The CLO managers cheered a Feb. 9 decision by the DC Circuit Court that they do not need to hold “skin in the game” of their deals.

But some investors in collateralized loan obligations see little to celebrate.

“We were sad to see them go,” said Kevin Croft, a senior vice president and portfolio manager for the Des Moines-based insurer American Equity and a panelist at the Structured Finance Industry Group's annual conference in Las Vegas. “We were very happy to have risk retention in place.”

So was William Moretti, a managing director who heads the investment portfolio of MetLife’s structured finance group. “In general we favored risk retention as part of more global reform and a healthy securitization market along with transparency and good governance,” he said at the same panel. “It’s something that’s applied across all structured finance, but it’s difficult to have customized solution for each different asset class."

Moretti added, “It was a measure taken to simplify these three pillars of a healthy securitization market.”

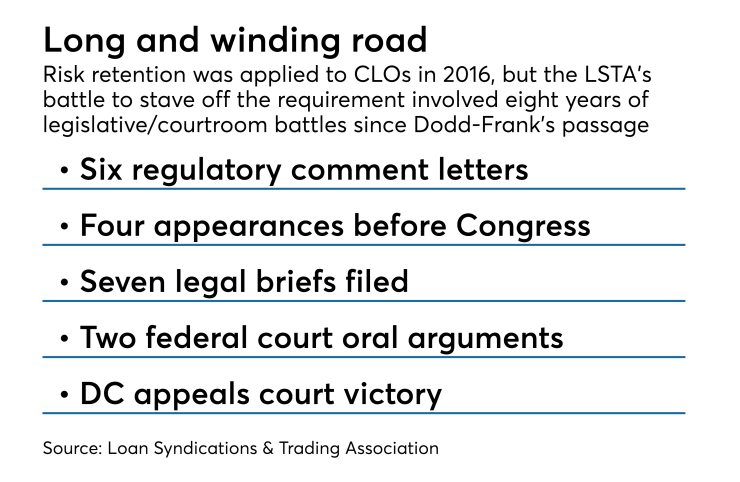

The appeals court decision was the culmination of a two-year legal battle that the Loan Syndications and Trading Association waged against the Securities and Exchange Commission and the Federal Reserve. Since December 2016, CLO managers have been required to hold on to 5% of the economic risk in their deals.

The LSTA argued that managers of open-market CLOs, which do not originate the loans that they securitize, should have been excluded from the Dodd-Frank rules.

LSTA executive vice president Meredith Coffey, also part of Monday’s panel, said the trade group's initial decision to pursue the matter legally was also driven by concerns about the impact on the diversity and health of the CLO manager industry — in particular, undercapitalized smaller managers who could not finance or retain 5% of a half-billion-dollar portfolio.

“We all talk about consolidation like it’s this bloodless thing [but] that’s people, entrepreneurs, who started a business but we’re forced to sell them,” Coffey said.

“We hope we are close to done, but we’re not done yet and we would argue against getting over our skis,” she added.

The ruling, which could take effect in a few weeks if it is not appealed, does not exclude CLO managers from retaining stakes in deals, something many did even before the rules took effect.

Paul Nikodem, managing director and head of securitized products research for Nomura, noted on the panel that retention also brought some new, permanent CLO capital to the market, including $10 billion for investing in or financing risk retention funds.

That money appears likely to stay, even if risk retention is ultimately vacated for the asset class. “The question is, where will all that money go?” he said. “It’s not obvious there are any other options. I guess it depends on the docs, but a lot of that money will remain in the sector — new money, new investors.”

One investor opposed to risk-retention for CLOs, Matt Natcharian, a managing director and head of CLO investments at Barings, said that risk retention “was just one piece of understanding the business plan of the managers” and how it fits into an asset management firm’s organization. “It is something important to them, or just something they’re trying on the side?”

MetLife’s Moretti said that to the extent managers will continue to use risk retention, “we would probably pay up for managers that continue to use risk retention.”

American Equity has not been “a real supporter” of the small end of the CLO manager universe, Kroft acknowledged, and the company would likely continue to invest in those with “deeper pockets, a diverse stream of revenue" and a "deeper, broader team of analysts.”

“I think people think about [the size] of management fees a lot,” Kroft said, “but I think they care about their capital at risk even more.”