To achieve a recovery in both the housing sector and the overall economy, mortgage banks need insight into the misconceptions on how mortgage delinquency and economic stress have impacted borrower behavior. This includes insight into what a "strategic default" is.

The recession of 2008 was the first since World War II that was consumer-driven. Consumer debt issues and mortgage problems were inevitably followed by a contraction in spending, said FICO CEO Mark Greene in his keynote address at the FICO World Forum event held in November.

He said that "a consumer-led recession needs a consumer-led recovery." Banks are still looking for the "new normal" in their relationship with consumers, Greene said, and the reason why these institutions have not found this yet is because they "haven't reset the rules, to both sides' satisfaction."

A FICO white paper called How Much Is U.S. Credit Behavior Changing? focuses on swings in consumer credit behavior from rising delinquencies in the beginning of the recession to the more recent decrease in credit card delinquencies. The paper wanted to find out whether consumers' behavior is "really this volatile?"

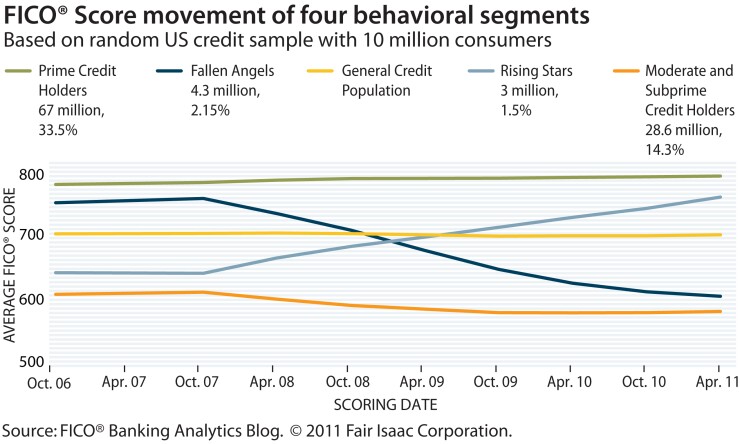

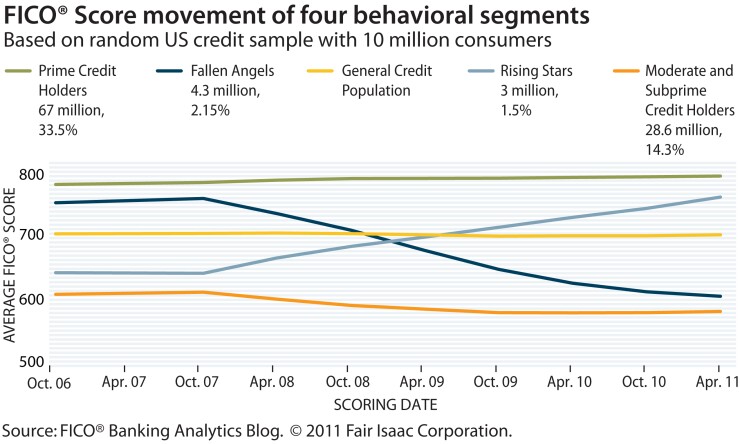

In the report, FICO analyzed score movement in a national random sample of 10 million U.S. consumers from October 2006 to April 2011. During these economically volatile years, the credit scoring firm identified four behavioral segments that together accounted for just over 51% of the sample population based on an extrapolated population of 200 million.

The chart from FICO tracking the U.S. consumers' credit risk score during an economic crisis and recovery period based on a random U.S. credit sample with 10 million consumers is published below. (Please note that this same chart was published in the December ASR issue, but with some errors. This is the more accurate version.)

"Rising Stars" and "Fallen Angels," which illustrated the "migration patterns" that offer "significant insight into consumer credit attitudes," FICO analysts said.

Key findings, however, defied expectations and public perception. For example, the number of "Fallen Angels" or consumers whose scores fell more than 150 points, does not consist of the majority of borrowers.

During the study's time frame, difficulties with paying mortgage loans were not the cause of the financial problems for almost 72% of these borrowers of which 40% had no mortgages; of those that did, 53% had clean mortgage payment records. The study also showed that the 34% who had defaulted mortgages "look to be strategic defaulters," as they continued to pay other credit obligations.

The size of the segment of borrowers whose scores increased more than 100 points, whom FICO calls "Rising Stars," is only slightly smaller than the "Fallen Angel" segment. This means that there is a healthy segment of borrowers who have taken steps to significantly improve their credit worthiness. This is in addition to those who have improved their credit scores while taking on significant new debt obligations. In this group, only 45% have mortgages.

Surprisingly, one-third of the credit population belong to "Prime Holders," the third customer group identified by FICO whose scores remained at low risk levels during the crisis because they managed to maintain "a stable level of high credit worthiness during a severe economic downturn."

Nonetheless, "a significant segment of consumers" whose scores remained in the medium- and high-risk ranges fell into the "Moderate & Subprime Holders" category and continue to struggle with credit management.

In this group, up to 39% have mortgages. However, 63.8% of them "have not yet defaulted on those mortgages though they have problems on other trade lines." Only 6% with defaulted mortgages appear to be strategic defaulters.