely, the overcollateralization test, according to John Nagykery, a vice president and CLO ratings analyst with Morningstar Credit Ratings. Although a rare occurrence, if the percentage of triple-C assets rises past a standard 7.5% threshold (via downgrades of single-B loans), managers would have to hold the assets in excess of that cap at market value – resulting in a loss of par.

CLOs buying up loans can be a crucial stopgap for the loan market when selloffs occur, providing an outlet for liquidity and maintaining corporate borrowers with a more viable finance channel to finance operations, leveraged buyouts or other general-purpose business activities. “If CLOs take a pause, borrowers will not have many options,” said Josh Siegel, chief executive officer of StoneCastle Financial Corp., a former CLO investment firm that now primarily invests in subordinate debt for community banks.

While CLO managers remained active in the secondary market in December, there was not much appetite for new deals. According to KDP Advisors, only a dozen companies issued leveraged loans in December, and they were only able to do so by offering them a substantial discount to face value.

Bank of America Merrill Lynch, in arranging financing for private equity firm Platinum Equity’s announced $1.3 billion buyout of academic memorabilia manufacturer Jostens, priced the issuer’s $775 million term loan B at a discounted price of 97 cents on the dollar, even though it was rated as a high single-B loan.

Even a higher-rated (double-B) $500 million term loan sponsored by commercial printing services Quad/Graphics for its acquisition by LSC Communications had to be discounted to 97 cents on the dollar via JPMorgan to close – even though the resulting overall leverage would remain in the 2.5x-3.0x range, according to Moody’s Investors Service.

The difficult market also forced at least three issuers to pull deals in December, according to KDP. Most notably, Deutsche Bank and UBS postponed a $1.275 billion term loan B/second-lien buyout loan to be used for the $1.8 billion acquisition of IT services firm ConvergeOne by CVC Capital Partners.

Window of opportunity is closing

Like previous periods of print-and-sprint production, CLO managers are likely to find the opportunity to pick up assets on the cheap to be short-lived.

While investors continue to withdraw from leveraged loan mutual funds in January, loan prices have rebounded in the first few weeks of the year, climbing an average of $2.09 through Jan. 10 to reach 96.56 cents on the dollar. The window may have already on any more print and sprints out of December’s cheap-loan bonanza. At least one print-and-sprint deal discussed in the market never materialized, according to one CLO manager.

Sean Solis, a partner in the CLO and structured finance practice at New York law firm Milbank, Tweed, Hadley & McCloy, said that “print and sprint was a hot idea. A lot of managers were trying to get it done ... [but] the loan market has rallied and made the print and sprint difficult to pull off. The equity returns are just a lot less optimal” at the rebounded price trends, he added.

One reason for recovery in loan prices, according to THL’s Herzig, may be that some fund managers have come back into the market, after overestimating the amount of cash they needed to meet redemptions, particularly when calculating the year-end principal payments made by issuers to pay off loans.

“So people [fund managers] have cash and there are no new-issue loans that have come out yet,” said Herzig. “A lot of those mutual funds have to go back into the market to buy the same assets they just sold two weeks ago.”