A large number of commercial mortgage backed securities (CMBS) are maturing this quarter in the region of Europe, the Middle East and Africa, but only a few are expected to actually repay, according to a release today by Fitch Ratings.

Largely a reflection of the economic crisis that has engulfed much of Europe, loan-to-value (LTV) numbers keep edging higher. As a result, many of the loans backing CMBS are struggling.

“Ten loans maturing this quarter are already in default and special servicing due to covenant breaches and payment defaults,” said Fitch Associate Director Mario Schmidt in the release.

Loans that do not mature on time get restructured, extended, in a standstill agreement, or they post a loss.

Some 24 CMBS loans are maturing in July, with the rate slowing to three for each August and September. Fitch said that if the second quarter is any indication of what might happen during the current one, then there is cause for concern. Only five of the 27 loans that came due last quarter paid in fill. Most of the delinquent loans are now in standstill agreements.

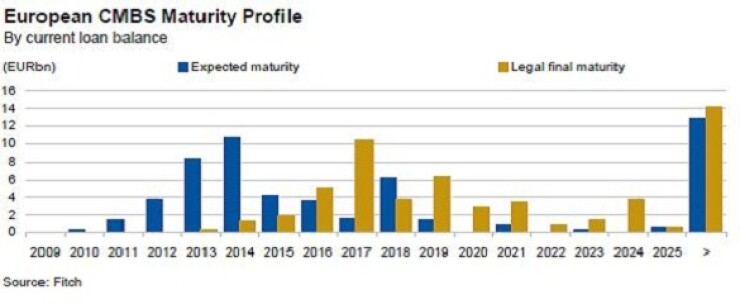

As seen in the chart below, expected maturities in EMEA CMBS are higher in 2014 from this year, boding ill for an appreciable increase in timely repayments.